Updated February 2022

As the costs, for the equipment for looking after our elderly loved ones, mounts up, it becomes really important to get help wherever you can. So, here’s an outline of Medicare’s hospital bed coverage guidelines, and the types of beds they cover. If you don’t qualify, there’s more information on Medicaid, and other forms of state funding.

Medicare Part B will typically cover, when they have been prescribed as “medically necessary”, by a Medicare-enrolled physician, the following hospital beds for use in the home –

- variable height hospital beds

- semi-electric hospital beds

- heavy-duty extra wide hospital beds

- extra heavy-duty hospital beds

One important point to note, is that Original Medicare Part B will not provide cover for just any hospital bed of the type an individual requires, but will usually offer coverage for a basic model of the type required.

Contents Overview & Quicklinks

Medicare adjustable beds for seniors

What are the different types of hospital bed ?

Medicare requirements for a hospital bed

Medicare qualifying diagnosis for a hospital bed

How much does it cost to rent a hospital bed ?

How much does a hospital bed cost ?

How often can you get a hospital bed with Medicare ?

Medicare-approved hospital bed suppliers

What do you do if you have a Medicare Advantage Plan

Does Medicare cover bed wedges ?

Will Medicare cover trapeze bars ?

Does Medicare cover over-bed tables ?

Will Medicare pay for bed alarms ?

What equipment does Medicare cover ?

How do you get coverage from Medicare Part B ?

What do you do with the signed prescription from your Medicare-enrolled physician ?

Find a local Medicare-enrolled DME Supplier near you

List of durable medical equipment typically covered by Medicare

Free help understanding Medicare

How to get a hospital bed through Medicaid ?

Programs and waivers for home care with a greater breadth in what is understood to be DME ?

How to find the HCBS programs, waivers and 1915 waivers in your state ?

The steps to getting a hospital bed through Medicaid ?

If your income is a bit too high to qualify for Medicaid

Medicare adjustable beds for seniors

Adjustable beds are simply beds which can adjust the level of different sections of the bed – elevate or lower them.

Hospital beds are a type of adjustable bed – you can raise and lower the head and foot sections, and on a variable height hospital bed, you can raise or lower the whole bed.

Medicare Part B considers manual, semi-electric and variable height hospital beds to be durable medical equipment, and covers the twin sized and bariatric models, according to their guidelines.

Fully electric adjustable beds are not covered, as they are not considered to be medically necessary.

What are the different types of hospital bed ?

There are 4 main types of hospital bed for which you may be able to get Medicare coverage for use in your home are –

- manual hospital bed

- semi-electric hospital bed

- variable height hospital bed

- bariatric hospital bed

Manual hospital bed

These beds are fully manual, and adjustments are made by turning a crank.

The number of cranks may vary.

These are the most economical of all the hospital beds, but also the most physically demanding for the carer.

Variable height hospital bed

Variable height beds are another type of manual bed, which has the added option of adjustable height, so as well as being able to adjust the head and foot sections of the bed, you can change the overall bed height.

The adjustments are made using a hand crank.

The variable height bed is often used for individuals who need to get very low to the floor, and for those who risk falling from the bed, where the best solution for this is to lower the bed as close to the floor as possible while they are sleeping.

Semi-electric hospital bed

Semi-electric beds use motors to adjust the head and foot sections of the bed, and a manual crank to adjust the height of the bed.

The electric motors are easily controlled with a hand held device, which allows the person in the bed to adjust the head, and foot, sections for themselves without calling for help.

This is also a lot easier for the caregiver, both because they can save on time and, and it’s easier on their back, as they don’t need to use a crank to adjust the head and foot sections – although they will still have to use a crank to adjust the height.

Bariatric or “Heavy Duty” Hospital bed

These are hospital beds which are made for heavier individuals.

There are two weight categories for bariatric hospital beds which are covered –

- 300 lb to 600 lb – Heavy Duty extra wide hospital beds

- 600 lb and above – Extra Heavy Duty hospital beds

Medicare Requirements for a hospital bed at home

Medicare Part B covers the use of durable medical equipment in the home.

To qualify under the Original Medicare guidelines, you must –

- be enrolled in Original Medicare Part B

- have a signed prescription from a physician stating that the bed is “medically necessary” in accordance with the Medicare guidelines

- your physician, who prescribes the bed, must be in Medicare-enrolled

- you must have had a face-to-face visit with the physician within 6 months prior to the date the bed is ordered

- have a qualifying diagnosis for a hospital bed (see below)

- have documents supporting the diagnosis, and any supporting documents from other practitioners, hospital visits, nursing facilities

- the physician must explain how you will benefit from having the hospital bed – how it will maintain your health, or improve it

- use a Medicare-enrolled durable medical equipment supplier – preferably a “Participating” Supplier

Medicare qualifying diagnosis for a hospital bed

If you meet one or more of the following criteria, Original Medicare will typically cover 80% of the cost of a hospital bed :

- If you have a medical condition “which requires positioning of the body in ways not feasible with an ordinary bed. Elevation of the head/upper body less than 30 degrees does not usually require the use of a hospital bed, or”

- If you require “positioning of the body in ways not feasible with an ordinary bed in order to alleviate pain, or”

- If you require “the head of the bed to be elevated more than 30 degrees most of the time due to congestive heart failure, chronic pulmonary disease, or problems with aspiration. Pillows or wedges must have been considered and ruled out, or”

- If you require “traction equipment which can only be attached to a hospital bed.”

Variable Height Hospital Beds – can be covered by Medicare if you have met one or more of the above criteria, and require “a bed height different than a fixed height hospital bed to permit transfer to chair, wheelchair or standing position.”

Semi-electric Hospital Beds – can be covered if you have met one or more of the above criteria, and require “frequent changes in body position and/or has an immediate need for a change in body position.”

- The “immediate need for a change in body position” here is important, as with a semi-electric bed, the user doesn’t need assistance if they can use an electric hand held device to immediately change the position of the head or foot sections.

Heavy Duty Extra Wide Hospital Beds – can be covered if you have met one or more of the above criteria, and your body “weight is more than 350 pounds but does not exceed 600 pounds.”

Extra Heavy Duty Hospital Beds – can be covered if you have met one, or more, of the criteria above, and your body“weight is more than 600 pounds”.

Total Electric Beds are considered to be a “convenience feature” and are not covered by Medicare, and so are “denied as not reasonable and necessary.”

The above guidelines are from the CMS (Centers for Medicare and Medicaid Services) Requirements list for Hospital Beds and Accessories.

There is a technical document which you can read on CMS.gov – National Coverage Determination (NCD) for Hospital Beds (280.7) – here.

How much does it cost to rent a hospital bed ?

Depending on a person’s case, and the duration of the need for the bed, Medicare may give the choice of either purchasing the bed, or renting the bed.

If you rent a hospital bed with Medicare coverage, it is considered to be a “capped rental” item, renting the bed for 13 monthly payments, after which the beneficiary, you, will own the bed.

As I noted earlier, Medicare will only cover certain types of hospital bed, and only up to 80 % of the Medicare-approved cost, and only if they are prescribed by a Medicare-enrolled physician and only if they are bought from a Medicare-enrolled supplier.

Renting a hospital bed will typically cost $200 – $500 a month to rent, and if you are doing so with Medicare Part B coverage of 80%, you will then pay 20% of the rental cost.

In other words, if the bed rental were to be $250 per month, Medicare Part B would pay $200 towards the rental each month, and you would pay your coinsurance of $50 each month.

If your deductible applies, you would have to pay that as well, once, at the outset.

For a larger item, the cost is more easily managed with a rental.

How much does a hospital bed cost ?

Hospital beds range in price from $500.00 to $12,000.00 – this does not include the highly specialized ICU beds.

This includes all kinds of fully electric beds, which are not covered by Medicare

So, let’s now just take a look at the cost of the types of bed for which Medicare offers 80% coverage if you are enrolled and qualify under their regime – that is not to say that Medicare will cover the more expensive models, they typically only cover the most basic.

The following prices are taken from normal medical supply retailers, so the prices will most likely be higher than those paid by Medicare, as they agree with enrolled suppliers to specific prices which are reduced due to the fact that they are buying so many.

The beds in the price ranges below are for standard sized single hospital beds, and do not include the mattress or side rails –

- Manual hospital beds – no electric parts – $500.00 – $800.00

- Variable height manual hospital bed – $550.00 – $700.00

- Semi electric hospital beds – $550.00 – $900.00

For larger individuals, Medicare covers Heavy Duty and Extra Heavy Duty hospital beds, but does not cover fully electric beds – well all bariatric beds are fully electric –

- Heavy Duty hospital bed (300 lb – 600 lb) – $1750.00 – $4000.00

- Extra Heavy Duty Hospital bed (600 lb and above) – $3875.00 – $7,000.00

How often can you get a hospital bed with Medicare ?

For Original Medicare to replace any covered durable medical equipment which is worn out, including a hospital bed, it must have been in your possession for its whole lifetime.

For Original Medicare, the lifetime of a covered piece of durable medical equipment cannot be less than 5 years.

Original Medicare will only replace “like for like” – when an item is replaced you cannot get an upgraded version, the replacement will be the same as the equipment it replaces.

And if a DME is damaged or stolen?

If any durable medical equipment which had Original Medicare Part B coverage is lost, stolen, or damaged in an accident or a natural disaster, and so badly that it can’t be repaired, Original Medicare Part B will, as long as you have the proof of coverage, replace it.

Medicare-approved hospital bed supplier near me ?

To find a Medicare-enrolled supplier near you, you can use this link to Medicare.gov, and use their tool to locate Medicare-enrolled Medical Equipment Suppliers in your area zip code.

You can check Medicare’s documentation on DME’s here – Medicare.gov

What do you do if you have a Medicare Advantage Plan ?

Medicare Advantage plans have to offer at least the same coverage as Original Medicare Parts A and B, as they are companies which have been contracted by Medicare to provide the same Medicare services, and sometimes a few extra benefits as well.

So, Medicare Advantage plans should cover hospital beds, so long as you fulfill the Original Medicare criteria, and so long as you follow all the guidelines for your Advantage plan’s provider – staying within their network of providers and suppliers etc.

Does Medicare cover bed wedges ?

Original Medicare Part B does not cover bed rails for a standard bed, Medicare does, however, cover hospital beds which come with side rails.

I have already laid out the guidelines above for qualifying for a hospital bed, so if you don’t qualify you may want to look into Medicaid, or some of the other state funding programs.

There is, in every state in the US, an Assistive Technology Program, and these programs often run online exchanges where state residents can register and either donate, buy, sell (at a very low cost), or exchange, durable medical equipment and AT devices.

You can skip ahead to the Assistive Technology Program section here, and find out about projects and online exchanges in your state.

If you are interested in getting bed rails, you may want to take a look at my article “10 Great Alternatives To Bed Rails For The Elderly”.

In my article, I outline a range of safer options which can also stop an elderly loved one from falling out of bed, and you can find that here.

Bed rails are not the safest option for certain categories of elderly, or frail individuals, and have been linked to deaths in certain cases.

Does Medicare cover trapeze bars ?

Yes, Original Medicare Part B will typically cover 80 % of the Medicare-approved cost of trapeze bars in certain situations –

- the beneficiary must be bed bound

- the trapeze bar has to be prescribed as “medically necessary”

- by a Medicare-enrolled doctor

- according to the Medicare guidelines.

The Medicare guidelines are as follows –

If you already have a Medicare covered hospital bed, a trapeze bar attached to a bed is covered –

“if patient is bed confined and the patient needs a trapeze bar to sit up because of a respiratory condition, to change body position for other medical reasons, or to get in or out of bed”.

A trapeze which is attached to an ordinary bed will not receive Medicare coverage, but –

if you do not have a Medicare covered hospital bed, a “Free standing” trapeze bar is covered –

“if patient is bed confined and the patient needs a trapeze bar to sit up because of a respiratory condition, to change body position for other medical reasons, or to get in or out of bed”.

The source text of the guidelines is the “National Coverage Determination (NCD) for Durable Medical Equipment Reference List (280.1)” implemented in 7/5/2005 which is available for all to read at CMS.gov.

If the user’s body weight exceeds 250 lb, and they meet the criteria outlined above, they will qualify for Medicare coverage for a “heavy duty” trapeze bar.

Does Medicare cover over-bed tables ?

Over-bed tables are the tables that you typically see in hospitals, which have a stand at one side with a base with wheels or casters, and that slips under the bed as the table-top moves into place over the bed.

Original Medicare Part B does not offer coverage for over-bed tables, as it does not consider them as “medically necessary”, but rather as a “convenience item” which is “not primarily medical in nature”.

The medicare guidelines are –

“Over-bed Tables – Deny – convenience item; not primarily medical in nature (§1861(n) of the Act).”

Source: National Coverage Determination (NCD) For Durable Medical Equipment Reference List (280.1) – You can find the document here, on the Center for Medicare and Medicaid Services website (cms.gov).

Over-bed tables may well be covered under Medicaid, state HCBS programs, waivers and 1915 waivers, and other state financial assistance plans for the elderly and disabled, which I will be covering after the next section on the Medicare purchasing procedure.

Does Medicare cover bed alarms ?

Original Medicare Part B does not give any coverage to bed alarms or bed exit sensors, as they are deemed to be “not medically necessary”.

Just because you can’t get one covered by Medicare, though, doesn’t mean that you can’t get one under Medicaid, or one of the different state funded programs for which many elderly adults can qualify.

I will be laying out the different options with state level programs, and funding opportunities, once I have outlined the procedure for applying for a hospital bed with Medicare.

If you want to learn about bed alarms and bed exit sensors, I have a long article “Types Of Bed Alarms: What You Should Know Before You Buy”, which takes an in depth look at the different types and their possible uses – I have bought and tested a range of types, and with my mom we used them to find out which we preferred and found to be the best. You can read that article here.

What equipment does Medicare cover ?

Original Medicare Part B typically covers 80% of the Medicare-approved price of durable medical equipment for use in the home.

I have a long list of durable medical equipment covered by Medicare, which you can skip ahead to here.

For Medicare, durable medical equipment must fit the following criteria :-

- Durable (can withstand repeated use)

- Used for a medical reason

- Not usually useful to someone who isn’t sick or injured

- Used in your home

- Generally has an expected lifetime of at least 3 years

Source: Medicare.gov website – here

Original Medicare Part B covers durable medical equipment such as wheelchairs, crutches and walkers, which it sees as “medically necessary”.

Original Medicare Part B doesn’t cover what Medicare considers to be comfort items, such as bathroom safety equipment, air purifiers or a wedge pillow.

Original Medicare Part B’s coverage of the Durable Medical Equipment typically extends to 80 % of the cost of the item, and the beneficiary is responsible for the coinsurance payment of 20%, and if it applies their deductible.

How do you get coverage from Original Medicare Part B ?

The criteria for an individual to get coverage from Original Medicare Part B for Durable Medical Equipment for “use in the home” is –

- you must be enrolled in Original Medicare Part B program

- you will have to have a prescription signed by your Medicare-enrolled doctor certifying the equipment is a “medically necessary”

- the procuring of the equipment must be done through a Medicare-enrolled supplier

What does Medicare mean by “living at home” for coverage –

This can be –

- living in your own home

- living in the family home

- living in the community, such as assisted living

What do you do with the signed prescription from your Medicare-enrolled physician ?

If your physician finds that you qualify for a hospital bed, and prescribes one for you as “medically necessary”, then the physician will typically order your bed with you.

Original Medicare Part B typically covers 80% of the Medicare-approved price for your hospital bed, and, assuming that you are acquiring your hospital bed from a Medicare-enrolled “participating” supplier who accepts assignment, you will be responsible for paying your Medicare 20% coinsurance payment of the Medicare-approved price of the hospital bed, plus your deductible if it applies.

Always confirm with the supplier, before you enter into any agreement, that the supplier is a Medicare-enrolled “participating” supplier who accepts “assignment” !

Medicare Rentals – if your hospital bed is rented from a Medicare-enrolled supplier, you will still have the same amount to pay as if you bought it rather than renting.

With a hospital bed, it is more than likely that Original Medicare Part B coverage will be done on a rental basis, as this is standard practice for larger items.

The difference is, that you will still pay a 20% coinsurance payment, but it will be a monthly rental, i.e. 20% of the Medicare agreed monthly rental price that you will pay monthly. And your deductible will be paid at the outset, if it applies.

Find a local Medicare-enrolled DME Supplier near you

This link will help you find a Medicare-approved supplier who is local to you – Medicare.gov

This is the list of durable medical equipment which is typically covered by Medicare

To qualify, you will need to have Original Medicare Parts A and B.

Air-Fluidized Bed

Alternating Pressure Pads and Mattresses

Audible/visible Signal Pacemaker Monitor

Pressure reducing beds, mattresses, and mattress overlays used to prevent bed sores

Bead Bed

Bed Side Rails

Bed Trapeze – covered if your loved one is confined to their bed and needs one to change position

Blood sugar monitors

Blood sugar (glucose) test strips

Canes (however, white canes for the blind aren’t covered)

Commode chairs

Continuous passive motion (CPM) machines

Continuous Positive Pressure Airway Devices, Accessories and Therapy

Crutches

Cushion Lift Power Seat

Defibrillators

Diabetic Strips

Digital Electronic Pacemaker

Electric Hospital beds

Gel Flotation Pads and Mattresses

Glucose Control Solutions

Heat Lamps

Hospital beds

Hydraulic Lift

Infusion pumps and supplies (when necessary to administer certain drugs)

IPPB Machines

Iron Lung

Lymphedema Pumps

Manual wheelchairs and power mobility devices (power wheelchairs or scooters needed for use inside the home)

Mattress

Medical Oxygen

Mobile Geriatric Chair

Motorized Wheelchairs

Muscle Stimulators

Nebulizers and some nebulizer medications (if reasonable and necessary)

Oxygen equipment and accessories

Patient lifts (a medical device used to lift you from a bed or wheelchair)

Oxygen Tents

Patient Lifts

Percussors

Postural Drainage Boards

Quad-Canes

Respirators

Rolling Chairs

Safety Roller

Seat Lift

Self-Contained Pacemaker Monitor

Sleep apnea and Continuous Positive Airway Pressure (CPAP) devices and accessories

Sitz Bath

Steam Packs

Suction pumps

Traction equipment

Ultraviolet Cabinet

Urinals (autoclavable hospital type)

Vaporizers

Ventilators

Walkers

Whirlpool Bath Equipment – if your loved one is home bound and the pool is medically needed. If your loved one isn’t home bound, Medicare will cover the cost of treatments in a hospital.

Prosthetic and Orthotic Items

Orthopedic shoes only when they’re a necessary part of a leg brace

Arm, leg, back, and neck braces (orthotics), as long as you go to a supplier that’s enrolled in Medicare

Artificial limbs and eyes

Breast prostheses (including a surgical bra) after a mastectomy

Ostomy bags and certain related supplies

Urological supplies

Therapeutic shoes or inserts for people with diabetes who have severe diabetic foot disease.

Corrective Lenses

Prosthetic Lenses

Cataract glasses (for Aphakia or absence of the lens of the eye)

Conventional glasses or contact lenses after surgery with insertion of an intraocular lens

Intraocular lenses

Important: Only standard frames are covered. Medicare will only pay for contact lenses or eyeglasses provided by a supplier enrolled in Medicare, no matter who submits the claim (you or your supplier).

Free help with understanding Medicare

SHIP – State Health Insurance Assistance Programs –

Medicare, Medicaid and Medigap – free counseling over the phone is available from your SHIP if you need help.

I have a short article which outlines how to find your SHIP, which you can find that here – “Free Help Understanding Medicare And Medicaid ? Here’s Where You Get It”.

How to get a hospital bed through Medicaid ?

On a state level, there are different options as to what can be done with Medicaid.

In all states, Medicaid may agree to waive some requirements for eligibility for different programs.

The programs where Medicaid agrees to waive requirements are called “waivers”.

Health Care in the home – Medicaid and state programs

Programs for low income families, the disabled and the elderly, for care in the home, are called “Home and Community Based Services” (HCBS), “Waivers” or “1915 Waivers”.

The goal of the programs is to help the participants to maintain their independence in their homes, and the community.

The programs and waivers, will all cover “home medical equipment”, and in some cases they will cover as much as 100% of the cost.

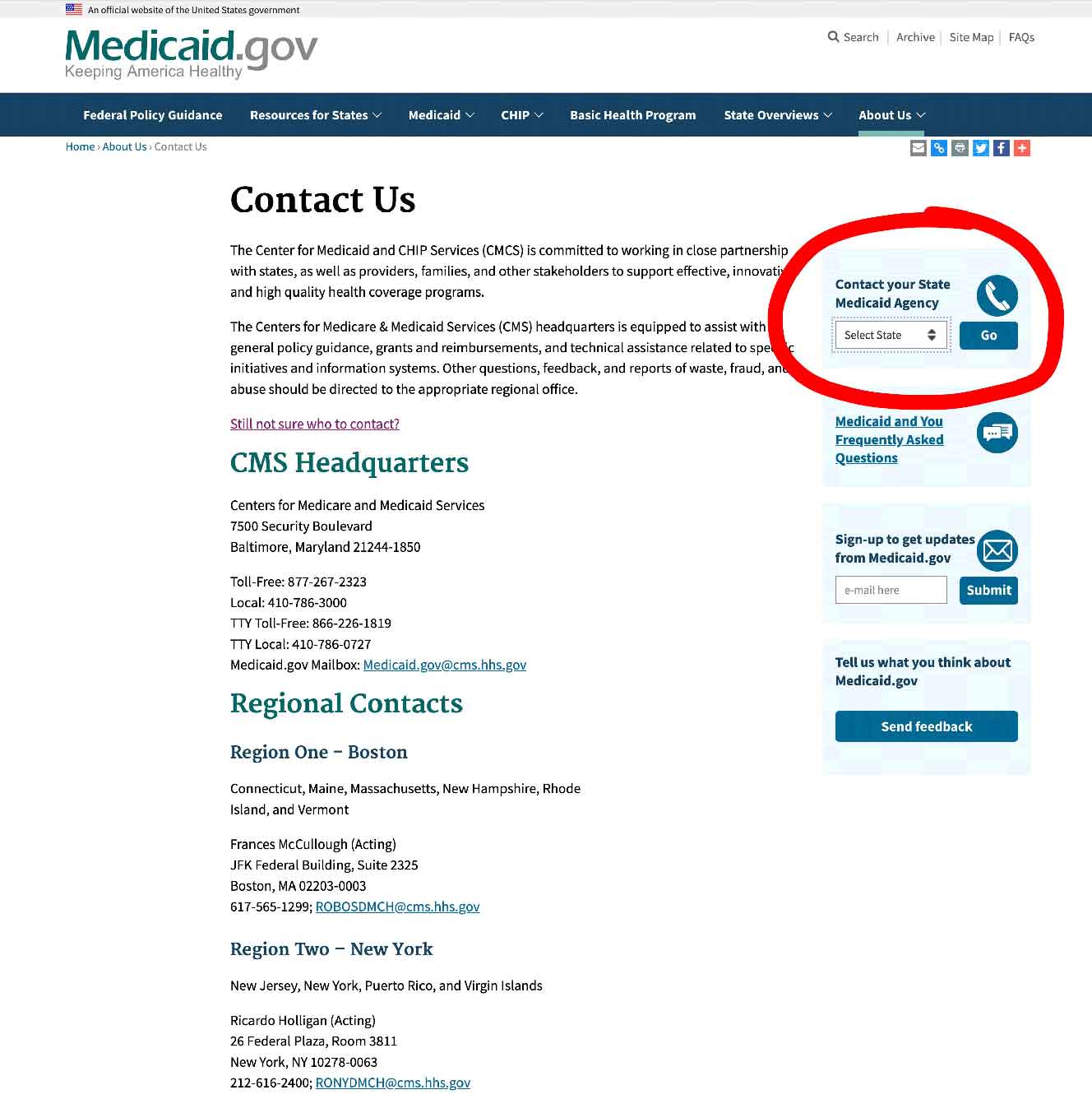

To check your eligibility for any programs, contact your State Medicaid Agency here.

For more information on HCBS programs, or waivers, you can go here on Medicare.gov –

https://www.medicaid.gov/medicaid/hcbs/authorities/index.html

For the purposes of these home care programs, the term “home” is used to mean the following –

- their own home

- their family home

- a group home

- an assisted living facility

- a custodial care facility

Programs and waivers for home care with a greater breadth in what is understood to be DME

There are two main state program types which offer the broadest interpretation of durable medical equipment –

HCBS programs and waivers which employ a system of budget self-management called either “Consumer Direction” or “Self Direction”.

Participants on these programs and waivers will, with the help of an appointed financial advisor, get to decide what equipment is necessary for them to maintain their independence in their homes.

If the equipment they require is within their budgetary constraints, they will invariably be allowed to purchase it – but it must be proven to be necessary.

The types of equipment which qualify here are far more broad ranging than under Medicare.

To find out more about Medicaid Self Direction, click here.

The Medicaid program “Money Follows The Person”

This Medicaid program was set up to help elderly adults living in nursing homes to move back to into their own homes.

It supports individual states with the funding to, either build a new program from the ground up, or to adapt an already existing program.

Programs may pay for remodeling parts of the home to make things safer, improve lighting, build ramps etc. or just buy a shower chair.

The range of durable medical equipment is far wider than that which is allowed on Medicare.

How to find the HCBS programs, waivers and 1915 waivers in your state

If you are trying to find the Medicaid HCBS waivers and programs for seniors in your state, just take a look at my guide which lists them by state – in addition it includes all Money Follows The Person Programs, and PACE Programs (Programs of All-inclusive Care for the Elderly).

The guide is here – “Medicaid Home and Community Based Services Waivers and Programs For Seniors Listed By State”.

The steps to getting a hospital bed through Medicaid ?

Step 1

– the doctor, or therapist, has to provide a medical justification letter, stating it is medically necessary

Step 2

– find a Medicaid-approved DME supplier, and give them the medical justification letter

Step 3

– the Medicaid-approved supplier fills out a Prior Approval Application form for Medicaid

Step 4

– the Prior Approval Application is sent to the Medicaid State Office

Step 5

– if you are unsuccessful you will be contacted and given the reasons as to why, as well as advice on how to make an appeal

Step 6

– if approved, you will receive the DME

If your income is a bit too high to qualify for Medicaid

Spend Down Programs

The goal of “spending down” is a reduction in a program participant’s income level, or their income + asset level, so that they may qualify for Medicaid coverage.

There are two methods –

- Income Spend Down

- Asset Spend Down

Income Spend Down is the simpler of the two methods, and basically allows a participant to deduct certain medical expenses from their income.

Asset Spend Down is more complex, with different types of deductions allowed.

You can find my article post about how it works here – What is Spend Down ?

To find your State Medicaid State Agency

If you want to discuss things, or to email someone, you can contact your state Medicaid Agency here.

Step 1 –

Click the link to Medicaid.gov and look for the section that I have outlined in red.

Step 2 –

Select your state and click on the button marked “GO” – it will take you to your State Medicaid Agency with all their contact info.

How to get free hospital beds

There exist quite a few resources which you can use in your state to find out if you can get free hospital beds, if you put in some time.

Some funding sources will pay for a new hospital bed, or a refurbished bed, or you may find someone who is donating a bed they no longer need.

I have seen private individuals offering hospital beds for free on multiple occasions, so it is possible to find them.

State Assistive Technology Programs

Assistive Technology Programs, in all states across the US, have been designed to improve access to assistive devices in the home, primarily for the elderly and the disabled.

Most state Assistive Technology Programs have –

- an online exchange where people will post assistive devices and medical equipment, such as hospital beds as donations, or at very low cost – state residents can just register on the exchange website, and participate at no cost for using the site

- a main website where you can make contact and ask about how to get access to free equipment, and what the eligibility requirements are

- reuse and refurbishment programs which are run by the state program, or partnered with community groups to help them provide free or extremely low cost equipment for the disabled, the elderly and other disadvantaged individuals – sometimes the equipment is free, and in other cases you have to pay a little, depending on the individual’s circumstances

- some states have loan closets as part of their program, and particularly short term loans for checking that the equipment suited to an individual

Assistive Technology Programs will also make contact with individuals who enroll when they know that there is equipment available that the person needs.

You can find out about this on your state assistive technology program website.

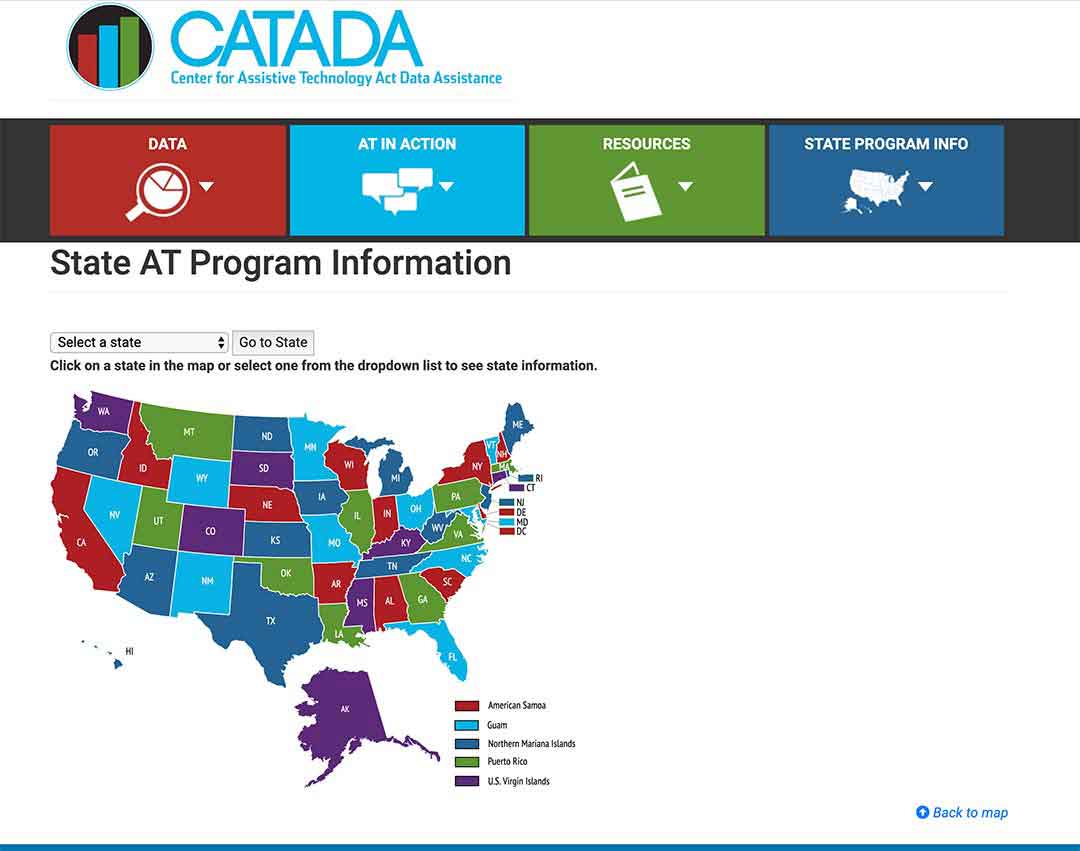

To see what projects are in your state, click here.

Step 1/

Pick your state on the map or the drop-down menu, and click on “Go to state”

– I chose Florida for this example

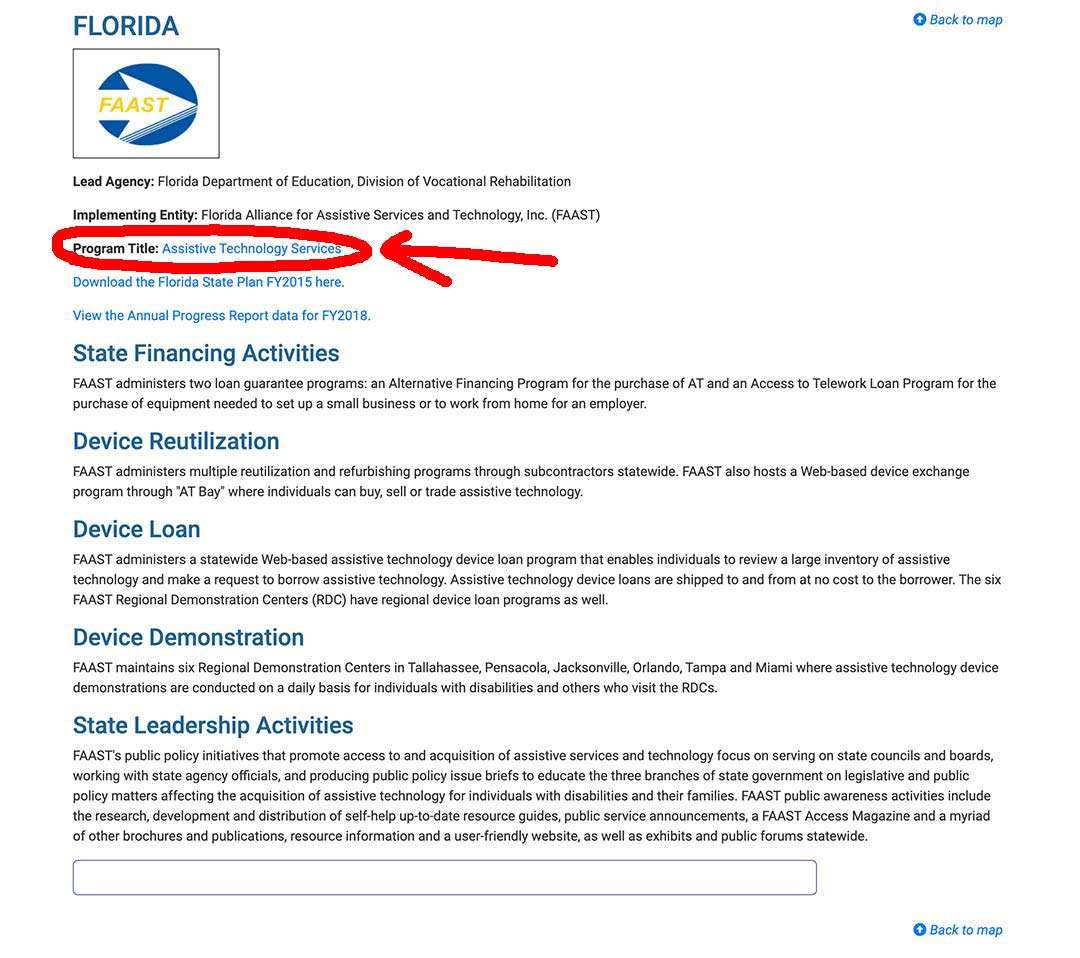

Step 2/

Click on the link “Program Title” – for my example, I outlined it in red.

Step 3/

The AT Program state website will come up, and you can sign up, or use their contact info .

State Financial Assistance Programs

Numerous states will have non-Medicaid programs designed to assist the elderly, and the disabled, in maintaining a more, or less, independent lifestyle in their own homes – these are usually known as State Financial Assistance Programs.

State Financial Assistance Programs will pay for a wide variety of assistive and safety equipment, and even home modifications.

The durable medical equipment and remodeling are paid for with grants or loans, or sometimes a combination of both.

To find out about your State Financial Assistance Programs, ask at your local Area Agency on Aging.

You can find your local Area Agency on Aging here.

Free hospital beds near me ?

Here’s how to find free medical equipment near you.

Free hospital beds on online listings and groups

Online listings very often have free medical equipment posted on them.

When you use online listings and groups, you will be able to make your searches as local as you want, allowing you to get results for free equipment near to you.

Important points to remember –

- the quality of the equipment you are going to find is not guaranteed to be great, and if it is faulty you don’t have any recourse, you will be accepting it for free in the condition that you find it

- always pick up your free equipment with a friend – you know nothing about the person, people, you are meeting

- don’t have the items brought to your home (especially if an elderly adult lives there) – meet up somewhere local, such as a mall car park

Here are the online listings and groups where you can find used medical equipment –

- Craigslist online listing

- UsedHME.com

- Freecycle.org

- Nextdoor.com

- Facebook Groups and Facebook Marketplace

- Buynothingproject.org

Free hospital beds from Medical Equipment loan closets

Medical Equipment Loan Closets offer free (usually), new or gently used, equipment on either temporary or long term loan, or both. Some closets ask for a deposit, which you get back when you return the equipment, but it is generally very little money.

The closets are often run by volunteers for the town or village, and by nonprofit organizations.

Lots of churches have independent loan closets for the community, as well as religious charities such as The Society of Vincent De Paul, or UMC.

American Legion Posts, VFW, Lions Clubs, and Rotary Clubs often run loan closets for their local communities, and a few by Elk lodges.

Medical equipment loan closets are also known as –

- medical equipment lending libraries

- community loan closets

- assistive technology lending libraries

- lending libraries

- medical equipment banks

To find a medical equipment loan closet in your area, first have a look on the internet. If you don’t find anything, you can contact these different admins and ask if they know of one –

- your local Area Agency on Aging

- your town council human services

- your town or municipal senior services department

- public senior centers near you

- established religious charities

- local churches and faith groups

I’m Gareth, the author and owner of Looking After Mom and Dad.com

I have been a caregiver for over 10 yrs and share all my tips here.