And for my first bathroom item I have chosen the humble, and yet I think, a vital piece of safety equipment for my mom, and your parents, the grab bar.

Original Medicare Part B doesn’t typically cover bathroom grab bars, because they are not considered as “medically necessary”, but rather as a “convenience”, or “comfort” items.

If you have a Medicare Advantage plan, or Part C, it may help cover some bathroom equipment, but it depends on the plan.

Contents Overview & Quicklinks

Do Medicare Advantage Plans cover grab bars and other bathroom equipment ?

Does Medicare cover shower chairs ?

Does Medicare cover raised toilet seats or toilet seat risers ?

Will medicare pay for bathroom modifications ?

Does Medicare cover walk in showers ?

Does Medicare cover bathroom equipment ?

What equipment does Medicare pay for ?

List of durable medical equipment typically covered by Medicare

Medicare-approved medical equipment supplier near me ?

How can you get coverage from Original Medicare Part B for your DME ?

What to avoid when purchasing, so you pay the least amount with Medicare ?

What if you are in a skilled nursing facility ?

Does Medicaid cover bathroom grab bars ?

Certain programs and waivers offer greater latitude in what they are willing to consider as DME ?

How to find the HCBS programs, waivers and 1915 waivers in your state ?

What’s the procedure for getting DME with Medicaid and state waivers, and HCBS programs ?

What if your revenue is too high to qualify for Medicaid ?

How much do grab bars cost ?

Grab bars generally cost between $15 – $100. There are some very elaborate models which cost more.

The installation cost will vary, depending on whether the wall needs any structural reinforcement, or not.

Porch.com says that it costs anywhere from $17 – $227 to pay a workman to install grab bars.

Do Medicare Advantage plans cover grab bars and other bathroom equipment ?

Medicare Advantage Plans, or Medicare Part C, do cover a wider range of bathroom equipment than Medicare Part B.

Medicare Advantage plans have been allowed to add new benefits since the 2020 fall enrollment.

In 2019, the Centers for Medicare & Medicaid released a brief outlining their plans for Medicare Advantage plans and Part D plans, to increase their competitiveness and the coverage they provide.

Beginning in 2019, Medicare Advantage plans can now offer supplemental benefits that are not covered under Medicare Parts A or B, if they diagnose, compensate for physical impairments, diminish the impact of injuries or health conditions, and/or reduce avoidable emergency room utilization.

Source: “CMS finalizes Medicare Advantage and Part D payment and policy updates to maximize competition and coverage” April 1, 2019. You can find it on the CMS.gov website here.

Some Medicare Advantage plans are offering new benefits for bathroom equipment such as grab bars.

Does Medicare cover shower chairs ?

Medicare Part B does not usually consider shower chairs as “medically necessary”, and so will not typically cover them for use in the home.

Medicare Part C, or Medicare Advantage Plans may well offer coverage for a shower chair, but you will need to check the policy, as it will differ from plan to plan.

To get coverage for a shower chair, you will have to have a prescription from your doctor, who must be a Medicare-enrolled physician

Your doctor is going to have to show how it is “medically necessary”, and that it is going to help you with your care of a diagnosed medical condition.

As I have said, Medicare Part B does not typically cover shower chairs, except for extreme cases where it is diagnosed as “medically necessary”.

If you want to find out more about the medical diagnosis it takes to qualify for coverage, and all the Medicare guidelines, you can read about that in my article “Does Medicare cover Shower Chairs ?”.

Does Medicare cover raised toilet seats, or toilet seats risers ?

Medicare Part B considers raised toilet seats to be a “convenience item” and does not typically give coverage to them.

For medicare Part B to cover any medical equipment in the home it has to be “medically necessary”, as certified by a Medicare-enrolled physician.

Medicare considers neither raised toilet seats, nor toilet seat risers, to be “medically necessary” and so does not cover them.

But, Medicare part B, under certain circumstances, does cover bedside commodes.

You can find out about the conditions, which you must meet, to qualify if you go to my article “Does Medicare Cover Bedside Commodes ?”. You will find all the necessary information about the diagnosis, the documents of medical necessity and the Medicare guidelines in the article.

As with all items for the bathroom, you will find that Medicare Advantage Plans are more likely to cover bathroom safety equipment, but you must shop around to find the policies which do so.

Will Medicare pay for bathroom modifications ?

Almost all home modifications will not be covered by Medicare Part B.

Medicare Part B typically only covers durable medical equipment for use in the home which it considers to be “medically necessary”, and unfortunately for the most part, equipment for the bathroom is considered, by Medicare, to be for comfort, and bathroom modifications as “not primarily medical in nature”.

In some rare instances Medicare will cover the cost of a bathroom modification i.e. walk in bathtubs, but Medicare has to be convinced of a real “medical necessity” –

to prove this, both a medical diagnosis documenting proof of need is required, and a signed prescription of “medical necessity” from a physician which demonstrates –

- the reasons why the patient cannot live without the modifications – the necessity

- what it is that is needed from required modification, or equipment

In addition, Medicare Part B requires that it can be “reasonably expected” that the modification, or equipment, will either help to maintain the patient’s condition, or give rise to improvement.

Still, the person who has a prescription of “medical necessity”, a diagnosis and a statement stating that the equipment, or modification, will either improve or maintain, the condition of their health, is not guaranteed that medicare will give the coverage.

In such a case, you will also have to pay for everything up front, and that hope that Medicare will agree and reimburse you for some costs.

But, as I said earlier, Medicare Advantage Plans are allowed, since the fall of 2020, to offer new benefits for bathroom equipment, and modifications for policyholders who suffer from chronic health conditions, and where the need can be diagnosed as “medically necessary”.

Does Medicare cover walk in showers ?

Walk in showers would be considered as bathroom modifications by Medicare, and as such as I stated above, they are rarely going to be considered “medically necessary” and covered.

They are considered to be a comfort item and also “not primarily medical in nature”.

But if you can prove that it is –

- unconditionally “medically necessary”

- have a prescription certifying this from a Medicare-enrolled doctor

- have a diagnosis with “proof of need” that supports this

- have lots of supporting evidence of why you can’t live without it

- have evidence of why this particular walk in shower will do what you need

- and that it can be reasonably expected that the shower will either maintain, or even improve your condition

then Medicare may agree to help cover.

Or you could just wait until the fall of 2020 to see which Medicare Advantage plans may be offering to cover modifications or walk in bathtubs.

Does Medicare cover bathroom equipment ?

As I said above, Medicare coverage extends to items which it sees as “medically necessary”, but not too many safety items sees these as comfort items or, “not primarily medical in nature”.

The term “not primarily medical in nature” is one of the expressions that Medicare uses on its statements of coverage, as a reason for denial.

The majority of what is considered safety equipment, and helping the elderly to maintain their independence in their homes, is not covered by Original Medicare.

For the bathroom, Medicare Part B does not typically cover any of the following –

- grab bars

- raised toilet seats

- transfer seats

- bath lifts (these are seats which rise up and down within the bathtub)

- floor to ceiling poles

- shower chairs

- bath chairs

- toilet safety frames

Some medical equipment designed for the elderly with mobility issues is covered (when “medically necessary” according to the Medicare guidelines), and can useful in the bathroom for avoiding falls –

- crutches

- walkers

- bedside commodes

- patient lifts

- a raised toilet seat –

- a shower chair if they are waterproof

- a safety frame for the toilet

- a safety frame or chair in front of a sink

- or as a chair for a sponge bath in the bathroom

If you want to find out more about how to use a 3-in-1 bedside commode as a raised toilet seat, you can read my article on that topic here.

I have an article about using a “3-in-1” commode in the shower, and more specialist shower commodes, which you can read here.

If your 3 in 1 commode isn’t waterproof or won’t fit into the shower, it is perfectly easy to get your loved one to sit on the commode chair and help them wash there – you can place a portable commode chair anywhere there is space.

My Mom was washed by nurses in our home on a portable commode after a hip replacement for a few weeks, as it was the safest option other than the bed, which my mom didn’t want to use.

Walkers which are waterproof –

- can be used as an aid to standing in the shower, so long as they are a waterproof model

- my mom uses her walker to help her up the little step into our shower and then back down and out

- any type of walker can be used as a safety rail in front of the sink or mirror

- as an aid to sitting down on, and getting up from the toilet

Mechanical Patient lifts are also covered by Medicare for people who cannot leave their beds (there are strict guidelines), and can in a lot of cases be used to help a person wash themselves in a shower, or a tub.

I have an article which outlines the Medicare qualifying guidelines for individuals needing patient lifts, and also the types of lifts which are covered – “Does Medicare Cover Patient Lifts ?”.

If you are not sure what you can get instead of a grab bar, I have a long article with 54 safety tips put together over the years of caring for my mom and dad to make the bathroom a safer place. You can find that here.

What equipment does Medicare pay for ?

For use in the home, Medicare Part B covers certain durable medical equipment if it is considered “medically necessary”.

For Medicare to cover an item as durable medical equipment, it has to meet these basic criteria:

- Durable (needs to be able to resist repeated use over a sustained period of time)

- It must be used for a medical reason, as opposed to just for comfort

- Not usually useful to someone who isn’t sick or injured

- You must be using it in your home

- Generally has an expected lifetime of at least 3 years

So when searching for cover for equipment, if it doesn’t meet these criteria, you probably won’t be able to get it covered by Medicare.

List of durable medical equipment covered by Medicare

Air-Fluidized Bed

Alternating Pressure Pads and Mattresses

Audible/visible Signal Pacemaker Monitor

Pressure reducing beds, mattresses, and mattress overlays used to prevent bed sores

Bead Bed

Bed Side Rails

Bed Trapeze – covered if your loved one is confined to their bed and needs one to change position

Blood sugar monitors

Blood sugar (glucose) test strips

Canes (however, white canes for the blind aren’t covered)

Commode chairs

Continuous passive motion (CPM) machines

Continuous Positive Pressure Airway Devices, Accessories and Therapy

Crutches

Cushion Lift Power Seat

Defibrillators

Diabetic Strips

Digital Electronic Pacemaker

Electric Hospital beds

Gel Flotation Pads and Mattresses

Glucose Control Solutions

Heat Lamps

Hospital beds

Hydraulic Lift

Infusion pumps and supplies (when necessary to administer certain drugs)

IPPB Machines

Iron Lung

Lymphedema Pumps

Manual wheelchairs and power mobility devices (power wheelchairs or scooters needed for use inside the home)

Mattress

Medical Oxygen

Mobile Geriatric Chair

Motorized Wheelchairs

Muscle Stimulators

Nebulizers and some nebulizer medications (if reasonable and necessary)

Oxygen equipment and accessories

Patient lifts (a medical device used to lift you from a bed or wheelchair)

Oxygen Tents

Patient Lifts

Percussors

Postural Drainage Boards

Quad-Canes

Respirators

Rolling Chairs

Safety Roller

Seat Lift

Self-Contained Pacemaker Monitor

Sleep apnea and Continuous Positive Airway Pressure (CPAP) devices and accessories

Sitz Bath

Steam Packs

Suction pumps

Traction equipment

Ultraviolet Cabinet

Urinals (autoclavable hospital type)

Vaporizers

Ventilators

Walkers

Whirlpool Bath Equipment – if your loved one is home bound and the pool is medically needed. If your loved one isn’t home bound, Medicare will cover the cost of treatments in a hospital.

Prosthetic and Orthotic Items

Orthopedic shoes only when they’re a necessary part of a leg brace

Arm, leg, back, and neck braces (orthotics), as long as you go to a supplier that’s enrolled in Medicare

Artificial limbs and eyes

Breast prostheses (including a surgical bra) after a mastectomy

Ostomy bags and certain related supplies

Urological supplies

Therapeutic shoes or inserts for people with diabetes who have severe diabetic foot disease.

Corrective Lenses

Prosthetic Lenses

Cataract glasses (for Aphakia or absence of the lens of the eye)

Conventional glasses or contact lenses after surgery with insertion of an intraocular lens

Intraocular lenses

Important: Only standard frames are covered. Medicare will only pay for contact lenses or eyeglasses provided by a supplier enrolled in Medicare, no matter who submits the claim (you or your supplier).

Medicare-approved equipment supplier near me ?

To find a Medicare supplier in your area you can use this link at Medicare.gov

How can you get coverage from Original Medicare Part B for your DME ?

To qualify for any DME for “use in the home” under Medicare Part B, you, or your loved one, will have to –

- be enrolled in Medicare Part B

- have a signed prescription from your Medicare-enrolled doctor which states the item is medical necessity – the doctor may need to provide further documented proof of medical necessity in certain situations

- purchase the DME through a Medicare-enrolled supplier

If you are claiming DME for your “home”, a hospital or nursing home cannot qualify as your “home”, although a long-term care facility, such as an assisted living, can qualify as “home”.

What qualifies as a home for Medicare Coverage ?

The following forms of residence qualify as living at “home” for Medicare –

- living in your own home

- living in the family home

- living in the community, such as assisted living

What happens next ?

If Medicare accepts to cover the purchase, you will still have to pay your annual deductible (if it hasn’t already been met), and your co-payment of 20% of the Medicare-approved price of the item. Medicare will pay the remaining 80% of the Medicare-approved price.

In the case of cheaper items, Medicare will usually purchase the items, but in cases such as hospital beds, it is more likely that they would rent a hospital bed on a monthly basis.

If the item is rented by Medicare from a Medicare-approved supplier who accepts “assignment”, you will have to pay a monthly co-payment of 20% of the Medicare-approved rental price, and Medicare will pay 80%.

What to avoid when purchasing, so you pay the least amount with Medicare ?

If you want to pay the least amount possible, you must make sure that your Medicare-enrolled “participating” supplier accepts “assignment”. This ensures that you are only going to pay your Medicare co-pay of 20% of the Medicare-approved price, and if you haven’t already met it, their annual Medicare Part B deductible.

Here’s Why –

Medicare-enrolled suppliers are divided into two groups –

- Medicare Suppliers

- Medicare “Participating” Suppliers

Medicare “Participating” Suppliers have agreed to what is known as “assignment” – this means that they have agreed to charge the Medicare-approved price only.

When you buy your durable medical equipment from a Medicare Participating Supplier, you will not be paying more than the 20% co-payment of the Medicare-approved price for the equipment, and if you have not yet met it, your annual deductible.

What happens if they are not a Participating Supplier ?

Dealing with a supplier who is Medicare-enrolled, but not a “Participating” Supplier, means that the supplier takes payment from Medicare, but doesn’t have to accept “assignment”.

The upshot of this is that they are then free to charge as much as 15% for the item, which can drive the cost of more expensive items considerably higher.

Medicare then pays the supplier 80% of the Medicare-approved price, and you have to pay your 20% co-pay of the Medicare-approved price, your annual deductible if you haven’t yet met it, plus the difference, over and above, the Medicare-approved price for the equipment to the supplier.

So, if the price for an item were $50 above the Medicare-approved price, you would have to pay it all.

What if you are in a skilled nursing facility ?

If you are in a Skilled Nursing Facility or hospital, the facility is required to supply any necessary medical equipment for up to 100 days. It is covered by Medicare Part A (Hospital Insurance).

Does Medicaid cover bathroom grab bars and other bathroom equipment ?

Medicaid funding for programs is both federal and state level funding.

Each state can have a number of different Medicaid programs, each with different eligibility guidelines, which has resulted in hundreds of programs for Medicaid across the US.

Medicaid programs are designed for people with extremely low incomes; mainly the elderly and the disabled, but also low income families.

Medicaid, like Medicare, will also pay for “home medical equipment”, and unlike Medicare, will very often cover 100% of the cost.

When Medicaid uses the term “home” for its programs, it means that for a person to be eligible for those programs, they can be in –

- their own home

- their family home

- a group home

- an assisted living facility

- a custodial care facility

Certain programs and waivers offer greater latitude in what they are willing to consider as DME

The Medicaid state programs which are for delivering Medicaid to people in their homes, as opposed to in skilled nursing facilities, are called Home and Community Based Services (HCBS) Waivers, or 1915 Waivers.

The programs do vary from state to state, but most allow for a good range of DME, and some are broader in their range than Medicare.

Certain waivers allow for what is called Consumer Direction.

The beneficiary is allotted a budget, which with the help of financial planning, they may decide how to use to cover their requirements. The allotted budget can be used to buy products, including durable medical equipment.

The program Money follows the person was designed to assist people in leaving nursing facilities, and to return them to live in their homes, or assisted living facilities. Durable medical equipment which is required for the beneficiaries to return to their homes is bought by the program.

How to find the HCBS programs, waivers and 1915 waivers in your state ?

To find the HCBS Waivers, 1915 Waivers, HCBS Programs and the Money Follows The Person Programs for seniors available in your state you can go to my article which lists what is available in each state, along with links to the different program websites. In addition, the Article also lists all the PACE programs which are for all-inclusive care in the home by state – “Medicaid Home and Community Based Services Waivers and Programs For Seniors Listed By State”.

What’s the procedure for getting DME with Medicaid and state waivers, and HCBS programs ?

As a participant in a program of this type, your loved one would get their doctor, or therapist, to provide a medical justification letter, saying that the equipment they want is medically necessary.

You will then contact a DME supplier, who is Medicaid-approved, and give them the medical justification letter from the doctor, or therapist.

The supplier would then fill out a Prior Approval application.

The document is sent to Medicaid at the state office where the purchase is either approved, or denied, and your loved one and the supplier would be notified.

If you were unsuccessful, you will be notified as to the reasons why, and how to appeal the decision.

If your purchase was approved, unlike with Medicare, there would be nothing to pay.

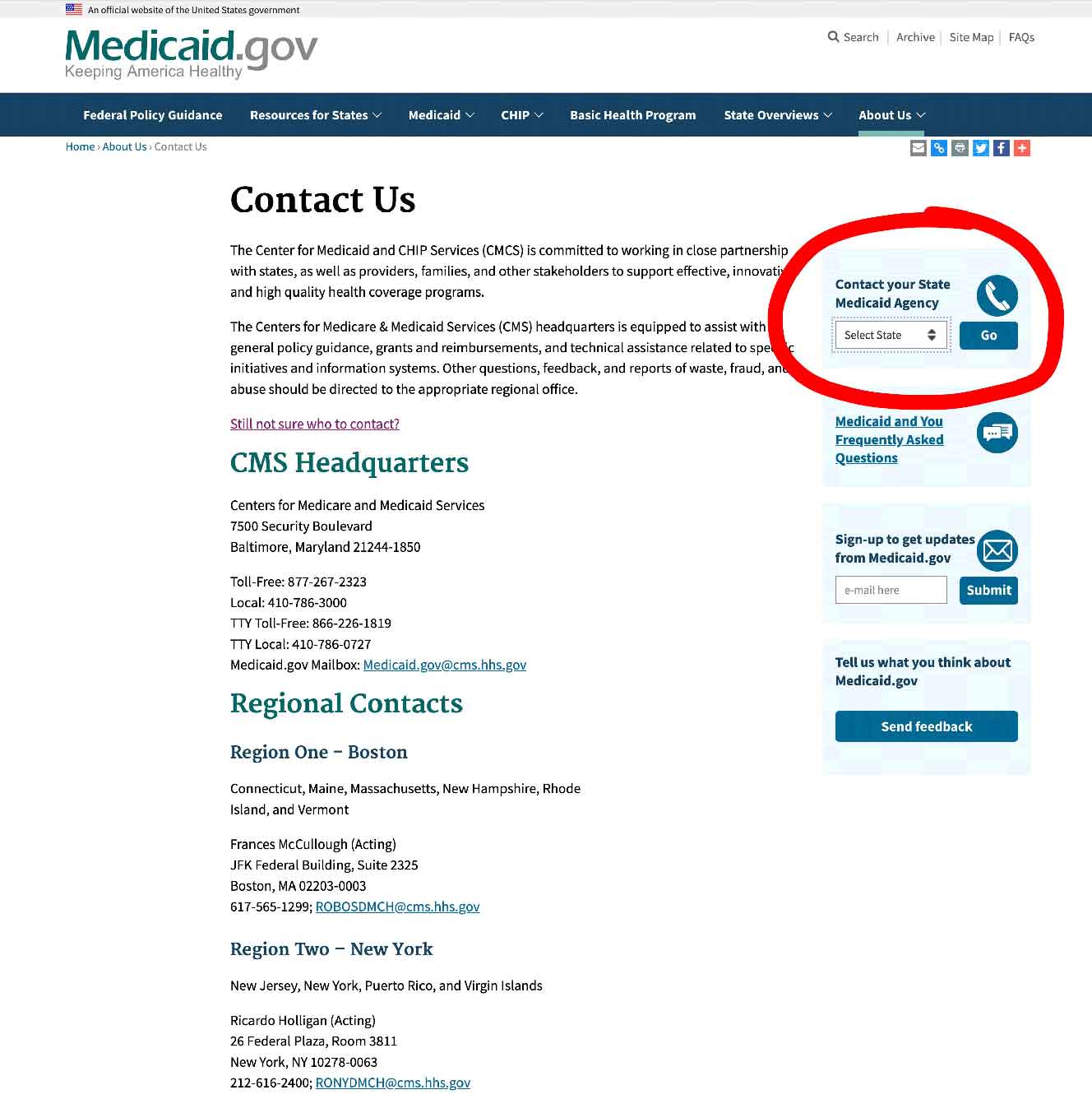

To find your State Medicaid State Agency

If you want to discuss things, or to email someone, you can contact your state Medicaid Agency here.

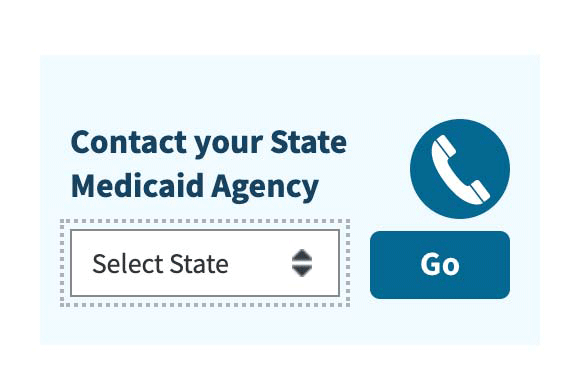

Step 1 –

Click the link to Medicaid.gov and look for the section that I have outlined in red.

Step 2 –

Select your state and click on the button they have marked “GO” – it will take you to your State Medicaid Agency with all their contact info.

What if your revenue is too high to qualify for Medicaid ?

The Spend Down Program

Spend Down programs will try to lower a person’s income, or income + asset level so that they may qualify for Medicaid, HCBS’s and waivers.

This can be achieved by two methods –

- Income Spend Down

- Asset Spend down

If you would like to find out if you qualify and how it all works, I have an article all about it here – What is Spend Down ?

State Funding Assistance

Assistive Technology Programs

Thanks to a Federal grant, all states across the US now have what is called a State Assistive Technology Program.

The programs are designed to improve access to assistive devices in the home, and it’s primarily for the elderly and the disabled.

Your State Assistive Technology Programs should have the following services –

- an online equipment exchange on which state residents can register, and then post used assistive devices and medical equipment to donate, swap or sell, with one another

- a main website which coordinates the whole project, lists the different ongoing events and projects, and where you can contact the projects to see if you are eligible for assistance and equipment

- recycling, refurbishment and reuse programs – these can be run by the state program, but are also run by no-profit and community groups in partnership with the state AT project to provide either free or low cost used equipment for the disabled and the elderly

- loan closets are usually part of the programs, and can be either long or short term, or sometimes both – they may just loan equipment to a person before they actually purchase it, so they have time to make sure it is the right fit for them, or it can be a permanent loan

To find out more, go to your State Assistive Technology Program website.

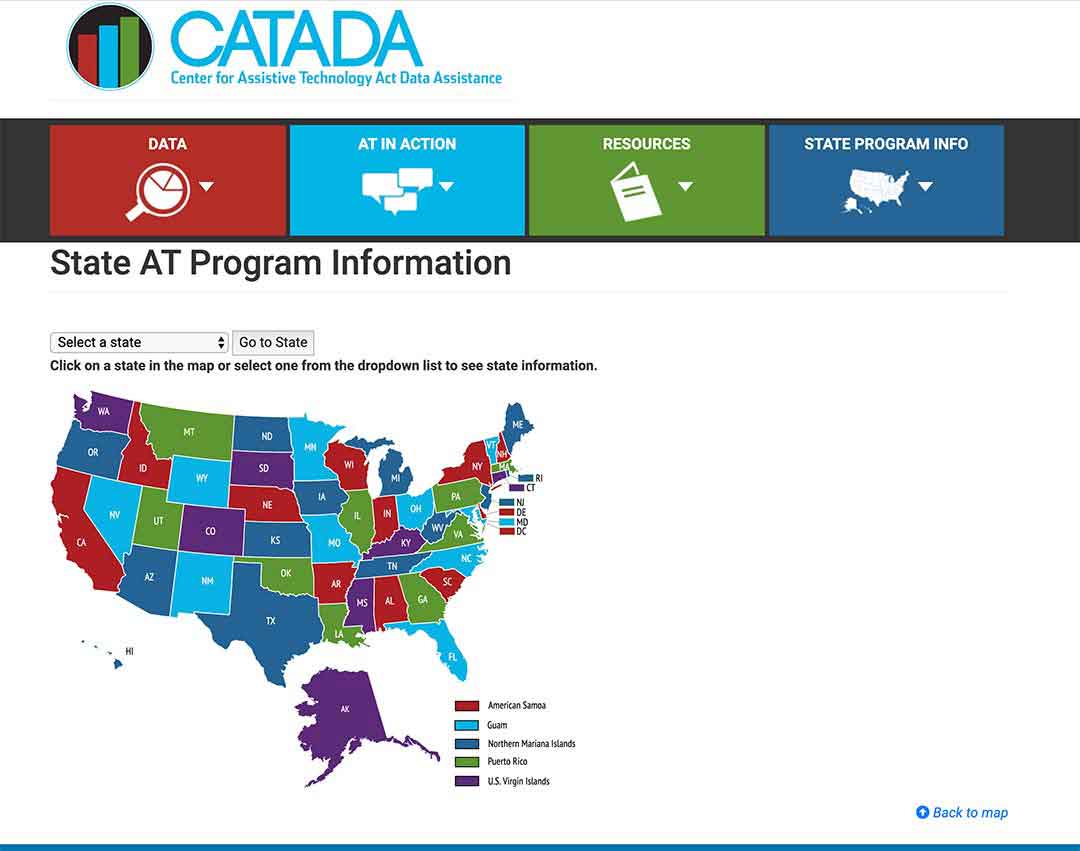

To see what projects are in your state, click here.

Follow the steps below to see the program in your state

Step 1/

Pick your state on the map or the drop-down menu, and click on “Go to state”

– I chose Florida for this example

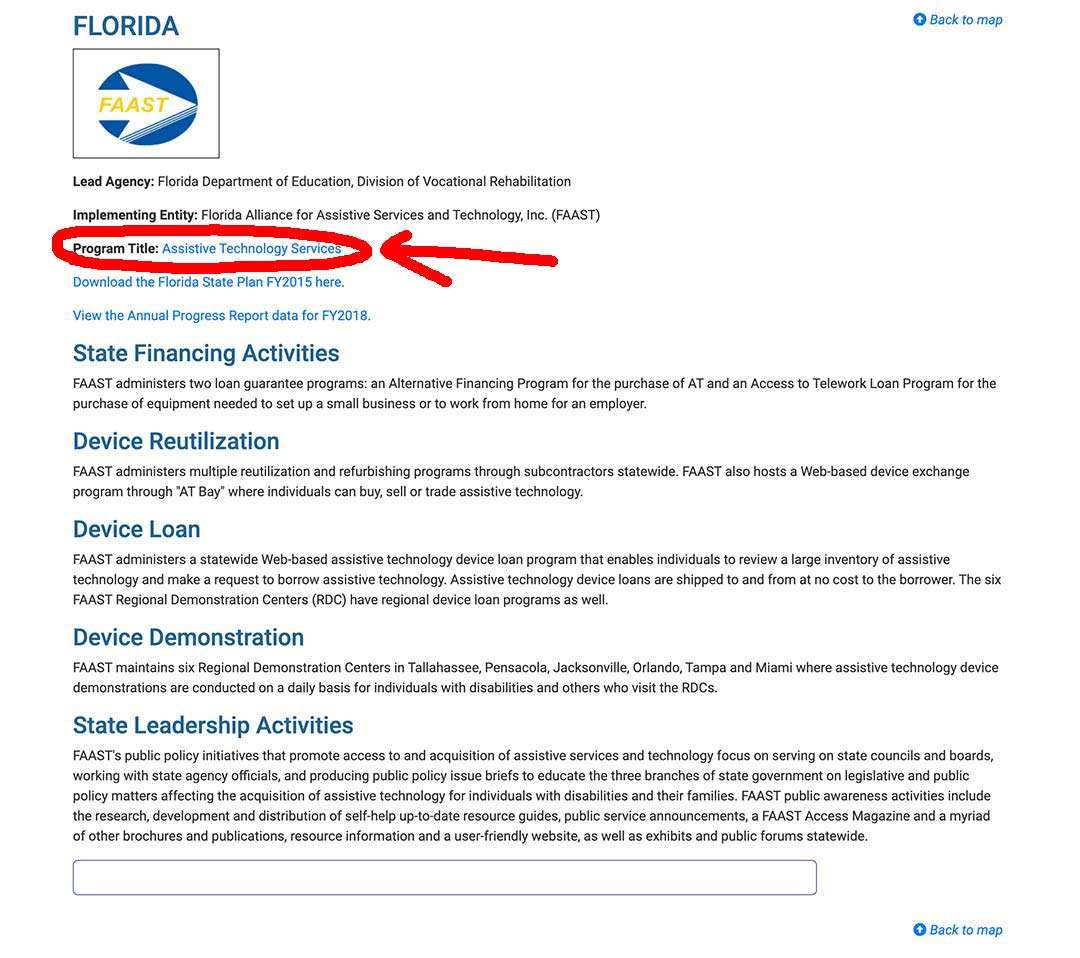

Step 2/

Click on the link “Program Title” – for my example I outlined it in red.

Step 3/

The AT Program state website will come up, and you can register, or use their contact info .

State Financial Assistance Programs

Non-Medicaid financial assistance programs to help the elderly and the disabled to live independently in their own homes exist in a number of states.

Grants and loans will be given to pay for assistive devices, safety equipment, durable medical equipment, as well as home modifications.

To find out if your state has a financial assistance program for the elderly, you can just contact your local Area Agency on Aging.

To locate the nearest Area Agency on Aging to you, use the locator on this link here.

How to get bathroom equipment and DME covered as a Veteran

If you are a veteran, the Department of Veterans’ Affairs has many grants, programs and forms of financial assistance which will help to cover the cost of DME and also Home Care Supplies.

Veterans are entitled to receive healthcare under the VA Medical Benefits Package.

The law provides that the VA has to provide hospital care, and outpatient care services, that are defined as “needed”, to eligible veterans.

The VA defines “needed” as a care, or a service, which promotes, preserves or restores health.

You can find out about their local VA Medical Centers, different clinics and offices in each state here.

Below are just some different forms of assistance for you to look at if you are a veteran –

- Tricare for life

- Tricare

- Veterans Directed Home and Community Based Services – these programs are designed to help veterans to stay living in their own homes

- ChampVA for Life – this program is for 65’s and over who are family members of veterans who died in the course of their duties, or who were permanently disabled – it covers the beneficiary’s Medicare co-pays and deductibles

Summary

It isn’t possible to get grab bars covered by Medicare Part B, or for that matter most other bathroom safety equipment.

There are, though, possibilities of getting grab bars covered by Medicaid state programs, non-medicaid state programs for the elderly, State Assistive Technology Projects, or if you are a veteran, certain programs may be able to cover them through the VA medical Benefits Package.

I’m Gareth, the author and owner of Looking After Mom and Dad.com

I have been a caregiver for over 10 yrs and share all my tips here.