Original Medicare Part B typically covers 80% of equipment rental costs if –

(a) “medically necessary”

(b) primarily for use in the home

c) prescribed by a Medicare-enrolled doctor

(d) from a Medicare-approved supplier

If you are your parents’ caregiver, you will have started to realize, or maybe you knew already, that unless a piece of equipment is really “medically necessary”, that Medicare will not cover it.

And that a doctor is going to have to state that it is so.

The rules, for what is covered, do not change when the equipment is rented rather than bought, and visa versa.

I am going to take a look at some medical and safety equipment to broadly outline –

- what is, and what isn’t, covered by Medicare

- how to get Medicare coverage when it is available

- mistakes you must not make with Medicare

- where to get free Medicare guidance if you need it – on the phone, on websites and other resources freely available to you

There are other sources of coverage and funding which are available at a state level –

- Medicaid

- HCBS programs, waivers and 1915 waivers

- Money Follows the person

- State Assistive Technology Projects

- State Financial Assistance Plans

and I will be outlining a those the following information on Medicare.

Contents Overview & Quicklinks

What equipment does Medicare pay for ?

Does Medicare cover bathroom equipment ?

How often will Medicare pay for a wheelchair ?

Will Medicare pay for a walker and a wheelchair ?

Will Medicare replace DME for anything other than wear and tear ?

Does Medicare cover ice machines ?

Does Medicare cover walking boots ?

Medicare Oxygen rental guidelines ?

How does a person qualify for Medicare coverage with their DME ?

Once you have a signed prescription, what do you do ?

Finding a Medicare-enrolled DME Supplier near you ?

What coverage do you get with Medicare Advantage Plans ?

List of Durable Medical Equipment typically covered by Medicare

Durable Medical Equipment not covered by Medicare

Get free assistance with understanding Medicare

Will Medicaid cover equipment rental ?

How to find the HCBS programs, waivers and 1915 waivers in your state ?

How to get DME with Medicaid and state waivers and HCBS programs ?

If your income is a bit too high to qualify for Medicaid

Other financial assistance you or your loved one may be able to get for DME

What equipment does medicare pay for ?

Original Medicare Part B covers certain durable medical equipment, or DME, “for use in the home” when it is prescribed as “medically necessary” by a Medicare-enrolled physician, or treating practitioner, and bought or rented through a Medicare-approved supplier.

Durable medical equipment is equipment which is able to withstand repeated use over a sustained period of time.

Original Medicare Part A (hospital care) covers medical equipment used in skilled nursing facilities, including DME for short term stays.

For Medicare to consider an item of durable medical equipment for coverage –

- it has able to withstand sustained use over a long period of time – durable

- its usage must be for medical reasons only – not for comfort

- it must be useful to someone who is actually sick, and of little use to a person who is not

- it must be used primarily in the home

- it must be expected to last a minimum term of 3 years

Does Medicare cover bathroom equipment ?

Let’s start with bathroom safety equipment, as it is the bathroom which is notorious for being the most dangerous room in the house for the elderly, with over 80% of falls happening there.

Sadly, Medicare doesn’t come up trumps for us in the bathroom.

It will not cover –

- grab bars

- non-slip mats

- bath lifts

- shower chairs

- bath chairs

- transfer seats

- raised toilet seats

- toilet safety frames

Medicare Part B considers these to be comfort items and not “medically necessary”.

On the bright side though, Medicare does cover walkers, crutches and commode chairs, so long as they are prescribed by a Medicare-enrolled physician as “medically necessary” in accordance with medicare’s guidelines.

Luckily for the elderly, these items can all be used in the bathroom to help mitigate the risk of falls.

My mom purchase a 3 in 1 bedside commode prior to hip replacement surgery, and we have been able to use it for her as a raised toilet seat, toilet safety rail, a chair for sitting and having leg and foot baths on, and also as a bedside commode. If only we had a larger shower, Mom could have used it as a shower chair too.

So, if your doctor deems it “medically necessary”, you will only pay the 20% co-payment of the Medicare approved price of the commode, plus your deductible if you have yet to meet that for the year, and get 4 pieces of equipment in one.

And if you can’t get the prescription, you still get a very versatile piece of equipment for around $100, which can be used for at least 4 different jobs.

One quick point to make here, is that some Medicare Advantage Plans have benefits for certain chronic illnesses, and they may offer benefits for certain bathroom safety equipment. You would, of course, need to find a plan with the benefit you were looking for, before changing over to Medicare Advantage.

To learn more about bathroom safety and what’s possible, you can read my article with 50 plus safety tips gleaned from over the 11 years that I have looked after my mom and dad. It includes both practical tips, and a range of items you should find very useful. You can find that here.

If you are trying to find ways to make bathing easier for your parent, and for you (if you are helping), I have another article discussing different ways to make it a more comfortable and dignified experience. You can read that article here.

How often will Medicare pay for a wheelchair ?

The Medicare Part B coverage policy for replacing DME, is to replace equipment that you rent or own that is –

- worn out through use

- that has been in your possession for its entire lifetime

- the item must be so worn out that it can’t be fixed

- the minimum period considered to be a lifetime for an item is five years

- the lifetime varies on the type of equipment

That said, a wheelchair which is worn out under Medicare Part B coverage can be replaced every five years if it has always been in your possession – and that is if it is beyond repair.

Medicare will pay to repair worn items which have not reached the end of their lifetime – they will pay up to the cost of a replacement item.

In the case of a worn out item, you will need to get your Medicare-enrolled doctor to re-prescribe the wheelchair, and again say why it is “medically necessary”.

Will Medicare pay for a walker and a wheelchair ?

Medicare will not cover more than one mobility aid for use in the home, so if you have an electric, or manual, wheelchair you cannot get a walker as well.

As far as I could understand this point, the reasoning is that if you can use a walker, you don’t need a wheelchair, and so you fail their rule of medical necessity for the wheelchair.

Will Medicare replace DME for anything other than wear and tear ?

As long as you have proof of damage or theft, Medicare Part B will pay for the replacement of any items which are lost, stolen, or damaged beyond repair “in an accident or natural disaster”.

You can read more about this in Medicare’s own literature, in a document they published –

Source: Medicare coverage of Durable Medical Equipment and Other Devices, CENTERS for MEDICARE & MEDICAID SERVICES.

You can read, or download, the original Medicare document here.

The passage above is on Page 13 of the PDF.

Does Medicare cover ice machines ?

Original Medicare Part B covers certain cold therapies on an inpatient, or an outpatient basis when prescribed as “medically necessary” by a Medicare enrolled physician, or by a therapist and co-signed by a physician.

However, Medicare does not cover any form of ice or cold therapy unit – or cooling device.

Medicare considers any form of cooling therapy for use in the home to be comfort items, and not medically necessary.

The following passage is from Blue Cross Blue Shield of Rhode Island

“Cooling Devices used in the Home and Outpatient Setting”

Medicare “not reasonable and necessary:” Medicare indicates cooling therapy items do not fit the definition of reasonable and necessary and are therefore not be covered. Medicare defines services/items “not reasonable and necessary” as items not “reasonable and necessary for the diagnosis or treatment of illness or injury or to improve the functioning of a malformed body member.”

Services denied as not reasonable and medically necessary, under section 1862(a)(1) of the Social Security Act, are subject to the Limitation of Liability (Advance Beneficiary Notice) provision. Thus, to be held liable for denied charge(s), the beneficiary must be given appropriate written advance notice of the likelihood of non-coverage and agree to pay for services.

You may, though, be able to get a cold therapy device through Medicaid if you are eligible, or on one of the many state run programs and waivers, if you qualify.

Does Medicare cover walking boots ?

Medicare Part B will cover ankle braces, or orthotics – commonly known as “walking boots” in certain cases.

Medicare Part B will give coverage if the brace is used to immobilize the ankle/foot following orthopedic surgery, or for an orthopedic condition, under the Brace benefit – only rigid and semi-rigid braces are allowed.

You will also need for the brace to be prescribed by a Medicare-enrolled doctor.

Medicare Oxygen rental guidelines ?

Medicare Part B does cover rental of oxygen equipment and accessories for home use as durable medical equipment, as long as it is prescribed by a Medicare-enrolled doctor.

Your doctor can prescribe the oxygen equipment and accessories if –

- Your doctor says you have a severe lung disease, or you’re not getting enough oxygen.

- Your health might improve with oxygen therapy.

- Your arterial blood gas level falls within a certain range.

- Other alternative measures have failed.

Medicare oxygen equipment coverage includes:

- Systems that provide oxygen

- Containers that store oxygen

- Tubing and related oxygen accessories for the delivery of oxygen and oxygen contents

The monthly rental payments cover the following accessories as well –

- Tubing or a mouthpiece

- Oxygen contents

- Oxygen machine maintenance

- Oxygen machine servicing

- Oxygen machine repairs

PLEASE NOTE: everything in italics was taken directly from Medicare’s own information on their website.

The complete text from which I wrote this section can be found here on the Medicare.gov website.

In the full text on Medicare.gov, you can read about the rental structure, the length of rental periods, and the changing of suppliers at the end of a rental period if you wish to do so.

How does a person qualify for Medicare coverage with their DME ?

To qualify under Original Medicare Part B for coverage of DME “for use in the home” you –

- have to be enrolled in Medicare Part B

- have a signed prescription from your Medicare-enrolled doctor stating that your item is “medically necessary”

- have to purchase the item from a supplier who is a Medicare-enrolled supplier

What qualifies as “home” –

To qualify, you must be –

- living in your own home

- living in the family home

- living in the community, such as assisted living

Once you have a signed prescription, what do you do ?

As soon as you have your prescription from your Medicare-enrolled doctor for your equipment, you can –

- go see a Medicare-enrolled DME supplier

- make sure that he is a Medicare-enrolled supplier

- to get the best coverage from Medicare, make sure the supplier is a Medicare-enrolled “participating” supplier who accepts “assignment”

- Medicare usually gives coverage to only the basic versions of any equipment

- with certain equipment if you wish to upgrade you can, but you will pay the extra, and it isn’t always possible

- choose the equipment that you have been prescribed

- fill out any necessary paperwork with the supplier

With your prescription from a Medicare-enrolled doctor, Medicare part B covers 80% of the Medicare-approved price for DME.

If you used a Medicare-enrolled “participating” supplier who accepts assignment, as I said previously, you will typically pay your Medicare 20% co-payment of the Medicare-approved price for your equipment, plus your deductible.

Always ask for, and use, a Medicare-enrolled “participating” supplier who accepts assignment, or you may have to pay a lot more than you need to.

Does Medicare purchase or rent DME

Medicare both purchases equipment outright, and it also rents it.

It tends to be the case, that the small items are purchased and the larger pieces of equipment are rented.

If your equipment is rented through a Medicare-enrolled “participating” supplier who accepts assignment, you will pay a monthly 20% co-payment of the Medicare-approved rental for the equipment, and also your deductible at the beginning of the coverage if it applies.

Finding a Medicare-enrolled DME Supplier near you

To find a local Medicare supplier, check this here at Medicare.gov

What coverage do you get with Medicare Advantage Plans ?

Medicare contracts private companies to provide Medicare services – these are Medicare Advantage Plans.

They have to, by law, provide at least the same services as Original Medicare, and often provide more.

The extra benefits they provide depend on the individual plans, but there are new benefits since 2020 for individuals with chronic illnesses, and these are not benefits offered by Original Medicare.

To find out exactly what the process is for getting your DME through an Advantage plan, you will need to contact your plan provider and ask about their network of doctors and suppliers.

Failure to use the right doctors and suppliers will lead to a loss of coverage for your equipment.

List of durable medical equipment typically covered by Medicare

If you don’t find the equipment you are looking for in my list of Medicare covered DME below, you can use this link to Medicare.gov

Air-Fluidized Bed

Alternating Pressure Pads and Mattresses

Audible/visible Signal Pacemaker Monitor

Pressure reducing beds, mattresses, and mattress overlays used to prevent bed sores

Bead Bed

Bed Side Rails

Bed Trapeze – covered if your loved one is confined to their bed and needs one to change position

Blood sugar monitors

Blood sugar (glucose) test strips

Canes (however, white canes for the blind aren’t covered)

Commode chairs

Continuous passive motion (CPM) machines

Continuous Positive Pressure Airway Devices, Accessories and Therapy

Crutches

Cushion Lift Power Seat

Defibrillators

Diabetic Strips

Digital Electronic Pacemaker

Electric Hospital beds

Gel Flotation Pads and Mattresses

Glucose Control Solutions

Heat Lamps

Hospital beds

Hydraulic Lift

Infusion pumps and supplies (when necessary to administer certain drugs)

IPPB Machines

Iron Lung

Lymphedema Pumps

Manual wheelchairs and power mobility devices (power wheelchairs or scooters needed for use inside the home)

Mattress

Medical Oxygen

Mobile Geriatric Chair

Motorized Wheelchairs

Muscle Stimulators

Nebulizers and some nebulizer medications (if reasonable and necessary)

Oxygen equipment and accessories

Patient lifts (a medical device used to lift you from a bed or wheelchair)

Oxygen Tents

Patient Lifts

Percussors

Postural Drainage Boards

Quad-Canes

Respirators

Rolling Chairs

Safety Roller

Seat Lift

Self-Contained Pacemaker Monitor

Sleep apnea and Continuous Positive Airway Pressure (CPAP) devices and accessories

Sitz Bath

Steam Packs

Suction pumps

Traction equipment

Ultraviolet Cabinet

Urinals (autoclavable hospital type)

Vaporizers

Ventilators

Walkers

Whirlpool Bath Equipment – if your loved one is home bound and the pool is medically needed. If your loved one isn’t home bound, Medicare will cover the cost of treatments in a hospital.

Prosthetic and Orthotic Items

Orthopedic shoes only when they’re a necessary part of a leg brace

Arm, leg, back, and neck braces (orthotics), as long as you go to a supplier that’s enrolled in Medicare

Artificial limbs and eyes

Breast prostheses (including a surgical bra) after a mastectomy

Ostomy bags and certain related supplies

Urological supplies

Therapeutic shoes or inserts for people with diabetes who have severe diabetic foot disease.

DME, usually not covered by Medicare

Adult Diapers

Air Cleaners

Air Conditioners

Alcohol Swabs

Augmentative Communication Device

Bathroom Aids

Bathtub Lifts

Bathtub Seats

Bed Bath

Bed Boards

Bed Exit Alarms

Bed Sensor Pads

Bed Lifter

Beds – Lounge

Bed Wedges

Blood Glucose Analyzers

Braille Teaching Texts

Caregiver Paging Systems

Catheters – except those which are used for permanent medical conditions where the catheter is considered as a prosthetic

Chair Exit Alarms

Chair Sensor Pads

Communicator

Contact Lenses – Medicare helps pay for corrective lenses if you have cataract surgery to implant an intraocular lens

Dehumidifiers

Dentures

Diathermy Machines

Disposable Bed Protectors

Disposable Sheets

Door Exit Alarms

Easygrip Scissors

Elastic Stockings

Electrical Wound Stimulation

Electrostatic Machines

Elevators

Emesis Basins

Esophageal Dilators

Exercise Machines

Exit Alarm Mat

Eye Glasses – Medicare helps pay for corrective lenses if you have cataract surgery to implant an intraocular lens.

Fall Alarms

Fans

Fabric Supports

Fomentation Device

Grab Bars

Grabbers

Gauze

Hearing Aids

Heat and Massage Foam Cushion Pad

Heating and Cooling Plants

Home Modifications

Humidifiers – not room humidifiers

Incontinence Pads

Injectors (hypodermic jet pressure powered devices for Insulin injection)

Irrigating Kits

Insulin Pens

Massage Equipment

Motion Sensors

Motion Sensor Exit Systems with Pagers

Needles

Oscillating Beds

Over bed Tables

Paraffin Bath Units (if not Portable)

Parallel Bars

Portable Room Heaters

Portable Whirlpool Pumps

Preset Portable Oxygen Units

Pressure Leotards

Pressure Stockings

Pulse Tachometer

Pull String Alarms

Raised Toilet Seats

Ramps

Reading Machines

Reflectance Colorimeters

Sauna Baths

Special TV Close Caption

Speech Teaching Machines

Stair Lifts

Standing Table

Support Hose

Surgical Face Masks

Surgical Leggings

Syringes

Telephone Alert Systems

Television Assistive Listening Devices

Telephone Arms

Toilet Seats

Treadmill Exercisers

Walk in Bathtubs

Wheelchair Lifts

Whirlpool Pumps

White Canes

Wigs

Get free assistance with understanding Medicare

SHIP – State Health Insurance Assistance Programs –

For anyone needing help with Medicare, Medicaid and Medigap, the SHIP in your state offers free counseling over the phone.

To locate your SHIP contact info, you can go to my short guide on doing that here – “Free Help Understanding Medicare And Medicaid ? Here’s Where You Get It”.

Will Medicaid cover equipment rental ?

Medicaid has a rather different structure from Medicare, as it is funded both on a federal and on a state level.

Each state works within the overarching guidelines of Medicaid, but has a lot of room to change, and tweak things, as they are putting their own funding in to the projects as well.

Any state can have programs for which Medicaid has agreed to waive some requirements for eligibility.

This allows the state to provide care to those who might otherwise have been missed, or lost, by the system due to ineligibility under the Medicare rules.

Such programs are known as waivers and have specific eligibility requirements, and are generally limited to a specific number of places.

There may be waiting lists for those who qualify to enter such programs and waivers.

From state to state the waivers may vary a great deal, and the number of waivers a state has may vary, but they all have some waivers which exist specifically to help care for elderly and disabled individuals in their own homes.

With literally hundreds of waivers across the US, what can be considered to be DME is very wide-ranging, and much less restricted than under Medicare.

Medicaid and state programs and waivers for in home care services

“Home and Community Based Services” (HCBS), “Waivers” or “1915 Waivers” are the names given to the projects for caring for individuals in their homes and the community.

These programs were developed primarily for low income families, disabled individuals and the elderly with medical needs.

To get more thorough information on HCBS programs, or waivers, from Medicaid itself, you go to medicaid.gov –

https://www.medicaid.gov/medicaid/hcbs/authorities/index.html

HCBS programs, waivers, and 1915 waivers will pay for “home medical equipment” – DME.

For participants, the term “home” for eligibility means –

- their own home

- their family home

- a group home

- an assisted living facility

- a custodial care facility

Participants on some programs and waivers may have a broader range of what is considered a DME

“Consumer Direction” or “Self Direction”

An HCBS program, or waiver, with “Consumer Direction” or “Self Direction” for managing the funding, will allot the beneficiary a budget to cover their needs, and also an advisor to help them manage it.

Should the beneficiary of the program not be able to get by without a certain piece of equipment, and that item is within their budget, there is a good chance they will be able to purchase it using money from their budget.

The goal here, is to help the individuals to remain in their homes, so there is more flexibility as to what can, and can’t, be considered a DME than under Medicare.

That is, so long as the equipment is medically necessary, and within the beneficiary’s allotted budget.

To find out more about Medicaid Self Direction, click here.

Helping the elderly return to their homes

Money follows the person – The purpose of the is Medicaid based program is to help the elderly in nursing facilities, who are able, to live in their own homes again.

The program gives them the help they need to make the transition from nursing facilities back into the community and their homes.

For this program, DME may even be large jobs, such as remodeling parts of the house – the bathroom for example.

Assisted living is considered as an individual’s own home for this program.

How to find the HCBS programs, waivers and 1915 waivers in your state

I have an article with a list of the HCBS Waivers, 1915 Waivers, HCBS Programs and the Money Follows The Person Programs for seniors which are available in each state, along with links to the different program websites. Also listed are all the PACE Programs – Programs of All-inclusive Care for the Elderly -for care in the home – “Medicaid Home and Community Based Services Waivers and Programs For Seniors Listed By State”.

How do you get DME with Medicaid waivers and HCBS programs ?

Step 1

– get a medical justification letter from your doctor, or therapist, which states that the equipment is medically necessary

Step 2

– find a Medicaid-approved DME supplier and give to them the medical justification letter

Step 3

– the DME supplier should fill out a Prior Approval Application for Medicaid

Step 4

– the application is then sent to the Medicaid State Office

Step 5

– if your application is unsuccessful you will be notified as to the reasons why, and given advice on how to appeal the decision

Step 6

– if approved, you will receive the DME you applied for

If your income is a bit too high to qualify for Medicaid

Spend Down Programs

Spend Down programs are an initiative by Medicaid to reduce a person’s income level, or income + asset level, so that they may become eligible for Medicaid.

“Spending Down” is done in two forms –

- Income Spend Down (the simpler method)

- Asset Spend Down

I wrote a post with who can qualify for Spend Down, the which expenses are deductible and how to find out if you qualify, which you can find here – “What is Spend Down ?”

How to find your State Medicaid State Agency

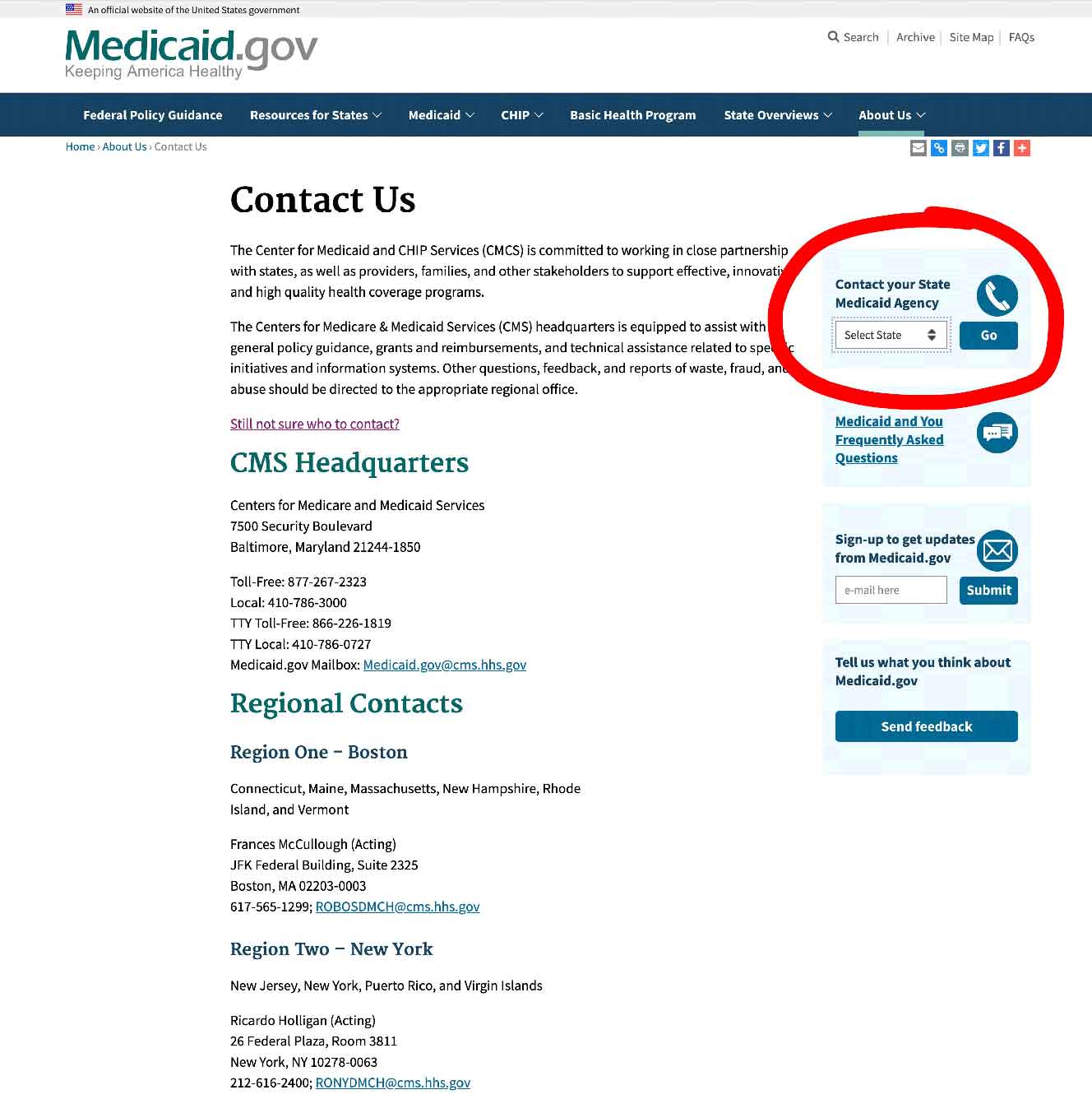

If all that was a bit too much for you, I would contact your state Medicaid Agency, and you can do that here.

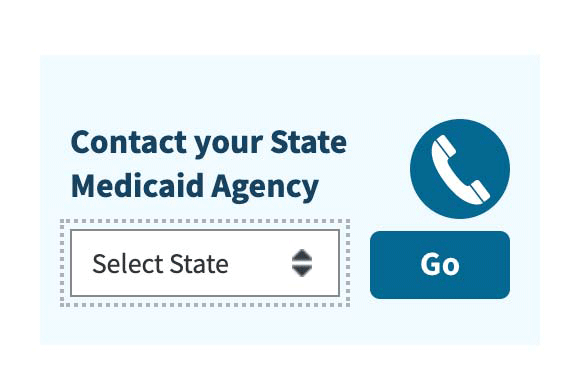

Step 1 – Once you have clicked the link to Medicaid.gov, look at the section I have outlined in the image below.

Step 2 – select your state, and click on “GO” – it will take you to your State medicaid Agency.

Other financial assistance you or your loved one may be able to get for DME

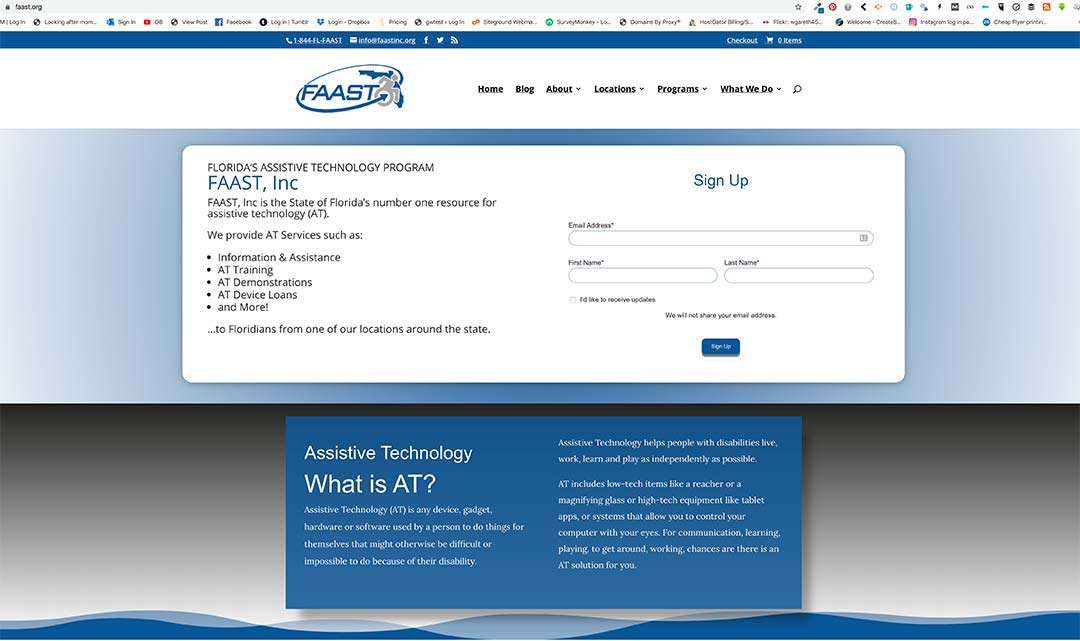

Assistive Technology Programs

All states have Assistive Technology Programs, which have been developed to increase access to devices in the home for these people in need – there is a primary focus on the elderly and the disabled.

You can find out about the programs in your state on the website at3.net, or just go to your local Area Agency on Aging.

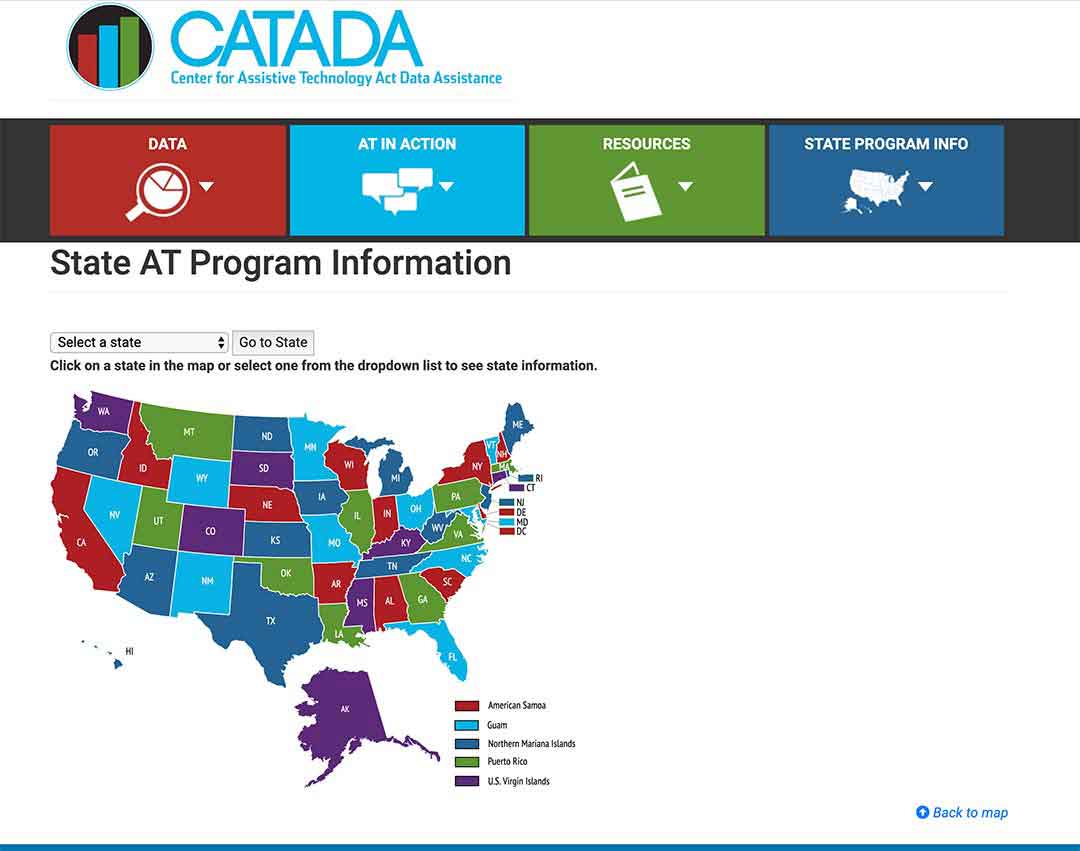

To see your state’s projects, click here.

Step 1/

Select your state on the map, or from the drop-down menu, and click on the button “Go to state”

– I chose Florida for this example

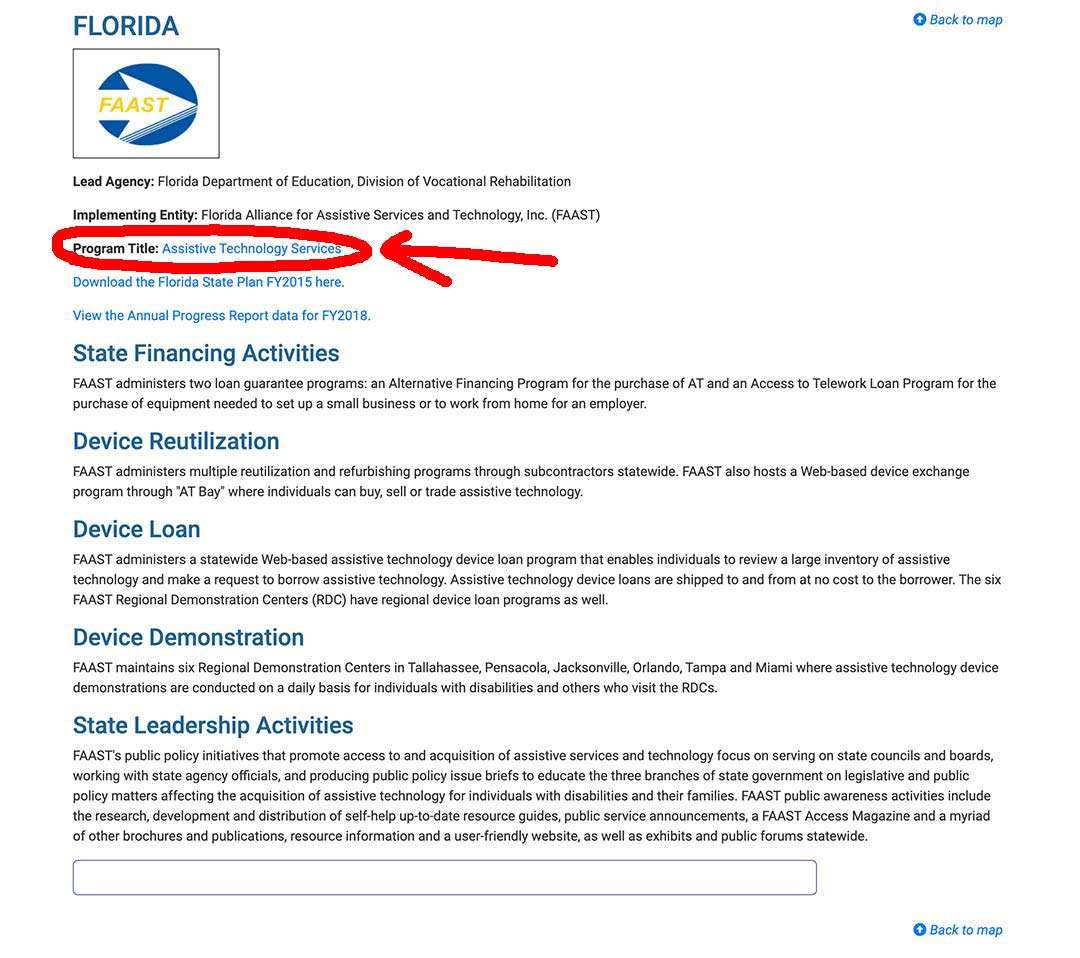

Step 2/

Look for the link “Program Title” – for my example I outlined it in red – and click on that.

Step 3/

The State AT Program website will come up, and you can sign up, or use their contact info, to get in touch and find out what they offer to help the elderly, and if you, or a loved one, are eligible.

State Financial Assistance Programs

Quite a few states have non-Medicaid programs which are designed for the elderly to remain living in their homes.

The programs pay for many safety items, medical equipment and even remodeling of the home, to ensure that the elderly are able to maintain their independence in their own homes.

The programs are typically focused on the elderly and the disabled.

Again, your local Area Agency on Aging should be able to help you find them, and to see if you are eligible.

Protection and Advocacy Programs

These are state legal services providing assistance to the elderly in disputing their denied claims.

Summary

Medicare Part B will typically cover DME rentals and purchases when the equipment is prescribed by a Medicare-enrolled doctor.

Remember to only get your equipment from a Medicare-enrolled “Participating” supplier who accepts assignment.

Medicare typically will cover 80% of your rental or purchase, and you will cover your 20% co-payment and deductible where applicable.

I’m Gareth, the author and owner of Looking After Mom and Dad.com

I have been a caregiver for over 10 yrs and share all my tips here.