If your elderly loved ones are anything like my own mom, they will have the heating cranked all the way up just to stay warm, and this can really dry the air out, leading to a lot of throat tickles and dry coughs. One solution is a humidifier, which can put a little moisture back into the air.

Does Medicare cover humidifiers ? Humidifiers which are used in conjunction with particular covered durable medical equipment, such as continuous positive airway pressure devices, respiratory assist devices, or oxygen equipment are covered by Medicare.

There will not be a separate charge for the humidifier, it will be included in the charge for the medical equipment it is being used with.

Medicare Part B doesn’t usually cover room humidifiers, as they are not primarily medical in nature and are used for comfort like room heaters, dehumidifiers, or air purifiers.

Room humidifiers are listed by Medicare as –

“environmental control equipment; not medical in nature”

You can find this information on their National Coverage Determination (NCD) for Durable Medical Equipment Reference List (280.1) on the “Center for Medicare & Medicaid Services” website, CMS.gov if you click here.

The list is the basic guide to what durable medical equipment is covered by Medicare if a person qualifies according to their guidelines, and it simply states in most cases whether a piece of equipment should be allowed or denied coverage, and also gives a very short qualification of why it is or isn’t given coverage.

This does not mean 100% that an item will be never given coverage, but typically whether it will be given.

If a diagnosis is given that a person has a medical condition which needs a room humidifier, and that a humidifier will either help a person’s health condition improve, or maintain them so that the health condition does not deteriorate, and is prescribed by a Medicare-enrolled physician as “medically necessary”, Medicare may listen.

In such a case, the doctor, or the doctor’s case manager will have to make the case to Medicare, and there is a chance that it may give the usual 80% coverage that Medicare Part B gives to “medically necessary” durable medical equipment.

Contents Overview & Quicklinks

Does Medicare cover oxygen rental ?

Why does Original Medicare Part B reject air purifiers ?

Does Medicare cover allergy testing ?

Does Medicare cover exercise equipment ?

What equipment does Medicare cover ?

What medical supplies does Medicare pay for ?

How do you get coverage from Original Medicare Part B for DME ?

What do you do with your signed prescription ?

Finding a local Medicare-enrolled Supplier near you ?

What if you have a Medicare Advantage Plan ?

Durable Medical Equipment generally covered by Medicare if you qualify

Free one-on-one help with understanding Medicare

Does Medicaid cover humidifiers ?

Programs and waivers which give greater leeway as to what may be determined to be DME ?

How to find the HCBS programs, waivers and 1915 waivers in your state ?

How to get DME with Medicaid, state waivers and HCBS programs ?

Does Medicare cover oxygen rental ?

As long as it is prescribed by a Medicare-enrolled doctor, Medicare Part B does cover the rental of oxygen equipment, and accessories, for home use as durable medical equipment, if prescribed by a Medicare-enrolled doctor.

Your Medicare-enrolled doctor may prescribe the oxygen equipment plus accessories if –

- Your doctor says you have a severe lung disease, or you’re not getting enough oxygen.

- Your health might improve with oxygen therapy.

- Your arterial blood gas level falls within a certain range.

- Other alternative measures have failed.

Medicare Part B oxygen equipment coverage includes:

- Systems that provide oxygen

- Containers that store oxygen

- Tubing and related oxygen accessories for the delivery of oxygen and oxygen contents

The monthly rental payments include all of these accessories as well –

- Tubing or a mouthpiece

- Oxygen contents

- Oxygen machine maintenance

- Oxygen machine servicing

- Oxygen machine repairs

PLEASE NOTE: the information in italics was taken from Medicare’s own information on their website.

The text from which I wrote this section is here on the Medicare.gov website.

You can learn about the rental structure, the rental periods, and how to change suppliers at the end of a rental period if you wish to.

Why does Original Medicare Part B reject air purifiers for coverage ?

For equipment to get coverage from Original Medicare Part B, it must fall into the category of Durable Medical Equipment or DME.

Medicare does not classify air purifiers as DME, but rather as “environmental control equipment” and “not primarily medical in nature“.

This also applies for air conditioners, dehumidifiers and room heaters – all are denied coverage as Medicare consider all are for “environmental control”.

The guidelines are on the Centers for Medicare and Medicaid Services website – CMS.gov – where you will find the “National Coverage Determination (NCD) for Durable Medical Equipment Reference List (280.1)”. You can click here to see that.

Does Medicare cover allergy testing ?

Allergy testing is covered by Medicare Part B as part of “clinical diagnostic laboratory services”.

According to the Center for Medicare & Medicaid services –

Allergy testing is covered when clinically significant symptoms exist and conservative therapy has failed. Allergy testing includes the performance, evaluation, and reading of cutaneous and mucous membrane testing along with the physician taking a history including immunologic history, performing the physical examination, deciding on the antigens to be used, and interpreting results.

You can read the full document here.

For Medicare Part B to cover your allergy tests –

- the tests must be prescribed by a Medicare-enrolled doctor

- the doctor must provide documentation that it is medically necessary

- there must be a history of allergic reactions

- prescribed to diagnose or eliminate an allergy as part of a treatment program

- all possible alternatives have been exhausted

Does Medicare cover exercise equipment ?

Original Medicare doesn’t typically give coverage to exercise equipment or exercise classes, as they are not seen as “medically necessary”, but it does give coverage to physical and occupational therapy treatments which may use exercise equipment.

Medicare Advantage plans don’t cover exercise equipment either, but may give coverage for exercise programs.

Original Medicare covers physical therapy and occupational therapy if it has been prescribed as “medically necessary” by a Medicare-enrolled physician.

As regards the therapist, they must be providing the physiotherapy, or occupational therapy treatment on an outpatient basis, they must be Medicare-certified, and the treatment must be part of a regularly reviewed program by the prescribing physician.

Your therapist must only charge the Medicare-approved prices.

Medicare will typically cover 80% of the Medicare-approved fee, and you will pay your remaining 20% coinsurance payment, plus your deductible if it applies.

What equipment does Medicare cover ?

Original Medicare Part B typically gives coverage to durable medical equipment, or DME, for use in the home, when it is “medically necessary”.

I have made a long list of durable medical equipment typically covered by Medicare, which you can skip ahead to here.

Medicare gives coverage to durable medical equipment if it is :-

- Durable (can withstand repeated use)

- Used for a medical reason

- Not usually useful to someone who isn’t sick or injured

- Used in your home

- Generally has an expected lifetime of at least 3 years

Source: Medicare.gov website – here

Examples of durable medical equipment which Medicare gives coverage are wheelchairs, crutches and walkers, hospital beds, respirators, patient lifts, and medical oxygen when they are “medically necessary”.

Medicare does not cover items which it sees as for convenience or comfort, or which are not primarily medical in nature, such as bath chairs, air purifiers, room heaters, grabbers, cold packs and massage devices.

Original Medicare Part B’s coverage typically extends to 80 % of the Medicare-approved price of the durable medical equipment, and the beneficiary will have to pay their coinsurance of 20% Medicare-approved price, and also, if it applies, their annual deductible.

What Medical supplies does Medicare pay for ?

Medicare Part B covers durable equipment and supplies, which means durable medical equipment that is proven to be “medically necessary”, and prescribed by a Medicare-enrolled physician.

Any disposable medical supplies needed for use with durable medical equipment will typically be covered.

Medical supplies, which are disposable items not used in conjunction with durable medical equipment, are not typically covered.

Supplies such bandages, face masks, elastic stockings, pressure leotards, support hose, surgical leggings, disposable sheets and bags, fabric supports and incontinence pads are not covered by Medicare Part B- these items are disposable and not durable, and also not used in conjunction with a piece of durable medical equipment.

Blood sugar strips and certain catheters may be covered by Medicare Part B, if they are needed for use in conjunction with durable medical equipment, and, or, to treat long term medical conditions.

For those receiving Home Health Care, Medicare will cover some supplies needed for your care under the Home Health Care Benefit.

How do you get coverage from Medicare Part B for DME ?

To get coverage from Medicare Part B for DME for “use in the home” –

- you have to be enrolled in Medicare Part B

- have your Medicare-enrolled doctor give you a signed prescription which states that the equipment is a “medically necessary” by the Medicare guidelines

- you have to purchase or to rent the equipment through a Medicare-enrolled supplier

For Medicare coverage, “living at home” is defined as –

- living in your own home

- living in the family home

- living in the community, such as assisted living

What do you do with your signed prescription ?

You will –

- find a Medicare-enrolled DME supplier near you

- ensure that the supplier is a Medicare-enrolled “participating supplier who accepts “assignment’ – so you have no extras to pay

- Medicare covers the more basic models of each type of equipment, but sometimes you may be able to upgrade, although you will pay the extra when it’s possible to do so

- pick out the version of the equipment that you have been prescribed

- complete all the necessary paperwork with the supplier, so that they can make sure the doctor does their part

If you have used a Medicare-enrolled doctor to get a prescription stating that your item is “medically necessary”, and a Medicare-enrolled supplier, Medicare part B covers 80% of the Medicare-approved price for DME.

If your supplier was a Medicare-enrolled “participating” supplier who accepts assignment, you will only have to pay your Medicare 20% coinsurance of the Medicare-approved price for your DME, plus your deductible if it applies.

If you did not use a Medicare-enrolled “participating” supplier who accepts assignment, the supplier is allowed to add up to 15% onto the Medicare-approved price, and that is for you to pay, not Medicare.

Medicare may rent or purchase your DME – if your item is rented, which is the case for more expensive items, you will still have the same payment structure, you will just pay a 20% coinsurance of the monthly rental, plus your deductible at the outset, if it applies.

Finding a local Medicare-enrolled DME Supplier near you

You can use this link to find a Medicare-approved supplier who is local to you – Medicare.gov

What if you have a Medicare Advantage Plan ?

With a Medicare Advantage plan, you have the same services and coverage as with Original Medicare Parts A and B, and often there will other benefits on offer as well.

Each plan will have its own network of doctors and suppliers, that they will want you to use.

So always contact your plan provider before you get any equipment.

Durable Medical Equipment generally covered by Medicare if you qualify

If you don’t find the equipment you are looking for in my list of Medicare covered DME below, you can use this link to Medicare.gov

Air-Fluidized Bed

Alternating Pressure Pads and Mattresses

Audible/visible Signal Pacemaker Monitor

Pressure reducing beds, mattresses, and mattress overlays used to prevent bed sores

Bead Bed

Bed Side Rails

Bed Trapeze – covered if your loved one is confined to their bed and needs one to change position

Blood sugar monitors

Blood sugar (glucose) test strips

Canes (however, white canes for the blind aren’t covered)

Commode chairs

Continuous passive motion (CPM) machines

Continuous Positive Pressure Airway Devices, Accessories and Therapy

Crutches

Cushion Lift Power Seat

Defibrillators

Diabetic Strips

Digital Electronic Pacemaker

Electric Hospital beds

Gel Flotation Pads and Mattresses

Glucose Control Solutions

Heat Lamps

Hospital beds

Hydraulic Lift

Infusion pumps and supplies (when necessary to administer certain drugs)

IPPB Machines

Iron Lung

Lymphedema Pumps

Manual wheelchairs and power mobility devices (power wheelchairs or scooters needed for use inside the home)

Mattress

Medical Oxygen

Mobile Geriatric Chair

Motorized Wheelchairs

Muscle Stimulators

Nebulizers and some nebulizer medications (if reasonable and necessary)

Oxygen equipment and accessories

Patient lifts (a medical device used to lift you from a bed or wheelchair)

Oxygen Tents

Patient Lifts

Percussors

Postural Drainage Boards

Quad-Canes

Respirators

Rolling Chairs

Safety Roller

Seat Lift

Self-Contained Pacemaker Monitor

Sleep apnea and Continuous Positive Airway Pressure (CPAP) devices and accessories

Sitz Bath

Steam Packs

Suction pumps

Traction equipment

Ultraviolet Cabinet

Urinals (autoclavable hospital type)

Vaporizers

Ventilators

Walkers

Whirlpool Bath Equipment – if your loved one is home bound and the pool is medically needed. If your loved one isn’t home bound, Medicare will cover the cost of treatments in a hospital.

Prosthetic and Orthotic Items

Orthopedic shoes only when they’re a necessary part of a leg brace

Arm, leg, back, and neck braces (orthotics), as long as you go to a supplier that’s enrolled in Medicare

Artificial limbs and eyes

Breast prostheses (including a surgical bra) after a mastectomy

Ostomy bags and certain related supplies

Urological supplies

Therapeutic shoes or inserts for people with diabetes who have severe diabetic foot disease.

Free one-on-one help with understanding Medicare

SHIP – State Health Insurance Assistance Programs

SHIPs are present in all states offering free counseling and guidance on all aspects of Medicare, Medicaid and Medigap.

Here’s a quick post outlining how to get in touch with your SHIP for free help – “Free Help Understanding Medicare And Medicaid ? Here’s Where You Get It”.

Does Medicaid cover humidifiers and other DME ?

State Medicaid programs are funded both federally and by the individual states, which gives the states quite a lot of say in the programs, as long they keep within the basic Medicaid guidelines.

Medicaid can often agree to waive some requirements for eligibility on programs, allowing states are able to provide health care to those who might otherwise fall through the system.

Such programs are known as Waivers.

Waivers will have specific eligibility requirements, and have limited places and will usually have waiting lists.

Care in the home – Medicare and state programs

The programs for care in the home are called “Home and Community Based Services” (HCBS), “Waivers” or “1915 Waivers” and are developed to help individuals maintain their independence in their homes.

These programs are primarily for low income families, disabled individuals and the elderly.

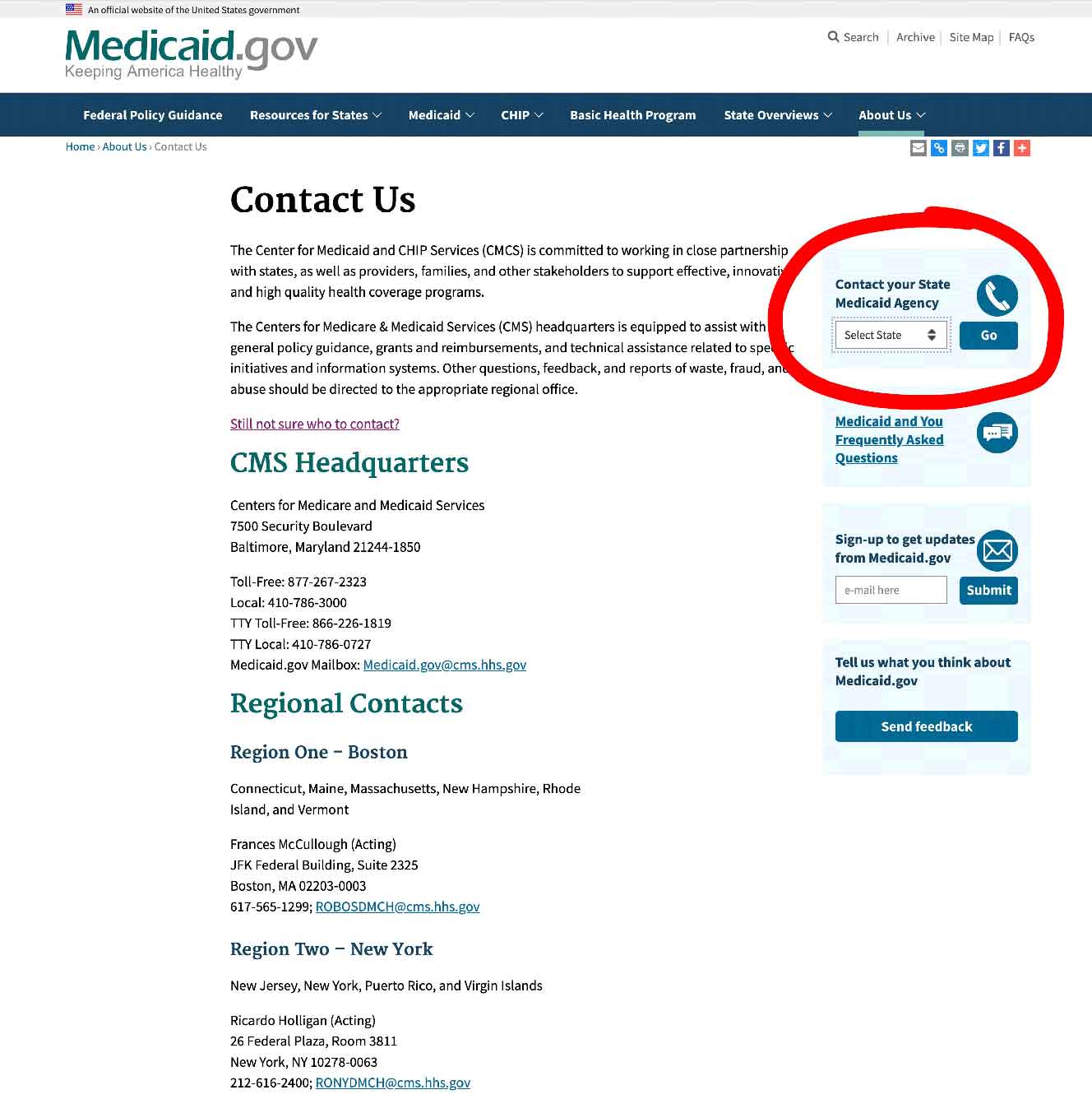

You can contact your State Medicaid Agency here to find out if you are eligible.

You can also inquire at the local Area Agency on Aging, where they should be able to help you find out as well.

To learn more about HCBS programs or waivers, you can follow the link below to medicaid.gov –

https://www.medicaid.gov/medicaid/hcbs/authorities/index.html

The HCBS programs and waivers, and 1915 waivers will all give cover to “home medical equipment”, often up to 100%, in order to help the elderly and disabled to remain in place in their own homes.

A “home”, for the beneficiary, can be any of the following –

- their own home

- their family home

- a group home

- an assisted living facility

- a custodial care facility

Programs and waivers which give greater leeway as to what may be determined as DME

Consumer Direction & Self Direction

HCBS programs and waivers which work with a type of budget self-management called, either “Consumer Direction”, or “Self Direction” may allow for a wider range of DME to be covered.

The program participant is allotted a budget which is to cover all their needs, and which they manage with the help of an appointed financial advisor.

The participant is largely in charge of how the money is spent across their different needs in their home.

If being able to maintain their independence depends on the program participant having certain medical equipment, and the allotted budget covers it, they will very often get it, if it is somehow medically necessary – this can lead to a much broader range of equipment being allowed as DME, than is allowed under Medicare.

To find out more about Medicaid Self Direction, click here.

Money Follows The Person

Initially a federal Medicaid program, the program was established to help the elderly living in nursing home care, but who could with help live in their own home, to make the move to live in their own home.

The Medicaid program now helps individual states, with the necessary funding, to set up their own Money Follows the Person program.

The states can either build a new program entirely, or tweak an existing HCBS program, or waiver.

The programs pay for all the essentials to make the transition possible for the participants, which can be simple DME, or more involved remodeling of kitchens and bathrooms, or the building of ramps for wheelchairs.

How to find the HCBS programs, waivers and 1915 waivers in your state

To see the Medicaid HCBS waivers and programs for seniors in your state, just take a look at my article where I listed them by state, along with the Money Follows The Person Programs and also PACE Programs (Programs of All-inclusive Care for the Elderly). The article is here – “Medicaid Home and Community Based Services Waivers and Programs For Seniors Listed By State”.

How to get DME with Medicaid and state waivers and HCBS programs ?

Step 1

– the doctor, or therapist, has to provide a medical justification letter, stating it is medically necessary

Step 2

– find a Medicaid-approved DME supplier, and give them the medical justification letter

Step 3

– the Medicaid-approved supplier fills out a Prior Approval Application form for Medicaid

Step 4

– the Prior Approval Application is sent to the Medicaid State Office

Step 5

– if you are unsuccessful you will be contacted and given the reasons as to why, as well as advice on how to make an appeal

Step 6

– if approved, you will receive the DME

If your income is a bit too high to qualify for Medicaid

Spend Down Programs

Medicaid’s Spend Down programs employ several methods to work to reduce a program participant’s income level, or income and assets level so that they may qualify for Medicaid coverage by allowing the deduction of certain medical and other expenses.

The simpler method of the two is the “Income Spend Down”.

I’ve written an article about how it works, which you can find here – What is Spend Down ?

To find your State Medicaid State Agency

If you just want to talk to, or to email someone, contact your state Medicaid Agency here.

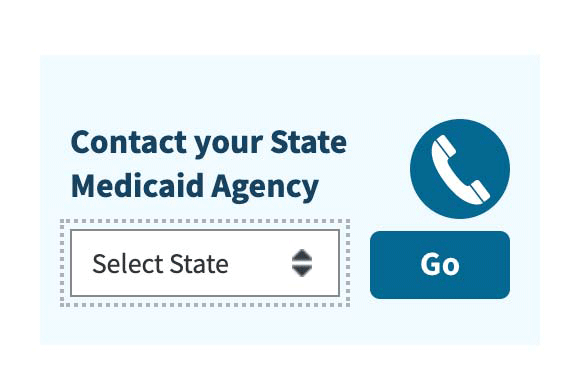

Step 1 –

Click the link to Medicaid.gov, look to the section I outlined in red.

Step 2 –

Select your state and click on the button they have marked “GO” – it will take you to your State Medicaid Agency with all their contact info.

State Funding Assistance

Assistive Technology Projects

All the individual states have an Assistive Technology Project to increase access to assistive devices in the home.

The projects are funded by a National Assistive Technology Grant, and the primary focus is on the elderly and the disabled.

Most states have a number of online services, including online equipment exchanges where state residents can buy, sell and donate equipment.

To use the exchanges, you just have to visit the sites and register as a user.

A lot of states also have recycling, reuse and refurbishment programs for “gently used” assistive devices and durable medical equipment, which is either given to people in need, or sold at very low cost.

Projects also partner with non-profits and local community groups whoa re already established in the community.

You should find all the information for your state on your state project website.

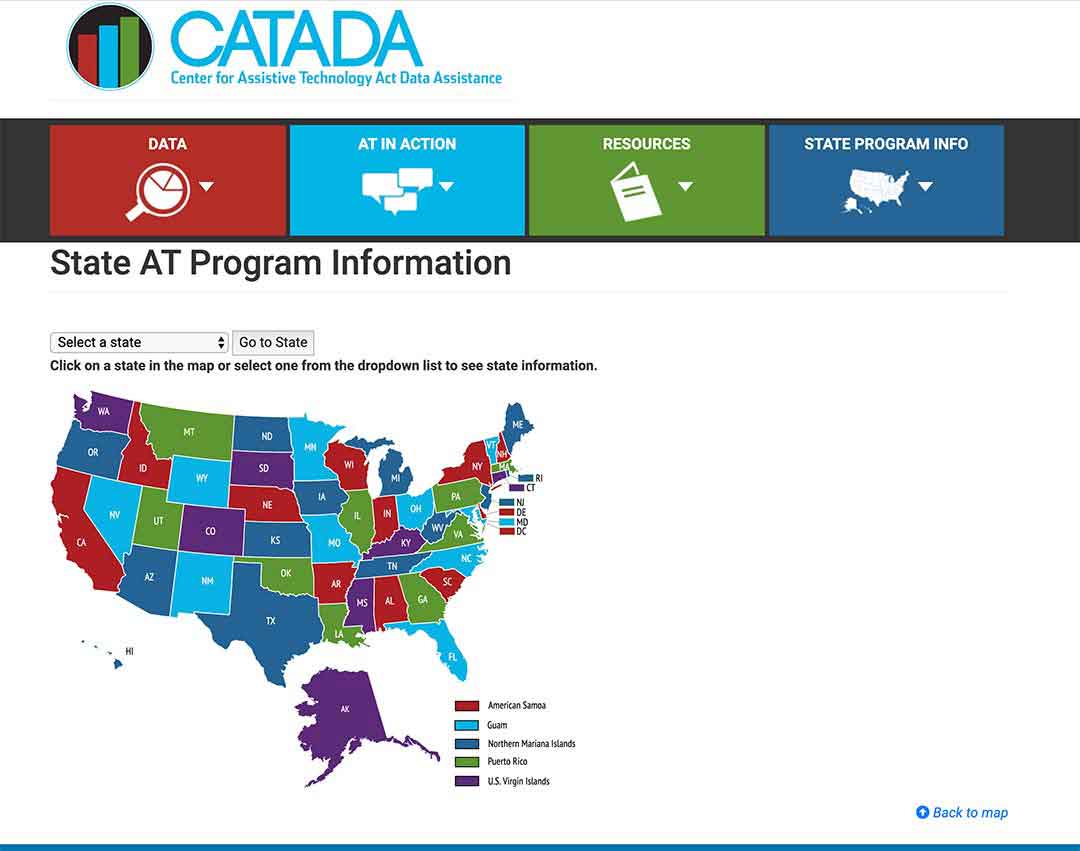

To find the projects in your state, click here.

Step 1/

Pick your state on the map or the drop-down menu, and click on “Go to state”

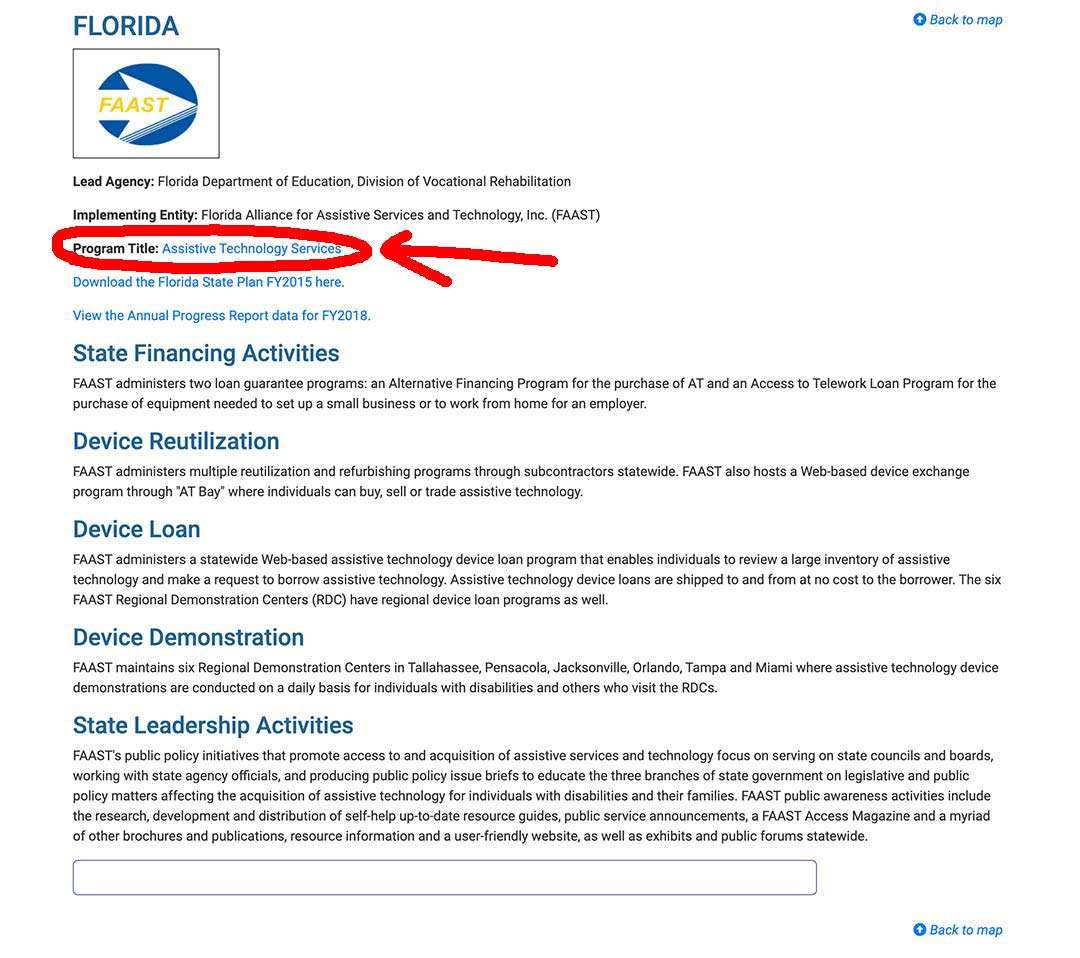

– I selected Florida for this example

Step 2/

Click on the link “Program Title” – for my example I outlined it in red.

Step 3/

The AT Project state website will come up, and you can sign up, or use their contact info.

State Financial Assistance Programs

A certain number of states have “non-Medicaid” State Financial Assistance Programs to help the elderly and the disabled to remain living in their homes.

The programs pay for safety items, assistive equipment, remodeling of kitchens and bathrooms, wheelchair ramps and more, with grants and loans, or a combination of both.

To get more information on these programs, check with your local Area Agency on Aging.

Summary

You cannot get Medicare Part B to give coverage for a humidifier if it is just to humidify a room on its own, as it is seen as a comfort item.

A Humidifier being used in combination with a piece of Medicare covered durable medical equipment will already be included in the coverage of that piece of equipment.

Remember to always ask the DME supplier if they are a Medicare-enrolled “Participating” Supplier who accepts “assignment”.

Medicaid and state programs in many cases may accept to cover a humidifier if it is deemed to be medically necessary, and also a lot of other equipment not covered by Medicare.

I’m Gareth, the author and owner of Looking After Mom and Dad.com

I have been a caregiver for over 10 yrs and share all my tips here.