As far as I can remember, I think we have had several grabbers floating around the house for my elderly mom’s use. They are just so practical, and make so many tasks easier, while also eliminating a lot of reaching forwards which can lead to nasty falls.

Original Medicare Part B does not cover grabbers for use in the home, as they are not considered to be “medically necessary”. Other programs such as Medicaid, non-Medicaid State Financial Assistance Programs and Assistive Technology Programs may pay for grabbers, if you are eligible.

Like so many handy items that our elderly parents use, the grabber doesn’t fit the bill (literally) with Medicare.

This is because their criteria for coverage is not that an article be useful, or that it keeps us comfortable, but that it is “medically necessary”.

There are four things that you have to take into account if an item is going to qualify for coverage by Medicare, apart from you needing to be enrolled in

Medicare in the first place –

- Medicare Part B only covers certain durable medical equipment

- the equipment is meant to be primarily for use in the home

- the equipment must be certified as “medically necessary” and signed for by a Medicare-enrolled doctor

- the equipment must be acquired through a Medicare-approved supplier

Contents Overview & Quicklinks

Does Medicare cover bathroom equipment ?

Does Medicare cover bed rails ?

How often does Medicare pay for a walker ?

What equipment does Medicare cover ?

How do you, or your loved, qualify for Medicare coverage of your DME ?

What happens once you have the signed prescription for your DME ?

How to avoid over-paying the supplier ?

What coverage do you get with Medicare Advantage Plans ?

Find a local Medicare-enrolled DME Supplier near you ?

List of durable medical equipment covered by Medicare

Get free help with understanding Medicare

Does Medicaid cover grabbers ?

How to find the HCBS programs, waivers and 1915 waivers in your state ?

How do you get DME with Medicaid state waivers and HCBS programs ?

If you don’t quite qualify for Medicaid ?

Does Medicare cover bathroom equipment ?

You may be surprised to discover that Medicare Part B will not cover grab bars, non-slip mats, bath lifts, shower chairs, transfer seats or raised seats for the toilet, as it views all of these items to be “comfort” items, and not to be “medically necessary”.

But luckily Medicare will cover walkers, crutches and commode chairs, and they can all be used in the bathroom as safety equipment to help protect our elderly parents and loved ones from the risk of falling.

Medicare Advantage Plans are allowed to offer benefits for equipment for individuals with chronic diseases, and you can find out about it in the section on Medicare Advantage a little further down the page here.

What to do if your bathroom equipment isn’t covered by Medicare ?

If you only have Medicare Part B and you don’t qualify for any other funding, you are going to have to improvise.

In our home we have a 3 in 1 bedside commode, and we have been able to use this as a raised toilet seat, a chair for sitting and having a sponge bath, a toilet safety rail and also as a bedside commode of course.

If your parent has a large enough shower, you can use a bedside commode as a shower chair as well if it’s waterproof.

Rather than have grab bars, my mom will sometimes put a walker where she is going to have to stand awhile, or to help her get up if she feels she is going to be a bit stiff – I am referring to a walker without wheels (a Zimmer frame). My mom also uses it to help her up a little step in the shower, and back down again afterwards.

Before her hip replacement surgery, I had bought a raised toilet seat for my Mom, but she found the 3-in-1 bedside commode placed over the toilet to be much more comfortable. Getting on and off using the arm rests also proved much easier than getting up from a raised toilet seat without them.

Don’t worry if you can’t get your equipment covered under Medicare, there are other sources of funding which will pay for quite large equipment, such as walk in bathtubs or showers with roll-in low thresholds, for which you or your loved ones may qualify.

If you have to totally remodel your bathroom there are even grants, or programs, which will pay for this when it is for health reasons !

But before I start to talk about those, I want to continue and outline the Medicare purchase process, and the types of equipment you can get when it is “medically necessary”.

If you can’t wait and want to see the other sources of coverage and funding, click here.

If you are not sure what type of bathroom safety equipment is available for you, or for a loved one, I have a long article with 54 safety tips that I have researched, and mostly tried and tested over the years for my mom and dad. It includes both practical tips, and a range of items you may wish to look at – I have not tried them all, but that doesn’t mean that they are not useful. You can find that here.

If you are struggling with, just starting to learn how to bathe a parent yourself, or just want to make bathing easier for your parent, then you may be interested in this article here.

Does Medicare cover bed rails ?

Medicare will not cover bed rails for a standard bed, however Medicare does cover hospital beds which come with side rails.

If you, or a loved one, have a prescription stating that it is “medically necessary”, you can get a hospital bed with bed rails.

Medicare will pay for a basic hospital bed, which is not fully electric. If you wish to have a fully electronic bed you can though pay the difference to get one.

Medicare negotiates with suppliers to obtain a certain price for certain beds, so those models of beds are going to be the ones covered by Medicare.

For this reason, it’s important to stick to the correct procedure if you want to be covered.

You may be able to get a hospital bed or bed rails with Medicaid and other sources of state funding, which I will be outlining further ahead.

For my mom, I did quite a lot of research into bed rails and their alternatives, as I discovered they are not suitable for certain individuals. Even if you are eligible, you may want to re-think bed rails as they have caused a significant number of deaths in at risk groups over the last 30 yrs. I wrote an article outlining some perfectly good and ultimately safer options.

You can read my article here.

How often does Medicare pay for a walker ?

Typically, Medicare Part B will replace equipment it covers, and which is worn out, once every five years from the date that it was received by the beneficiary.

So, a walker with Medicare Part B coverage can typically be replaced every five years if it is worn out beyond repair, that is, unless it has been lost, stolen or damaged beyond repair.

Equipment covered by Medicare which is lost, stolen or damaged beyond repair, may be replaced – Medicare will require that the beneficiary provide proof of the accident or damage.

The replacement item will be identical, or as near as is possible, to the item that is being replaced.

Source: Medicare coverage of Durable Medical Equipment and Other Devices, CENTERS for MEDICARE & MEDICAID SERVICES.

You can read, or download, the original Medicare document here.

The passage above is on Page 13 of the PDF.

What equipment does Medicare cover ?

As I said earlier, Medicare Part B covers certain durable medical equipment.

There are many guidelines for durable medical equipment, and some require documented proof of a condition, as well as a signed prescription.

Further down the page, I have compiled a long list of durable medical equipment and which are typically covered by Medicare Part B “for use in the home”.

If you want to look at that now, click here.

For Medicare Part B, durable medical equipment has to fulfill the following criteria –

- it’s got to be able to withstand repeated use over a sustained period of time – durable

- it’s got to be used for a medical reason only – not for comfort

- it’s got to be of use to someone who is actually sick, and of little use to a person who is well

- it is going to be used primarily in the home

- it’s expected to last a minimum term of 3 years

How do you, or your loved one, qualify for Medicare coverage for your DME ?

For someone to qualify for Medicare Part B coverage of DME “for use in the home”, they have to –

- be enrolled in Medicare Part B

- have a signed prescription from their Medicare-enrolled doctor stating that the equipment is “medically necessary”

- purchase the equipment from a supplier who is a Medicare-enrolled supplier

To qualify as living at home, you can be –

- living in your own home

- living in the family home

- living in the community, such as assisted living

If you, or your loved one, are staying in a skilled nursing facility, this does not qualify as a home for Medicare Part B coverage.

You will be covered under Medicare Part A – Hospital Care.

In Skilled Nursing Facilities, the coverage for DME is handled differently – they are provided for up to 100 days by the nursing facility itself.

What happens once you have the signed prescription for your DME ?

After you have seen your Medicare-enrolled doctor, and you have the order/prescription, the next step is to go see a Medicare-enrolled DME supplier, where you can choose your item.

The range of models of your particular item will most likely be pretty limited, and only the more basic models.

There will be more forms to fill out with the supplier for Medicare.

With the prescription from a Medicare-enrolled doctor, Medicare part B will cover 80% of the Medicare-approved price for your item.

You, or your loved one, will usually pay the Medicare 20% co-payment of the Medicare-approved price of the item (unless you have supplemental insurance which covers your co-pay), if you used a Medicare-enrolled “participating” supplier who accepts assignment.

Be warned, if you didn’t use a Medicare-enrolled “participating” supplier who accepts “assignment” you can end up paying quite a lot more !!! More about that in a moment.

There will also be your Medicare deductible to pay, if it hasn’t already been met for the year in question.

Medicare will either purchase or rent DME

For smaller, less expensive items, Medicare will typically purchase them.

Typically, though, Medicare rents the more expensive equipment from the DME Medicare-enrolled suppliers on a monthly basis.

If you chose a Medicare-enrolled “participating” supplier who accepts “assignment” there will only be a monthly co-payment of 20% of the Medicare-approved rental price, and again the deductible if it has not been met.

How to avoid over-paying the supplier ?

You, or your loved one, must choose a Medicare enrolled “participating” supplier who accepts “assignment” so that you avoid paying any extra.

This way you know the DME is purchased, or rented, at the Medicare-approved price, and that you, or your loved one, will only pay the 20% co-payment and your deductible if it applies.

So, what happens if you don’t use a Medicare-enrolled “participating” supplier ?

Medicare has two types of Medicare-enrolled suppliers –

- Medicare Suppliers

- Medicare “Participating” Suppliers

Medicare “Participating” Suppliers, have an arrangement with Medicare which says they will accept what is called “assignment”.

This is crucial because it means that they are not allowed to charge more than the Medicare-approved price for DME.

A supplier who is not “Participating” can add up to an extra 15% on the price for equipment.

Medicare will pay only the Medicare-approved price, leaving you, or your loved one, to pay the difference between the Medicare-approved price and the supplier’s price, plus the co-payment and annual deductible (if it applies).

If the supplier is a Medicare-enrolled “participating” supplier, you will get the best price. Do always make sure that they accept “assignment”.

What coverage do you get with Medicare Advantage Plans ?

With enrollment in a Medicare Advantage plan, you are covered for all the same medical services, supplies and equipment that Medicare Parts A and B cover, and sometimes a few extra services.

As of the fall of 2020, Medicare Advantage Plans were allowed to offer more benefits to increase their competitiveness.

In 2019 the Centers for Medicare & Medicaid announced an expansion of the coverage of Medicare Advantage and Part D –

Beginning in 2019, Medicare Advantage plans can now offer supplemental benefits that are not covered under Medicare Parts A or B, if they diagnose, compensate for physical impairments, diminish the impact of injuries or health conditions, and/or reduce avoidable emergency room utilization.

The text source – “CMS finalizes Medicare Advantage and Part D payment and policy updates to maximize competition and coverage” April 1, 2019. You can read the text here.

Benefits for chronic conditions have been added, including transport to shops for certain individuals, air conditioners for certain illnesses and items of bathroom safety for individuals with mobility conditions.

You will need to contact your Advantage Plan provider to find out about their exact process for buying items with coverage, the doctors they work with and their supply network.

Using doctors and suppliers outside your plan’s network will usually lead to a loss of coverage for any items you buy.

Medicare-enrolled DME Supplier near me

To find a local Medicare supplier, check this here at Medicare.gov

List of durable medical equipment covered by Medicare

If you don’t find the equipment you are looking for in my list of Medicare covered DME below, you can use this link to Medicare.gov

Air-Fluidized Bed

Alternating Pressure Pads and Mattresses

Audible/visible Signal Pacemaker Monitor

Pressure reducing beds, mattresses, and mattress overlays used to prevent bed sores

Bead Bed

Bed Side Rails

Bed Trapeze – covered if your loved one is confined to their bed and needs one to change position

Blood sugar monitors

Blood sugar (glucose) test strips

Canes (however, white canes for the blind aren’t covered)

Commode chairs

Continuous passive motion (CPM) machines

Continuous Positive Pressure Airway Devices, Accessories and Therapy

Crutches

Cushion Lift Power Seat

Defibrillators

Diabetic Strips

Digital Electronic Pacemaker

Electric Hospital beds

Gel Flotation Pads and Mattresses

Glucose Control Solutions

Heat Lamps

Hospital beds

Hydraulic Lift

Infusion pumps and supplies (when necessary to administer certain drugs)

IPPB Machines

Iron Lung

Lymphedema Pumps

Manual wheelchairs and power mobility devices (power wheelchairs or scooters needed for use inside the home)

Mattress

Medical Oxygen

Mobile Geriatric Chair

Motorized Wheelchairs

Muscle Stimulators

Nebulizers and some nebulizer medications (if reasonable and necessary)

Oxygen equipment and accessories

Patient lifts (a medical device used to lift you from a bed or wheelchair)

Oxygen Tents

Patient Lifts

Percussors

Postural Drainage Boards

Quad-Canes

Respirators

Rolling Chairs

Safety Roller

Seat Lift

Self-Contained Pacemaker Monitor

Sleep apnea and Continuous Positive Airway Pressure (CPAP) devices and accessories

Sitz Bath

Steam Packs

Suction pumps

Traction equipment

Ultraviolet Cabinet

Urinals (autoclavable hospital type)

Vaporizers

Ventilators

Walkers

Whirlpool Bath Equipment – if your loved one is home bound and the pool is medically needed. If your loved one isn’t home bound, Medicare will cover the cost of treatments in a hospital.

Prosthetic and Orthotic Items

Orthopedic shoes only when they’re a necessary part of a leg brace

Arm, leg, back, and neck braces (orthotics), as long as you go to a supplier that’s enrolled in Medicare

Artificial limbs and eyes

Breast prostheses (including a surgical bra) after a mastectomy

Ostomy bags and certain related supplies

Urological supplies

Therapeutic shoes or inserts for people with diabetes who have severe diabetic foot disease.

DME not covered by Medicare

Adult Diapers

Air Cleaners

Air Conditioners

Alcohol Swabs

Augmentative Communication Device

Bathroom Aids

Bathtub Lifts

Bathtub Seats

Bed Bath

Bed Boards

Bed Exit Alarms

Bed Sensor Pads

Bed Lifter

Beds – Lounge

Bed Wedges

Blood Glucose Analyzers

Braille Teaching Texts

Caregiver Paging Systems

Catheters – except those which are used for permanent medical conditions where the catheter is considered as a prosthetic

Chair Exit Alarms

Chair Sensor Pads

Communicator

Contact Lenses – Medicare helps pay for corrective lenses if you have cataract surgery to implant an intraocular lens

Dehumidifiers

Dentures

Diathermy Machines

Disposable Bed Protectors

Disposable Sheets

Door Exit Alarms

Easygrip Scissors

Elastic Stockings

Electrical Wound Stimulation

Electrostatic Machines

Elevators

Emesis Basins

Esophageal Dilators

Exercise Machines

Exit Alarm Mat

Eye Glasses – Medicare helps pay for corrective lenses if you have cataract surgery to implant an intraocular lens.

Fall Alarms

Fans

Fabric Supports

Fomentation Device

Grab Bars

Grabbers

Gauze

Hearing Aids

Heat and Massage Foam Cushion Pad

Heating and Cooling Plants

Home Modifications

Humidifiers – not room humidifiers

Incontinence Pads

Injectors (hypodermic jet pressure powered devices for Insulin injection)

Irrigating Kits

Insulin Pens

Massage Equipment

Motion Sensors

Motion Sensor Exit Systems with Pagers

Needles

Oscillating Beds

Over bed Tables

Paraffin Bath Units (if not Portable)

Parallel Bars

Portable Room Heaters

Portable Whirlpool Pumps

Preset Portable Oxygen Units

Pressure Leotards

Pressure Stockings

Pulse Tachometer

Pull String Alarms

Raised Toilet Seats

Ramps

Reading Machines

Reflectance Colorimeters

Sauna Baths

Special TV Close Caption

Speech Teaching Machines

Stair Lifts

Standing Table

Support Hose

Surgical Face Masks

Surgical Leggings

Syringes

Telephone Alert Systems

Television Assistive Listening Devices

Telephone Arms

Toilet Seats

Treadmill Exercisers

Walk in Bathtubs

Wheelchair Lifts

Whirlpool Pumps

White Canes

Wigs

Get free assistance with understanding Medicare

SHIP – State Health Insurance Assistance Programs –

Free counseling on Medicare, Medicaid and Medigap from your SHIP.

I have a quick guide on how to find your local SHIP, which is here – “Free Help Understanding Medicare And Medicaid ? Here’s Where You Get It”.

Will Medicaid cover grabbers ?

Medicaid is funded both on a federal level and at the individual state level, and is very different from Medicare.

Each state, as long as it keeps within the basic Medicaid guidelines, can have quite a lot of latitude in how it allocates the funding it has.

A state can have multiple programs on which Medicaid agrees to waive certain requirements for eligibility, so that the state can provide care to those who need it, and who might otherwise be missed by the system because they were otherwise not eligible.

These programs are known as waivers, and will have specific eligibility requirements, and may have a limited number of places as well.

The waivers may vary greatly between states, and there are many for caring for people in their homes and in the community, to help them to maintain their independence.

Due to the hundreds of different waivers across the US, what is considered Durable Medical Equipment will vary widely, and not only from state to state, but also across the different waivers within the one state.

Medicaid and state programs and waivers for care services in the home

Programs which have been designed to help individuals to live independently in their homes, and in the community, by providing the care they require are called “Home and Community Based Services” (HCBS), “Waivers” or “1915 Waivers”.

Such programs are primarily for low income families, disabled individuals and the elderly with specific medical needs.

For more in depth information than I can provide here on the HCBS programs and waivers, you can use the link below to medicaid.gov –

https://www.medicaid.gov/medicaid/hcbs/authorities/index.html

The programs/waivers, that I have been briefly outlining, will pay for “home medical equipment”, and will often cover 100% of the cost of that equipment in order to help the beneficiaries maintain they independence in their homes.

The term “home”, for the beneficiary, can –

- their own home

- their family home

- a group home

- an assisted living facility

- a custodial care facility

Certain Medicaid and state programs and waivers, which may have a larger range of items they consider to be DME for home use

“Consumer Direction” or “Self Direction”

If an HCBS program, or waiver, implements “Consumer Direction” or “Self Direction”, as a way of managing the funding of the project, the program beneficiaries are each given a budget to cover their needs.

Each participant is also appointed a financial advisor to help them manage their budget.

The advisor is going to help the beneficiary to use the money to cover what they require, and to maintain their independence.

In these circumstances, the items bought can extend to all manner of bathroom safety equipment and other devices not available as DME under Medicare coverage, as long as they are needed.

To find out more about Medicaid Self Direction, click here.

Helping the elderly return to their homes

Money follows the person – is a Medicaid based program designed to assist elderly adults in making the transition back from nursing facilities into their homes.

For this program, assisted living can be considered as “their own home”.

If certain medical equipment is necessary for the participant to be able to make the move, it is purchased by the program.

As with a lot of the waivers, what may be considered a DME is often very different from that which is allowed with Medicare.

Even remodeling parts of the home, if it is necessary before the participant can make the transition, is paid for by this program.

How to find the HCBS programs, waivers and 1915 waivers in your state

If you want to find the HCBS Waivers, 1915 Waivers, HCBS Programs and the Money Follows The Person Programs for seniors which are run in your state, I have a guide with a list by state of all the waivers and programs, along with links to their different websites. I also listed all where PACE Programs – Programs of All-inclusive Care for the Elderly – were available – “Medicaid Home and Community Based Services Waivers and Programs For Seniors Listed By State.

How do you get DME with Medicaid waivers and HCBS programs ?

Step 1

– the doctor, or therapist, has to provide a medical justification letter, which states that the equipment is medically necessary

Step 2

– you or your loved one have to find a DME supplier who is Medicaid-approved, and to give to them the medical justification letter

Step 3

– the DME supplier then fills out a Prior Approval Application for Medicaid

Step 4

– the document is then sent to the Medicaid State Office for approval or denial

Step 5

– if you or your loved one are unsuccessful you will be notified as to the reasons why, and given advice on how to appeal the decision

Step 6

– if approved, you or your loved one will receive the DME

If you don’t quite qualify for Medicaid

Spend Down

Spend Down programs are a method designed by Medicaid to reduce a person’s income, or income + asset level, so that they may become eligible for Medicaid.

Particular deductions are made in what is called a “spend down”, so that the person’s income, asset level, or both, drops below the Medicaid eligibility limit and the person qualifies for coverage.

If you want to know more about Spend Down I wrote a post with who can qualify for Spend Down, the which expenses are deductible and how to find out if you qualify – “What is Spend Down ?”

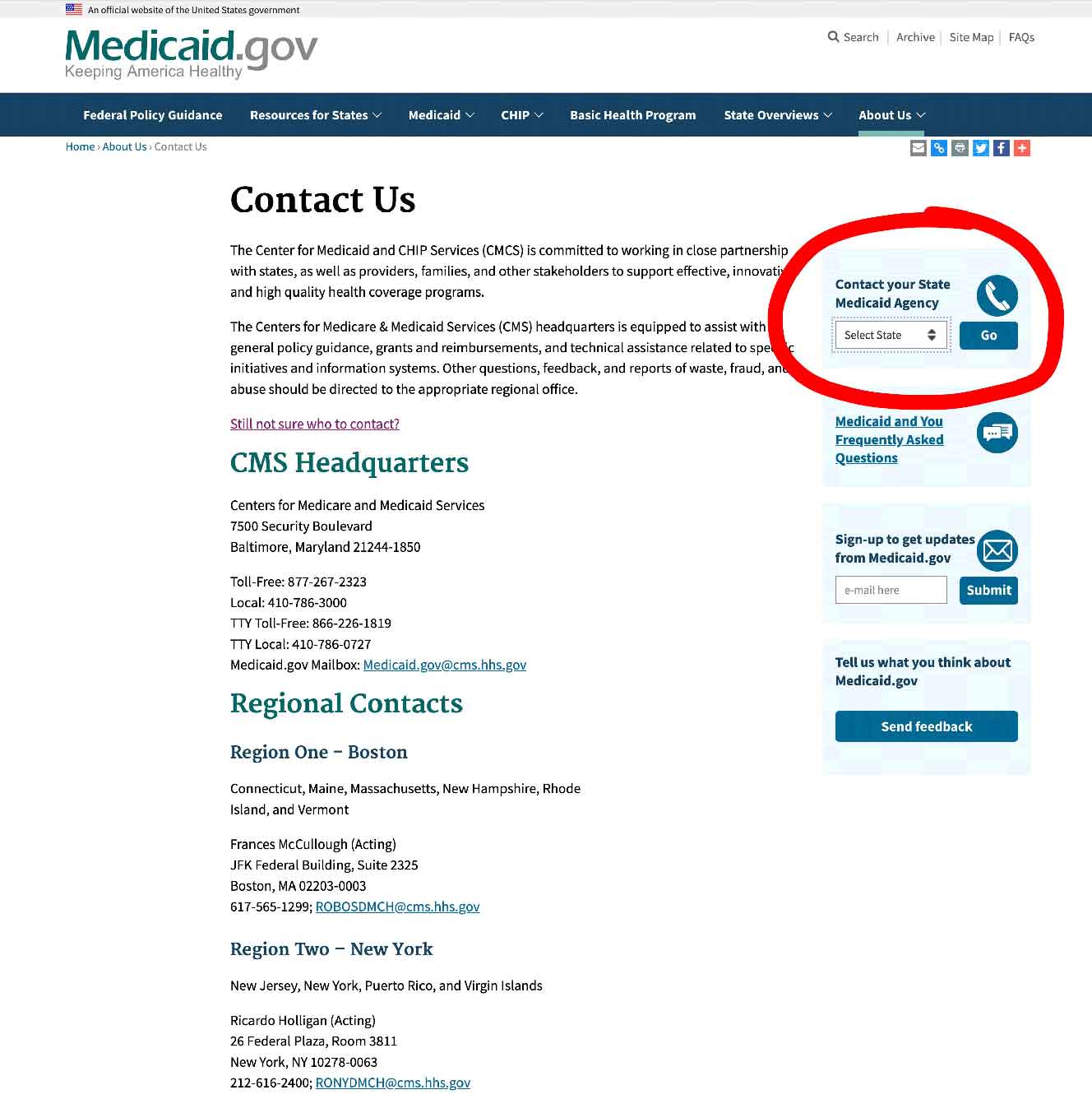

How to find your State Medicaid State Agency

If the documents on the link above are too technical, I wouldn’t waste your time. I would contact your state Medicaid Agency, and you can do that here.

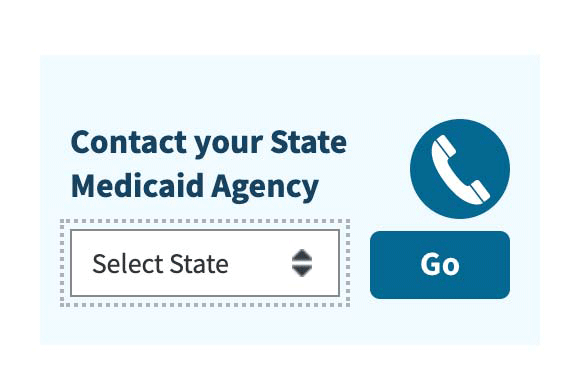

Step 1 – Once you have clicked the link to Medicaid.gov, look at the section I have outlined in the image below

Step 2 – select your state, and click on the button they have marked “GO” – it will take you to your State medicaid Agency.

Is there any other state financial assistance for DME ?

Assistive Technology Programs

Every state receives a national grant to be used for “Assistive Technology Programs”.

The programs are designed to increase access to assistive devices in the home for those who are in need of them, and the elderly are one of the primary focus groups.

The terms “Assistive Technology” and “DME” are synonymous for these purposes.

You, or your loved one, would need to contact the State offices to find out if they are eligible and how to apply.

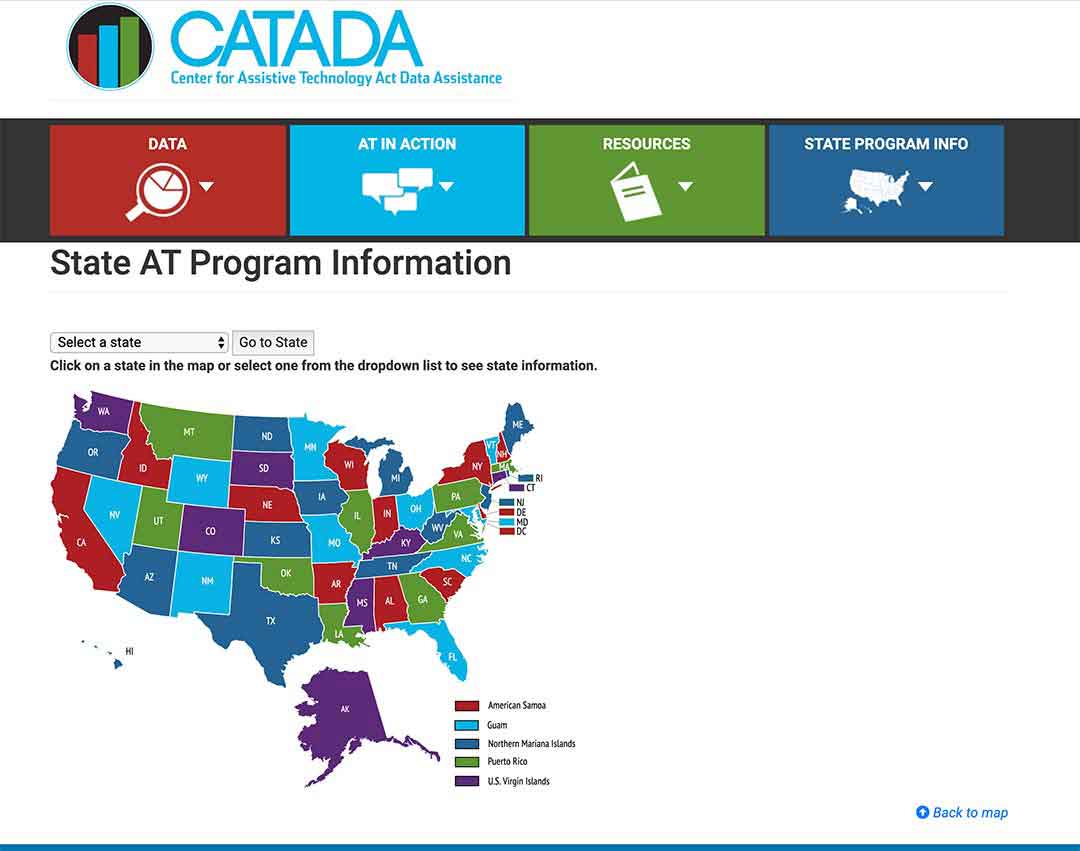

Find out what programs your state runs here.

Step 1/

Select your state on the map, or from the drop-down menu, and click on the button “Go to state”

– I chose Florida for this example

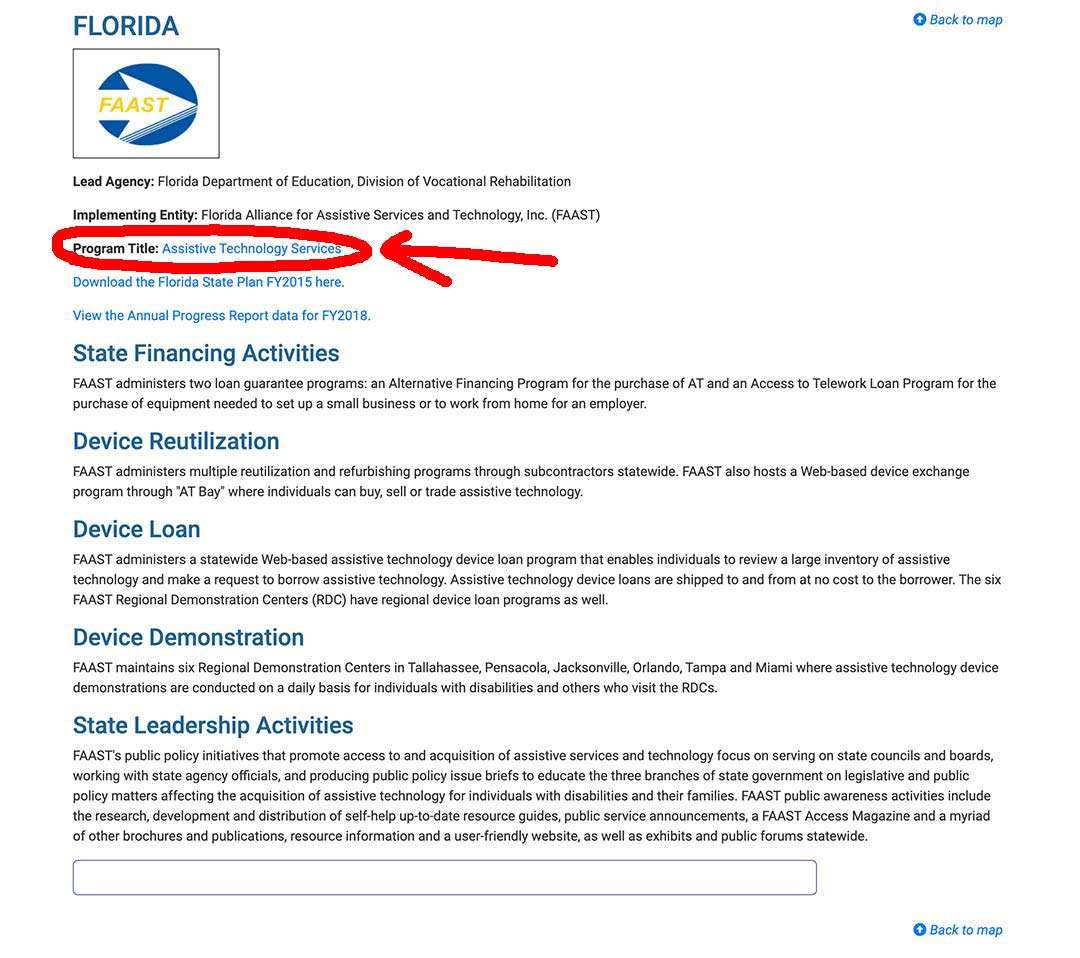

Step 2/

Look for the link “Program Title” – for my example I outlined it in red – and click on that.

Step 3/

The State AT Program website will come up, and you can sign up or use their contact info to get in touch and find out what they offer to help the elderly, and if you or a loved one are eligible.

State Financial Assistance Programs

These are non-Medicaid programs, which have been set up to lower the number of elderly persons entering Medicaid run nursing homes.

The programs are designed for the elderly to remain living in their homes – not all states have them.

Home modifications and purchases of necessary equipment, which include bathroom safety equipment, walk in tubs and showers, are all paid for by the programs.

Eligibility for the programs varies, but they are typically focused on the elderly and the disabled.

Protection and Advocacy Programs

Each state has legal services providing assistance to the elderly in disputing their denied claims.

Summary

You cannot get grabbers, and many other aids, covered by Original Medicare Part B for “use in the home” if Medicare doesn’t consider they are “medically necessary”.

On the occasion that Medicare Part B will cover your DME, don’t forget before purchasing to ask the supplier if they are a Participating Supplier who accepts “assignment”.

Even if Medicare won’t cover your grabber, or some other type of equipment, for the home, check that you don’t qualify for Medicaid or one of the other non-Medicaid state funded programs.

If you are spending a lot on Medical supplies, take a look at “Spend-Down” and see if you can qualify for Medicaid.

Medicaid state programs in many cases accept a broader range of equipment as DME and will often pay 100% of the cost.

Good luck !

I’m Gareth, the author and owner of Looking After Mom and Dad.com

I have been a caregiver for over 10 yrs and share all my tips here.