With the number of elderly adults that I know who have had total, and partial knee replacement surgery, I can imagine that many people are wondering whether treatment with a continuous passive motion machine is covered by Medicare, as the rentals are extremely expensive.

Medicare Part B covers knee continuous passive motion machines as durable medical equipment, if you have a prescription from a Medicare enrolled physician, which states that it is medically necessary, in accordance with the Medicare guidelines.

The treatment with the CPM must start within 48 hrs of surgery, and the coverage is limited to 21 days from the date of the surgery.

Continuous passive motion machines are covered for treatment after total knee replacement, or for a revision of a major component of a previously performed total knee replacement.

You must rent the device from a Medicare-enrolled equipment supplier, and if you are to get the best coverage, and to pay the least amount possible yourself, you have to rent the CPM machine from a Medicare-enrolled “Participating” supplier.

Medicare does not cover knee CPM machines for partial knee replacements, shoulder, elbow, hand, wrist, or wrist and hand CPM machines.

Medicare doesn’t cover for more than 3 weeks, as it states that there is no medical evidence that the machines have any effect on rehabilitation if used for longer than 3 weeks.

The purpose of the CPM machine is to increase the range of movement in the knee joint post-surgery, in the hope that this will make the recovery an easier one.

The fact remains though that there are no studies which prove anything either way.

I found one paper by Harvey LA, Brosseau L, Herbert RD from 2014 where they state that –

The review showed that CPM following knee replacement surgery probably improves the ability to bend the knee slightly and the person’s quality of life but may not improve pain or function.

The article is not particularly long, you can read it here.

Contents Overview & Quicklinks

Continuous passive motion machine rental

How much is a CPM machine rental with Medicare Part B ?

Does Medicare cover ice machines ?

What equipment does Medicare cover ?

How do you get coverage from Medicare Part B for DME ?

Once you have a signed prescription, what do you do next ?

Finding a local Medicare-enrolled DME Supplier near you ?

And if you have a Medicare Advantage Plan ?

Durable Medical Equipment generally covered by Medicare if you qualify

Free assistance with understanding Medicare

Will Medicaid cover CPM machines and other DME ?

Find the HCBS programs, waivers and 1915 waivers in your state

How to get DME with Medicaid and state waivers and HCBS programs ?

If your income is over the Medicaid eligibility limit, take a look at this

How much is a CPM machine ?

If you don’t have medical insurance, you would have to pay pretty crazy amounts to buy a CPM machine.

Purchasing prices CPM machines –

Knee – $4,285.00 + tax

Ankle – $5,499.00 + tax

Shoulder $5,995.00 + tax

Elbow $5,600.00 + tax

Hand & Wrist $6,076.00 + tax

Wrist only $4,095.00 + tax

Hand only $4,325.00 + tax

It is pretty clear that Medicare is not going to cover the purchase of a CPM machine at thousands of dollars for you to use for 3 weeks after surgery.

Instead, Medicare gives coverage for the rental a CPM machine for 3 weeks post surgery.

Continuous passive motion machine rental

Do note that the coverage period is for 21 days, and it starts the day that you are discharged from hospital.

Rental prices for CPM machines – from Medcomgroup.com

All the prices are for a two-week rental, and each week thereafter is another $100.00/week, up to a total period of 8 weeks –

Knee – 2 weeks – $425.00

Ankle – 2 weeks – $755.00

Shoulder – 2 weeks – $755.00

Elbow – 2 weeks – $755.00

Hand – 2 weeks – $755.00

Wrist – 2 weeks – $755.00

How much is a CPM machine rental with Medicare Part B ?

If –

- you are enrolled in Medicare Part B

- the CPM is a knee CPM machine for a total knee replacement

- a prescription from a Medicare-enrolled doctor

- you start treatment with 48 hrs of surgery

- you are using a Medicare-enrolled “Participating” Supplier

Typically, Medicare Part B will cover 80% of the Medicare approved rental cost of the knee CPM machine, and you will be responsible for the co-payment of 20% of the Medicare-approved price, plus your deductible if it applies.

If the Medicare-approved rental for a knee CPM machine is around a $525.00 for 3 weeks, you will pay $105.00, plus your deductible if it applies.

Knee CPM rental near me ?

To find a Medicare-approved DME supplier near you who rents CPM machines, you should really use the Medicare.gov website locator, and you can find that here.

Does Medicare cover ice machines ?

Medicare considers that ice packs and cooling therapy devices are not “medically necessary” and as such they aren’t classified as Durable Medical Equipment, so are not covered by Medicare Part B for use in the home.

Instead, ice therapy machines are considered to be part of the category of equipment considers to be for comfort only.

You may be able to get coverage for an ice machine under Medicaid, HCBS waivers, 1915 waivers, State Assistive Technology Projects or State Financial Assistance Programs for the elderly.

What equipment does Medicare cover ?

For use in the home, Original Medicare Part B covers durable medical equipment which must –

- be able to withstand repeated use over a sustained period of time – durable

- be used for a medical reason only – not for comfort

- be of use to someone who is actually sick, and of little use to a person who is well

- be primarily for use in the home

- be expected to last at least 3 years

How do you get coverage from Medicare Part B for your DME ?

To be sure of coverage under Medicare Part B for DME for “use in the home”, you –

- have to be enrolled in Medicare Part B

- have a signed prescription from a Medicare-enrolled doctor saying that the equipment is a “medically necessary”

- have to purchase or rent the equipment through a Medicare-enrolled supplier

What qualifies as “living at home” for Medicare coverage ?

- living in your own home

- living in the family home

- living in the community, such as assisted living

Once you have a prescription, what do you do next ?

With your prescription from you –

- locate a DME supplier who is Medicare-enrolled

- confirm that the supplier is a “participating” supplier who accepts “assignment” – this way you pay the least amount

- Medicare only covers the basic models of each type of equipment, if you wish to have an upgrade you will be obliged to pay the difference yourself – it is not always possible to upgrade

- select the equipment that you have been prescribed

- complete the necessary paperwork for Medicare with the supplier

Medicare part B covers 80% of the Medicare-approved price for DME with your prescription from a Medicare-enrolled doctor.

And you, if you got your DME from a Medicare-enrolled “participating” supplier who accepts assignment, as I said previously, will typically pay your Medicare 20% co-payment of the Medicare-approved price for your equipment, plus your deductible if it applies.

To avoid paying any extra for your equipment, always use a Medicare-enrolled “participating” supplier who accepts assignment.

Medicare may either rent or purchase your DME – if your item is rented from the supplier you will pay a 20% co-payment of the monthly rental, and your deductible if it applies.

Finding a local Medicare-enrolled DME Supplier near you

You can use this link to find a Medicare-approved supplier who is local to you – Medicare.gov

And if you have a Medicare Advantage plan ?

With a Medicare Advantage plan, you are covered for all that Original Medicare Parts A and B cover. You will have at least the same coverage for DME for “use in the home”.

You will have to contact your provider to find out exactly how to proceed. The plan will certainly have a network of doctors and suppliers who you will have to use if you are to have coverage for your equipment.

For details about your co-payments and deductible, you will need to check with your plan provider as well.

Durable Medical Equipment generally covered by Medicare if you qualify

If you don’t find the equipment you are looking for in my list of Medicare covered DME below, you can use this link to Medicare.gov

Air-Fluidized Bed

Alternating Pressure Pads and Mattresses

Audible/visible Signal Pacemaker Monitor

Pressure reducing beds, mattresses, and mattress overlays used to prevent bed sores

Bead Bed

Bed Side Rails

Bed Trapeze – covered if your loved one is confined to their bed and needs one to change position

Blood sugar monitors

Blood sugar (glucose) test strips

Canes (however, white canes for the blind aren’t covered)

Commode chairs

Continuous passive motion (CPM) machines

Continuous Positive Pressure Airway Devices, Accessories and Therapy

Crutches

Cushion Lift Power Seat

Defibrillators

Diabetic Strips

Digital Electronic Pacemaker

Electric Hospital beds

Gel Flotation Pads and Mattresses

Glucose Control Solutions

Heat Lamps

Hospital beds

Hydraulic Lift

Infusion pumps and supplies (when necessary to administer certain drugs)

IPPB Machines

Iron Lung

Lymphedema Pumps

Manual wheelchairs and power mobility devices (power wheelchairs or scooters needed for use inside the home)

Mattress

Medical Oxygen

Mobile Geriatric Chair

Motorized Wheelchairs

Muscle Stimulators

Nebulizers and some nebulizer medications (if reasonable and necessary)

Oxygen equipment and accessories

Patient lifts (a medical device used to lift you from a bed or wheelchair)

Oxygen Tents

Patient Lifts

Percussors

Postural Drainage Boards

Quad-Canes

Respirators

Rolling Chairs

Safety Roller

Seat Lift

Self-Contained Pacemaker Monitor

Sleep apnea and Continuous Positive Airway Pressure (CPAP) devices and accessories

Sitz Bath

Steam Packs

Suction pumps

Traction equipment

Ultraviolet Cabinet

Urinals (autoclavable hospital type)

Vaporizers

Ventilators

Walkers

Whirlpool Bath Equipment – if your loved one is home bound and the pool is medically needed. If your loved one isn’t home bound, Medicare will cover the cost of treatments in a hospital.

Prosthetic and Orthotic Items

Orthopedic shoes only when they’re a necessary part of a leg brace

Arm, leg, back, and neck braces (orthotics), as long as you go to a supplier that’s enrolled in Medicare

Artificial limbs and eyes

Breast prostheses (including a surgical bra) after a mastectomy

Ostomy bags and certain related supplies

Urological supplies

Therapeutic shoes or inserts for people with diabetes who have severe diabetic foot disease.

Free assistance with understanding Medicare

SHIP – State Health Insurance Assistance Programs

SHIPs are present in all states and offering free counseling services on Medicare, Medicaid and Medigap – usually by phone.

To find your local SHIP, to contact them, and to get free help, you can check my quick guide here – “Free Help Understanding Medicare And Medicaid ? Here’s Where You Get It”.

Will Medicaid cover CPM machines and other DME ?

Due to the way in which Medicaid is funded – both federal and state sources – a state may have a great deal of largesse in what its programs can do if it keeps within the basic Medicaid guidelines.

Medicaid often agrees to let states waive some eligibility criteria for different programs, so that certain persons who may be otherwise missed by the system may instead qualify for, and receive, care.

These programs are then known as waivers, and each will have its own specific eligibility criteria, so it may help a specific group of people.

Care in the home – Medicare and state programs

Programs for care in the home and the community are called “Home and Community Based Services” (HCBS), “Waivers” or “1915 Waivers”.

The programs work to help the beneficiaries to maintain their independence and to remain in their homes, and the community.

Such programs are for low income families, disabled individuals and the elderly.

You can find out if you are eligible by contacting your State Medicaid Agency here.

Your local Area Agencies on Aging will also be able to give you more information on the subject of waivers for the elderly in your state.

If you want to learn more about HCBS programs, or waivers in general, you can use the link below –

https://www.medicaid.gov/medicaid/hcbs/authorities/index.html

So that the elderly and the disabled are able to stay in their own homes, rather than being placed in state care facilities, the HCBS programs, waivers and 1915 waivers will cover a wide range of home medical equipment, and often covering the costs 100%.

Any of the following situations qualify as a “home” for the HCBS programs, waivers and 1915 waivers –

- their own home

- their family home

- a group home

- an assisted living facility

- a custodial care facility

Certain HCBS programs and waivers, and 1915 waivers will have the greatest flexibility with regard to DME’s for use in the home

Some HCBS waivers, programs, and 1915 waivers will use a type of budget management called either “Consumer Direction” or “Self Direction”

With this type of budget management, the program participant is largely responsible for how the budget is spent.

The participants are allotted a sum of money to cover all their needs, and the help of an appointed a financial advisor to do so.

As these programs and waivers are there for the participants to stay living in their homes, if certain equipment is vital for their independence – “medically necessary” – and there is enough money in their budget, they will very often get it.

The range of equipment they are allowed is larger than that available under Medicare, largely due to the fact that the states each provide funding towards these waivers etc.

You can read more about Medicaid Self Direction here.

Helping the elderly re-locate their own homes after nursing home care

Money follows the person – this Medicaid program takes the elderly who are in nursing care homes, but who could, with help, live in their own home, and gives them the assistance to do so.

What is necessary to make the move, and to the participant maintaining their independence in their own home, is covered by the program.

This coverage can extend to remodeling parts of the home, especially kitchens and bathrooms, for safety and for medical reasons.

Find the HCBS programs, waivers and 1915 waivers with their eligibility criteria in your state

I have produced a guide of what programs and waivers are run in each state for seniors, with links to the different program websites. You can find all of that here – “Medicaid Home and Community Based Services Waivers and Programs For Seniors Listed By State”.

How to get DME with Medicaid and state waivers and HCBS programs ?

Step 1

– the doctor, or therapist, has to provide a medical justification letter, stating it is medically necessary

Step 2

– find a Medicaid-approved DME supplier, and give them the medical justification letter

Step 3

– the Medicaid-approved supplier completes a Prior Approval Application for Medicaid

Step 4

-Prior Approval Application is sent for processing at the Medicaid State Office

Step 5

– if you are unsuccessful you will be contacted and told the reasons why, and as well as advice on how to make an appeal

Step 6

– if approved, you will receive the DME

If your income is over the Medicaid eligibility limit, take a look at this

Spend Down Programs

Simply put, Spend-Down programs can help to reduce a person’s income level, or income + assets level, so that they may become eligible for Medicaid by allowing the deduction of certain expenses.

I’ve written a short post outlining who can qualify for Spend Down, the expenses they can deduct and how you know if you qualify. You will find that here – What is Spend Down ?

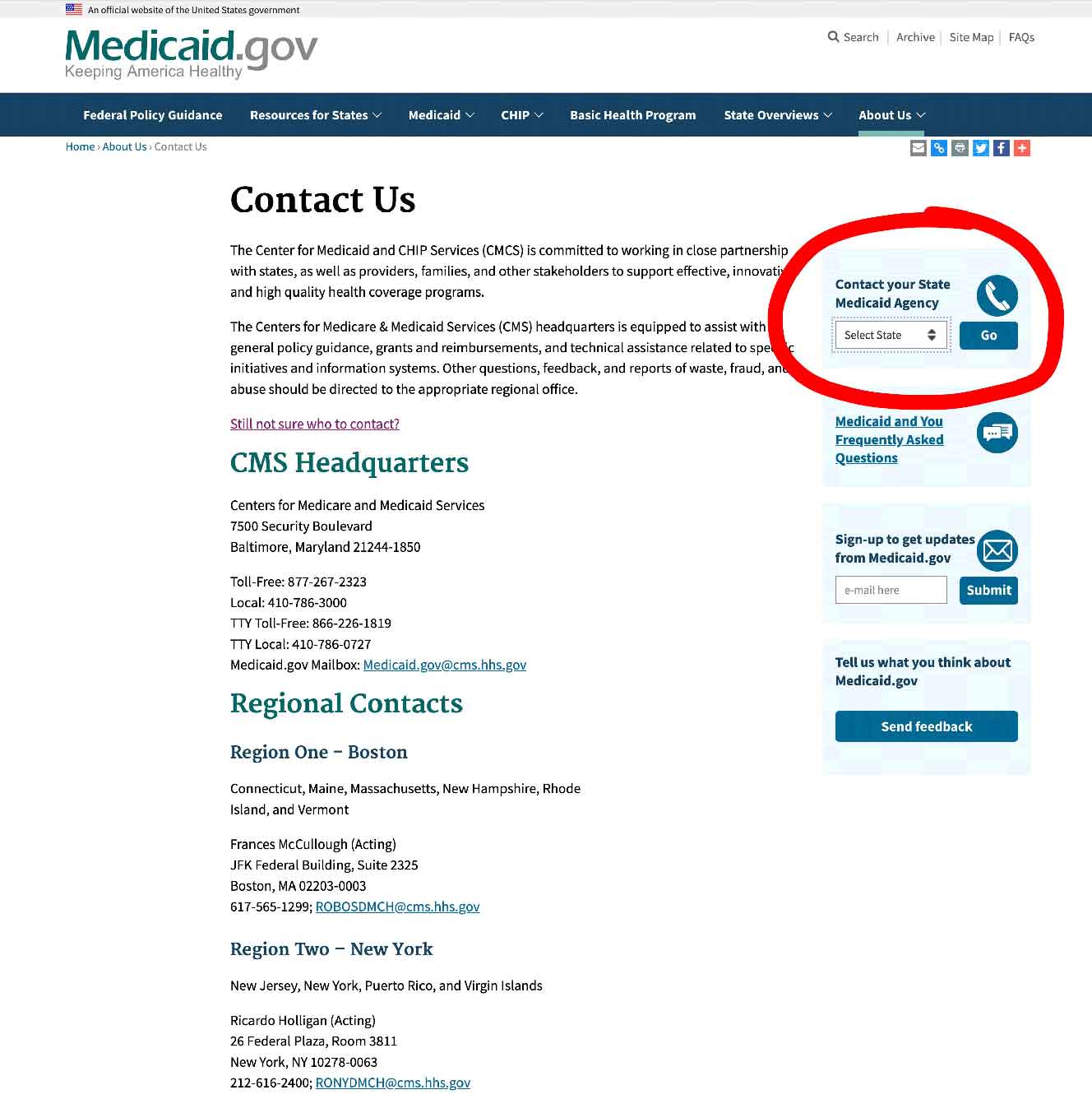

To find your State Medicaid State Agency

If you just want to talk to or email someone, contact your state Medicaid Agency here.

Step 1 –

Click the link to Medicaid.gov, look to the section I outlined in red.

Step 2 –

select your state and click on the button they have marked “GO” – it will take you to your State Medicaid Agency with all their contact info.

State Funding Assistance

Assistive Technology Programs

In the US, all states have Assistive Technology Programs to improve access to assistive devices in the home – the primary focus groups for these projects are the disabled and the elderly.

DME’s and Assistive Technology devices are very similar in what they cover, except that Assistive technology does not have to be “medically necessary”.

Assistive Technology covers equipment which allows a person to accomplish tasks they couldn’t otherwise. This equipment can range from electronic digital devices to bathroom and kitchen aids and safety equipment.

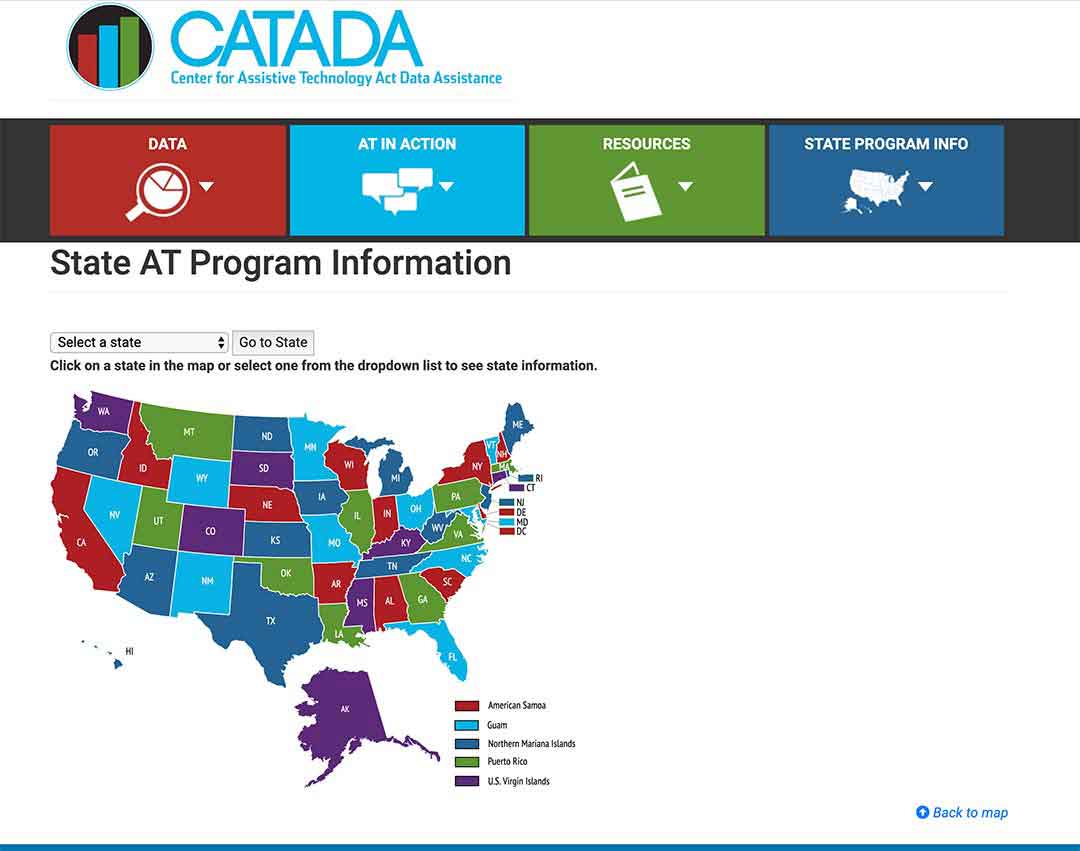

To find out what programs your state has, click here

Step 1/

Pick your state on the map or the drop-down menu, and click on “Go to state”

– I chose Florida for this example

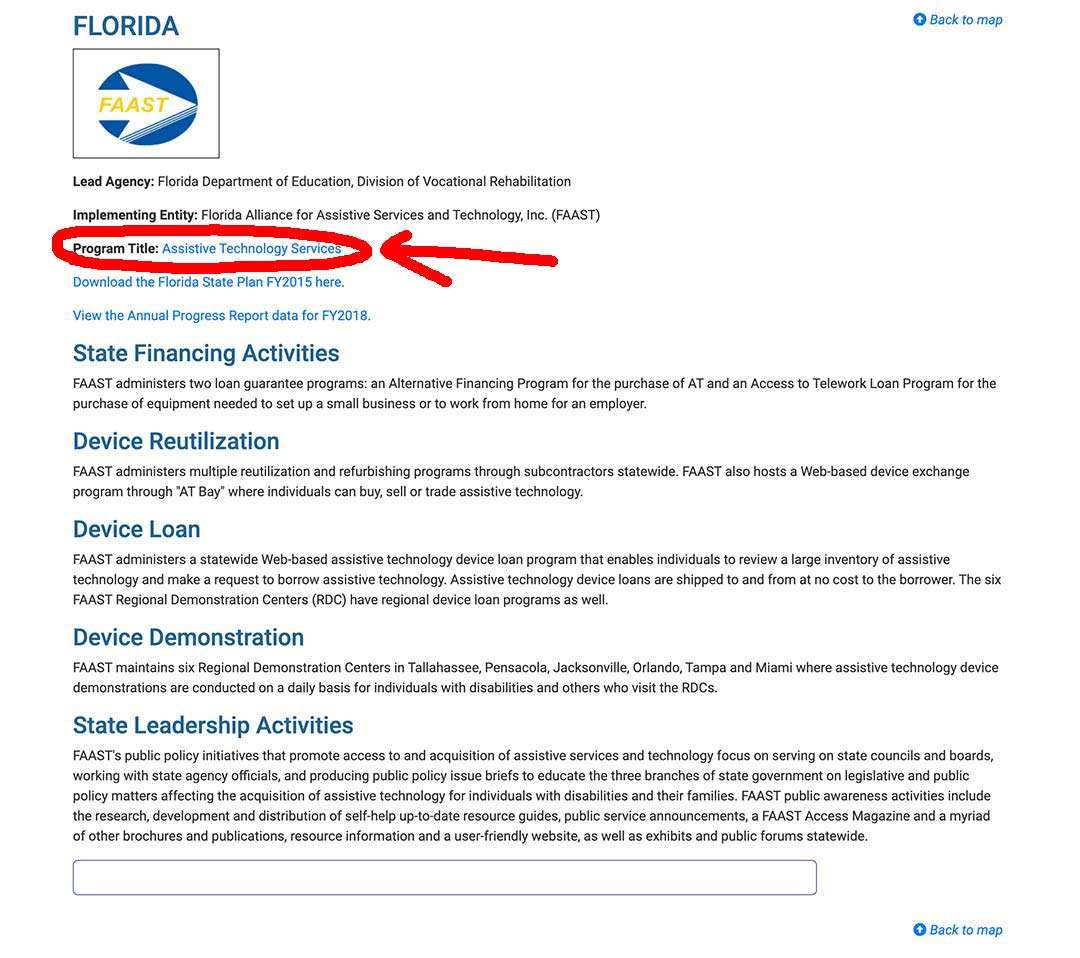

Step 2/

Click on the link “Program Title” – for my example, I outlined it in red.

Step 3/

The AT Program state website will come up, and you can sign up, or use their contact info.

State Financial Assistance Programs

A number of states have non-Medicaid programs which help the elderly to remain living in their homes, paying for – safety items, assistive equipment, and will cover the costs of remodeling bathrooms, wheelchair ramps, kitchen.

The programs primarily focus on the elderly and the disabled paying with grants, give loans or do a combination of both.

Find out about these from your local Area Agency on Aging.

I’m Gareth, the author and owner of Looking After Mom and Dad.com

I have been a caregiver for over 10 yrs and share all my tips here.