If you look after an elderly loved one with mobility issues, and who also struggles a great deal with getting out of any kind of chair, you may have looked at lift chairs. As this is a very common problem, especially for those like my mom who suffer from arthritis, I decided to see if lift chairs were covered by Medicare, and if not what other options there were for funding.

Does Medicare cover lift chairs ? Original Medicare Part B offers partial coverage for lift chairs for use in the home, if they are prescribed by a medicare-enrolled physician – they only cover 80% of the cost of the lift mechanism and no other part of the chair.

Contents Overview & Quicklinks

Medicare’s qualifying guidelines for a lift chair ?

Will Medicare pay for a sleep chair ?

How to find a lift chair supplier ?

Will Medicare pay for a stair lift ?

Is a Hoyer lift covered by Medicare ?

What equipment does Medicare cover ?

How to get coverage from Original Medicare Part B for DME ?

Now what do you do with the signed prescription ?

Locate a Medicare-enrolled DME Supplier near you ?

Does Medicare Advantage cover lift chairs ?

Does Blue Cross cover lift chairs ?

Does United Healthcare cover lift chairs ?

Durable Medical Equipment generally covered by Medicare

Get free assistance with understanding Medicare

Does Medicaid cover lift chairs ?

How to find the HCBS programs, waivers and 1915 waivers in your state ?

What is the procedure for applying to Medicaid state waivers and HCBS programs for DME coverage ?

If your income is a bit too high to qualify for Medicaid

What are lift chairs ?

Lift chairs look like big reclining armchairs, and may be reclining chairs, but with the difference that the chair has a mechanized hydraulic lift.

The hydraulic lift is for the primary function of the chair, to move the user from a seated position to a standing position.

The mechanized hydraulic lift is designed to smoothly lift the user at a very slow pace to avoid any dizziness and discomfort to users who have mobility issues.

Lift chairs can come with a variety of reclining positions – 2 position lift chairs, 3 position lift chairs and infinite position lift chairs.

Medicare’s qualifying guidelines for a lift chair ?

Lift chairs are classed under the category “seat lifts” by Medicare.

Medicare does not cover electric “seat lifts”, but mechanical/hydraulic seat lifts may be considered if you meet all the criteria – that is to say the mechanized hydraulic lift may be covered.

Original Medicare Part B – will typically give 80% coverage of the mechanized hydraulic lift part of the chair “for use in the home”, if it has been prescribed as “medically necessary” by a Medicare-enrolled physician.

This means that you have to pay for all the other parts of the chair, plus 20% of the price of the lift which is built into the chair – rather complicated !

Medicare only considers the “seat lift” to be medically necessary, so the rest of the chair isn’t covered at all.

At the time of purchase, you will likely pay the supplier for the whole chair, and Medicare will reimburse you for 80% of the Medicare-approved price for the mechanized hydraulic lift inside the chair.

This is of course if you actually qualify for coverage for the “seat lift”.

To qualify for Original Medicare Part B coverage for a seat lift mechanism, these are the guidelines –

“Indications and Limitations of Coverage

Reimbursement may be made for the rental or purchase of a medically necessary seat lift when prescribed by a physician for a patient with severe arthritis of the hip or knee and patients with muscular dystrophy or other neuromuscular diseases when it has been determined the patient can benefit therapeutically from use of the device. In establishing medical necessity for the seat lift, the evidence must show that the item is included in the physician’s course of treatment, that it is likely to effect improvement, or arrest or retard deterioration in the patient’s condition, and the severity of the condition is such that the alternative would be bed or chair confinement.”

Source: National Coverage Determination (NCD) for Seat Lift (280.4) – which you can find hereon the Center for Medicare and Medicaid Services website, CMS.gov.

Simply put, the to qualify for coverage for a Seat Lift, you must meet these criteria –

- you must have severe arthritis of the hip or knee or neuromuscular disease

- you must be incapable of standing up from a standard chair with or without arms in the home

- the seat mechanism must be part of the physician’s course of treatment for you to “effect improvement, or to arrest or retard deterioration” in your condition

- once you stand, you are able to walk

Medicare also does not cover seat lifts mechanisms which have a spring release mechanism, as these jolt you up to a standing position and this cannot be therapeutic, and that also do not have a recliner to return you gently to a seated position.

Will Medicare pay for a sleep chair ?

Yes, as a sleep chair is a type of lift chair.

Original Medicare Part B will typically cover 80% of the cost of the mechanized hydraulic seat lift in a sleep chair, as long as it is hydraulic, and so long as your chair has been prescribed as “medically necessary” by a Medicare-enrolled physician.

The rest of the chair is not at all covered by Medicare as it only considers the seat lift to be “medically necessary” and the rest is not medical in nature so doesn’t qualify for coverage.

The criteria for coverage that you have to meet to qualify for the prescription are those that I listed above.

How to find a lift chair supplier ?

Your physician will doubtless be able to point you in the right direction for equipment suppliers who are approved by Medicare.

But you can also find out by simply clicking here to go to the Medicare.gov website, to use their Medicare-enrolled supplier locator.

Just enter your zip code, and you will get a list of suppliers in your area that you can see on the screenshot of their web page below.

Will Medicare pay for a stair lift ?

Medicare does not cover stair lifts, as they are classed as electric seat lifts, which are classified as a convenience.

You can find the coverage determination in the National Coverage Determination (NCD) for Durable Medical Equipment Reference List (280.1) which you can read here.

However, as of 2019 Medicare Advantage plans will be allowed to add extra benefits to their policies, so keep a look-out as some policies may offer coverage for stair lifts as they will be allowed to tailor benefits to some conditions.

Is a Hoyer lift covered by Medicare ?

A Hoyer is a popular brand of what is called a “patient lift”.

Patient lifts are typically necessary to move an individual from a bed to a chair, a wheelchair, a commode, or to a completely different location.

They can be used to place a person in a bathtub, but should not be confused with a bath or toilet lift, which are not the same, and which are not covered by Medicare.

Original Medicare Part B typically offers 80% coverage for a manual/hydraulic full-body lift, or a stand-assist lift, as durable medical equipment “for use in the home”.

The lift has to be prescribed by a Medicare-enrolled physician and certified as “medically necessary” as defined in the Medicare guidelines for a patient lift.

You should qualify for Original Medicare Part B coverage for a patient lift –

If you cannot get from your bed to a chair, a wheelchair or a commode without the use of a lift, and would otherwise be confined to the bed, a patient lift will be partially covered by Original Medicare Part B.

You will typically qualify for Original Medicare Part B coverage for a multi-positional patient transfer system –

If you meet the criteria above, and also need to be transferred in a supine position, which simply means lying horizontally and face up.

Should you qualify with Original Medicare Part B for a patient lift, it will be for a manual patient lift, as Medicare does not cover electric patient lifts – it lists them as convenience items which are not to be covered.

What equipment does Medicare cover ?

Original Medicare Part B covers 80% of the Medicare-approved price of certain durable medical equipment for use in the home.

I have included a list of durable medical equipment covered by Medicare, which you can pop ahead to see here.

For durable medical equipment to be covered for use in the home by Medicare Part B, it has to qualify under the following criteria :-

- Durable (can withstand repeated use)

- Used for a medical reason

- Not usually useful to someone who isn’t sick or injured

- Used in your home

- Generally has an expected lifetime of at least 3 years

Source: Medicare.gov website – here.

Classic examples of durable medical equipment covered by Original Medicare are wheelchairs, crutches and walkers, which are seen as medically necessary.

Typically, Original Medicare’s coverage is for 80 % of the cost of durable medical equipment which is certified as “medically necessary”, bought from a Medicare-approved supplier, and then you will pay your co-payment of 20%, and, if it applies, your deductible.

What Original Medicare doesn’t give coverage to, are what it lists as “comfort or convenience items“, equipment such as raised toilet seats, bed exit alarms, dehumidifiers, or wigs.

How to get coverage from Medicare Part B for DME ?

Coverage from Original Medicare Part B for Durable Medical Equipment for “use in the home” is given only if –

- you are enrolled in Medicare Part B

- you have your Medicare-enrolled doctor sign a prescription certifying that the equipment is a “medically necessary”

- you purchase or to rent the DME through a Medicare-enrolled supplier

How does Original Medicare define “living at home” ?

Original Medicare defines “living at home” as –

- living in your own home

- living in the family home

- living in the community, such as assisted living

Now what do you do with the signed prescription ?

Now you have your prescription –

- locating an equipment supplier is going to be first – you need to find a Medicare-enrolled DME supplier – take a look at the link to the Medicare supplier locator in the next section of this article

- once you have a supplier, remember they must be a Medicare-enrolled “participating” supplier who accepts “assignment” – this will keep the costs as low as possible for you

- pick out the equipment with the supplier which corresponds to your prescription – the prescriptions have special codes which indicate the range of DME from which you can choose

- check that all the paperwork for Medicare is done correctly – the supplier will help you, so that you comply with Medicare guidelines

Original Medicare part B typically covers 80% of the Medicare-approved price for your DME.

If you are purchasing or renting your DME from a Medicare-enrolled “participating” supplier who accepts assignment, you will just have to pay your Medicare 20% coinsurance payment of the Medicare-approved price of the DME, and if it applies, your policy deductible.

Always check that the supplier is a Medicare-enrolled “participating” supplier who accepts “assignment” ! One who isn’t, can ask for as much as 15% percent on top of the Medicare-approved price, and you will pay that, not Medicare.

Locate a Medicare-enrolled DME Supplier near you

Find a Medicare-approved supplier who is local to you – here

Do Medicare Advantage Plans cover lift chairs ?

Advantage plans are provided by private companies contracted by Medicare to provide the same services and coverage as Original Medicare Parts A and B, and that includes lift chairs if you qualify under the Medicare guidelines.

Medicare Advantage plans have been allowed, up to this point, to offer some extra benefits which are for vision and hearing, but in the next year they will be allowed to add new benefits which can be tailored to people’s illnesses, so there may be greater coverage for lift chairs.

How to get coverage, and where to get equipment, will depend on who your provider is, and you should talk with them about suppliers and the acquisition procedure.

Does Blue Cross cover lift chairs ?

Blue Advantage is a Blue Cross Blue Shield Medicare Advantage plan, also known as Medicare part C, which provides its members with all their Medicare Parts A and B coverage.

So yes, they do give coverage to the mechanized hydraulic lifts inside the lift chair, but not to any other pat of the chair.

Does United Healthcare cover lift chairs ?

UnitedHealthcare offers a range of different Medicare Advantage plans through UnitedHealthcare Medicare Plans.

All of these plans must offer at least the same coverage as Medicare Parts A and B, and so they will have the same coverage for the mechanized hydraulic lift part of a lift chair, as does Original Medicare, and with the same guidelines and criteria for qualification.

This is the list of durable medical equipment which is typically covered by Medicare

To qualify, you will need to have Original Medicare Parts A and B.

Air-Fluidized Bed

Alternating Pressure Pads and Mattresses

Audible/visible Signal Pacemaker Monitor

Pressure reducing beds, mattresses, and mattress overlays used to prevent bed sores

Bead Bed

Bed Side Rails

Bed Trapeze – covered if your loved one is confined to their bed and needs one to change position

Blood sugar monitors

Blood sugar (glucose) test strips

Canes (however, white canes for the blind aren’t covered)

Commode chairs

Continuous passive motion (CPM) machines

Continuous Positive Pressure Airway Devices, Accessories and Therapy

Crutches

Cushion Lift Power Seat

Defibrillators

Diabetic Strips

Digital Electronic Pacemaker

Electric Hospital beds

Gel Flotation Pads and Mattresses

Glucose Control Solutions

Heat Lamps

Hospital beds

Hydraulic Lift

Infusion pumps and supplies (when necessary to administer certain drugs)

IPPB Machines

Iron Lung

Lymphedema Pumps

Manual wheelchairs and power mobility devices (power wheelchairs or scooters needed for use inside the home)

Mattress

Medical Oxygen

Mobile Geriatric Chair

Motorized Wheelchairs

Muscle Stimulators

Nebulizers and some nebulizer medications (if reasonable and necessary)

Oxygen equipment and accessories

Patient lifts (a medical device used to lift you from a bed or wheelchair)

Oxygen Tents

Patient Lifts

Percussors

Postural Drainage Boards

Quad-Canes

Respirators

Rolling Chairs

Safety Roller

Seat Lift

Self-Contained Pacemaker Monitor

Sleep apnea and Continuous Positive Airway Pressure (CPAP) devices and accessories

Sitz Bath

Steam Packs

Suction pumps

Traction equipment

Ultraviolet Cabinet

Urinals (autoclavable hospital type)

Vaporizers

Ventilators

Walkers

Whirlpool Bath Equipment – if your loved one is home bound and the pool is medically needed. If your loved one isn’t home bound, Medicare will cover the cost of treatments in a hospital.

Prosthetic and Orthotic Items

Orthopedic shoes only when they’re a necessary part of a leg brace

Arm, leg, back, and neck braces (orthotics), as long as you go to a supplier that’s enrolled in Medicare

Artificial limbs and eyes

Breast prostheses (including a surgical bra) after a mastectomy

Ostomy bags and certain related supplies

Urological supplies

Therapeutic shoes or inserts for people with diabetes who have severe diabetic foot disease.

Corrective Lenses

Prosthetic Lenses

Cataract glasses (for Aphakia or absence of the lens of the eye)

Conventional glasses or contact lenses after surgery with insertion of an intraocular lens

Intraocular lenses

Important: Only standard frames are covered. Medicare will only pay for contact lenses or eyeglasses provided by a supplier enrolled in Medicare, no matter who submits the claim (you or your supplier).

Get free assistance with understanding Medicare

SHIP – State Health Insurance Assistance Programs

For those who need help with understanding Medicare, Medicaid and Medigap, and I think that’s most of us, the State Health Insurance Programs offer free counseling over the phone.

You just have to find your SHIP contact info, and you can do that here – “Free Help Understanding Medicare And Medicaid ? Here’s Where You Get It”.

Does Medicaid cover lift chairs ?

Medicaid is funded federally and by the individual states, because of this it will often agree to waive certain requirements for eligibility for different programs.

Such programs for which Medicaid agrees to waive requirements are called “waivers”.

These waivers are designed to assist different groups, or demographic, which might otherwise be missing out on healthcare – across the US there are many waivers which are specifically for the elderly, and for helping them to remain living safely in their own homes, and which offer financial assistance with DME and health care.

You can check to see what your state offers below.

Health Care in the home – Medicaid and state programs

Programs which have been designed specifically for low income families, the disabled and the elderly for care “in the home”, are called “Home and Community Based Services” (HCBS), “Waivers” or “1915 Waivers”.

The object of the programs is to provide the participants with the help they need to remain in their homes, and to be able to maintain their independence in the community.

These programs and waivers, will all help to cover “home medical equipment” – DME – and even home modifications or remodeling, and often cover the whole cost.

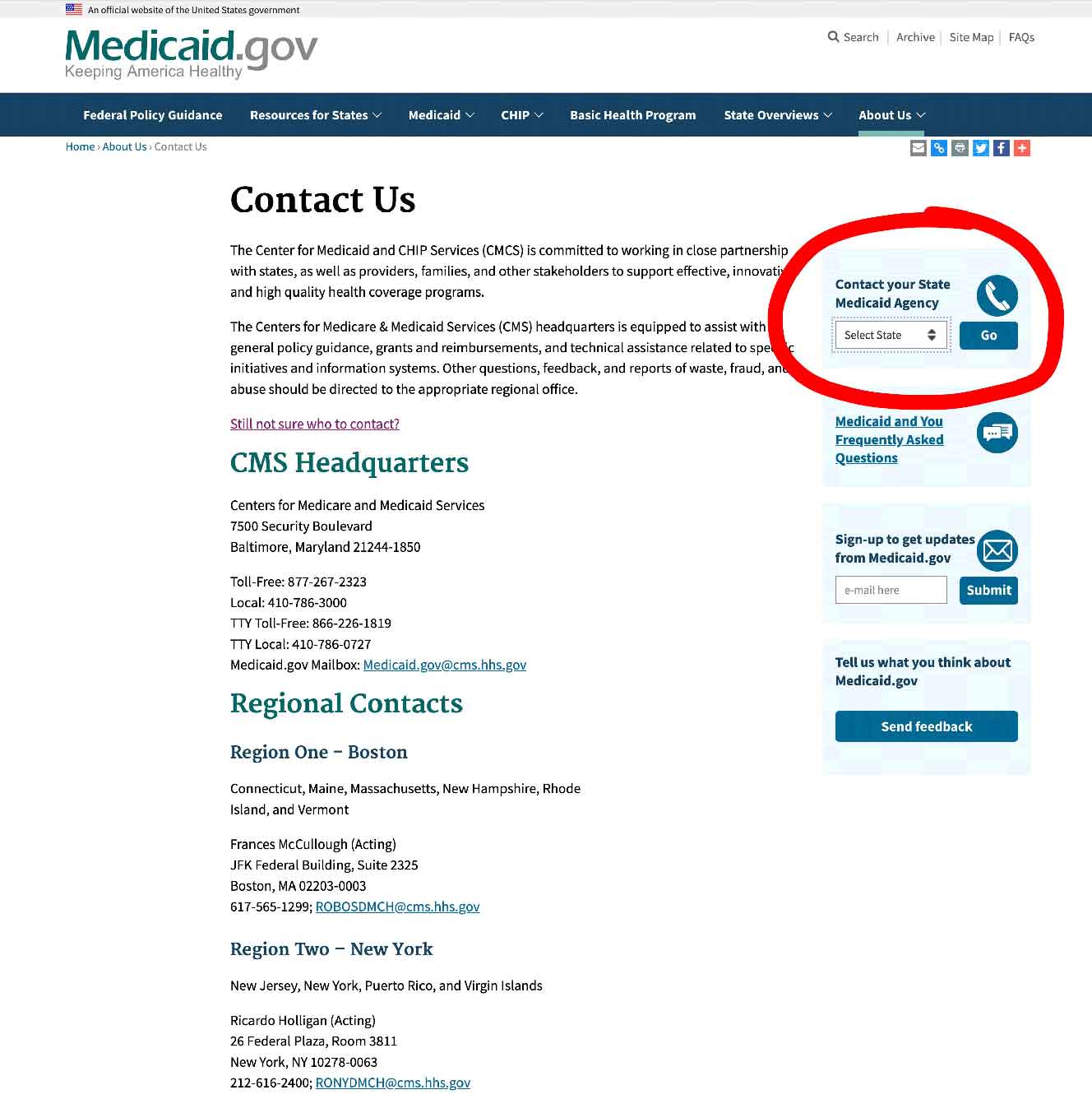

To find out if you are eligible for any programs, contact your State Medicaid Agency here.

To learn more about HCBS programs, or waivers, you can go here on Medicare.gov https://www.medicaid.gov/medicaid/hcbs/authorities/index.html

For the purposes of participants on these programs, “home” means –

- their own home

- their family home

- a group home

- an assisted living facility

- a custodial care facility

Programs with greater latitude in their interpretation of what DME is covered for care in the home

Two types of HCBS programs and waivers using a system of budget management called either,

- “Consumer Direction”

- “Self Direction”

offer a more flexible system for the participants to purchase equipment they need to maintain their independence.

To find out more about Medicaid Self Direction, click here.

The Medicaid program “Money Follows The Person”

Medicaid set up this program to help elderly adults living in nursing homes make the transition back to into their own homes, and now supports individual states with the funds to either build a new “Money Follows The Person” in their state, or to adapt an already functioning program in their state.

Money Follows The Person will fund the necessary medical equipment for the program participants to be able to live safely and independently, and will even go as far as remodeling their homes if needs be.

How to find the HCBS programs, waivers and 1915 waivers in your state

To find the Medicaid HCBS waivers and programs for seniors, just take a look at my guide listing them by state.

Also included are all the PACE Programs (Programs of All-inclusive Care for the Elderly) and Money Follows The Person Programs.

The guide is here – “Medicaid Home and Community Based Services Waivers and Programs For Seniors Listed By State”.

What is the procedure for applying to Medicaid and state waivers and HCBS programs for DME coverage ?

Step 1

– the doctor, or therapist, has to provide a medical justification letter, stating it is medically necessary

Step 2

– find a Medicaid-approved DME supplier, and give them the medical justification letter

Step 3

– the Medicaid-approved supplier fills out a Prior Approval Application form for Medicaid

Step 4

– the Prior Approval Application is sent to the Medicaid State Office

Step 5

– if you are unsuccessful you will be contacted and given the reasons as to why, as well as advice on how to make an appeal

Step 6

– if approved, you will receive the DME

If your income is a bit too high to qualify for Medicaid

Spend Down Programs

Spend Down programs employ several working methods to reduce a program participant’s income level, or income + assets level, so that the levels drop below the allowed limit to qualify for Medicaid coverage.

It is done by allowing the deduction of certain medical and other expenses – loan and debt payments – from a participant’s income, before considering the total.

I’ve written an article about how it works, which you can find here – What is Spend Down ?

To locate your Medicaid State Agency

If want you to discuss things, or to email someone, you can contact your state Medicaid Agency here.

Step 1 –

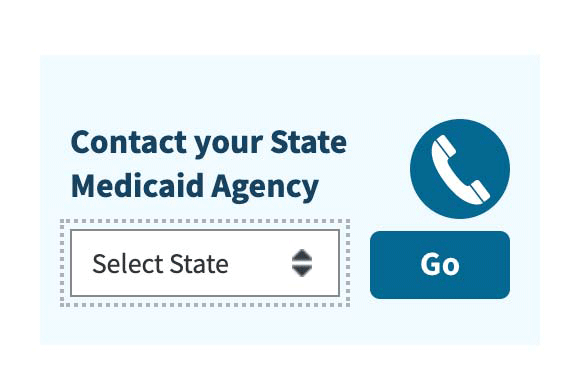

Click the link to Medicaid.gov and look for the section that I have outlined in red.

Step 2 –

Select your state and click on the button they have marked “GO” – it will take you to your State Medicaid Agency with all their contact info.

State Funding Assistance for the elderly

State Assistive Technology Programs

These programs are in all states and are primarily for the elderly and the disabled, to increase their access to assistive devices and medical equipment.

State Assistive Technology Programs offer a number of services, usually including these –

- an online exchange on where a member can post assistive devices and medical equipment for sale, donating or exchanging – you can simply register to become a member on your state exchange website and participate

- a central website where you can inquire about eligibility and how to gain access to free or low cost medical equipment and assistive devices

- reuse, recycling and refurbishment programs run by the state project, or by community partners providing free, or low cost medical equipment and assistive devices for the disabled, the elderly and other financially disadvantaged individuals

- loan closets – these can be short or long term loans – where an eligible individual can borrow medical equipment and assistive devices that they otherwise cannot afford

Assistive Technology Programs will also help to find equipment for those individuals who register with them.

You can research all of this on your state assistive technology program website.

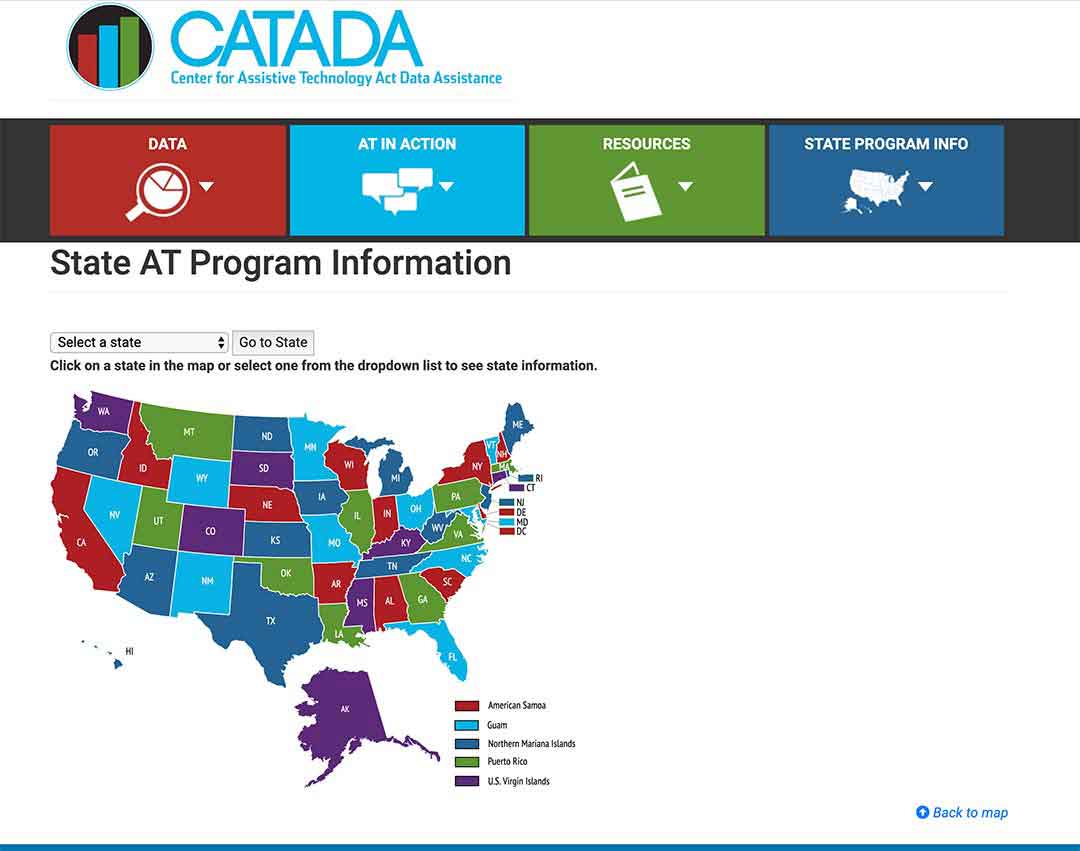

To see what projects are in your state, click here and follow the instructions below.

Step 1/

Pick your state on the map or the drop-down menu, and click on “Go to state”

– I chose Florida for this example

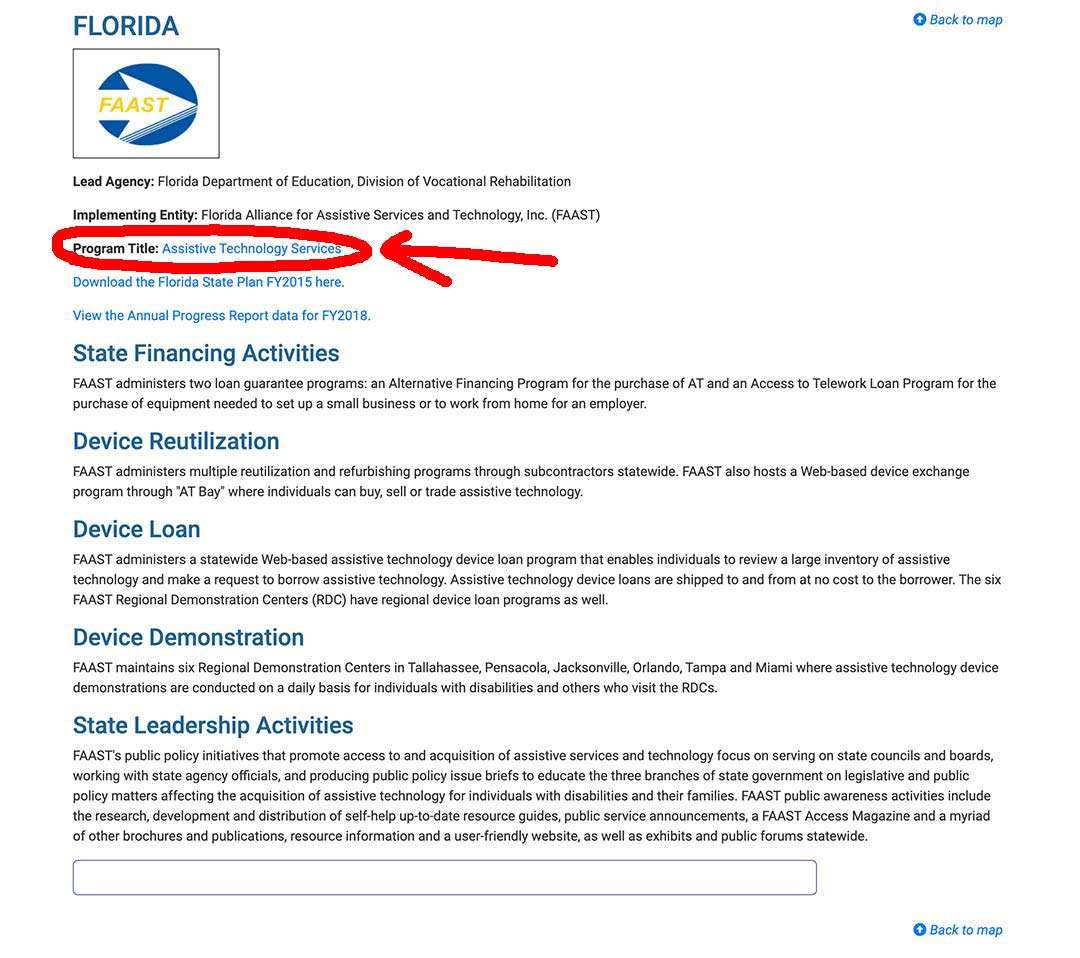

Step 2/

Click on the link “Program Title” – for my example, I outlined it in red.

Step 3/

The AT Program state website will come up, and you can sign up, or use their contact info.

State Financial Assistance Programs

Non-Medicaid state programs, which exist in a number of states, are another form of program designed to assist the elderly and the disabled to maintain, a more or less, independent lifestyle in their own homes.

These programs are usually known as State Financial Assistance Programs.

A broad range of assistive devices, safety equipment and also home modifications, can be covered by State Financial Assistance Programs if they will help the elderly beneficiaries maintain their independence.

This can be done with grants or loans, or both.

Ask your local Area Agency on Aging if your state has a Financial Assistance program – you can locate an Area Agency on Aging near you here.

I’m Gareth, the author and owner of Looking After Mom and Dad.com

I have been a caregiver for over 10 yrs and share all my tips here.