As our parents get older and more frail, the bathroom can come to represent a considerable challenge to some, and can threaten their independence. With all the risks of slipping and falling, and I’m sure that you, like my Mom and I, have been frequently looking at bathroom safety equipment and wondering how you will ever manage to pay for it.

Medicare Part B typically does not cover most items of bathroom safety equipment, as they are considered not to be “medically necessary”.

Medicare Advantage Plans, or Medicare Part C, may cover a wider range of bathroom safety equipment, but this depends on the individual policies.

So long as the qualification criteria are met, Medicare Part B will cover walkers, crutches and commode chairs for use in the home, which can all be used as bathroom safety equipment to help diminish the risk of falling.

Medicare Part B also covers patient lifts under certain circumstances, which can also be used in the bathroom in the shower, or over the toilet.

You can read my two articles on Medicare’s cover of patient lifts and of Hoyer lifts (a very popular brand of patient lift), to find out what the guidelines are for qualifying, and where you may find grants if you don’t qualify for coverage with Medicare Part B.

However, grab bars, non-slip mats, bath lifts, shower chairs, transfer seats or raised seats for the toilet make up the equipment not typically covered by Medicare Part B for use in the home.

These items are viewed as comfort items.

Of course, if a Medicare-enrolled physician can prove that a certain piece of durable medical equipment is “medically necessary”, and you buy the equipment from a Medicare-approved supplier, then you have a chance that Medicare will accept to cover the equipment.

That said, you will need to pay for it upfront, while taking the risk of not being reimbursed by Medicare.

Contents Overview & Quicklinks

Does Medicare cover shower chairs ?

Does Medicare cover walk-in showers ?

Will medicare pay for bathroom modifications ?

What if your item of bathroom safety equipment isn’t covered ?

What equipment does Medicare pay for ?

What is Durable Medical Equipment ?

Medicare-approved Durable Medical Equipment supplier near me ?

List of Durable Medical Equipment typically covered by Medicare

Does Medicare Advantage cover bathroom safety equipment ?

How do you get your from Medicare covered DME ?

What do you do now you have the signed prescription ?

What to avoid so that you pay the least amount with Medicare ?

What if you are receiving treatment in a skilled nursing facility ?

List of Durable Medical Equipment covered by Medicaid ?

Does Medicaid cover bathroom equipment ?

How to find the HCBS programs, waivers and 1915 waivers in your state ?

How to go about purchasing items in these Medicaid and state funded programs ?

If your income is a bit too high to qualify for Medicaid

How to get bathroom equipment and DME covered as a Veteran

Other funding sources for the elderly

Free bathroom safety equipment

- Free bathroom safety equipment on Assistive Technology Programs

- Medical equipment loan closets

- Craigslist

- UsedHME.com

- Freecycle.org

- Nextdoor.com

- Facebook Selling Groups and Marketplace

Where to ask about free bathroom equipment in your neighborhood ?

Does Medicare cover shower chairs ?

Medicare Part B typically will not cover shower chairs, as they are not seen as “medically necessary”.

Medicare Part C, or Medicare Advantage Plans, offer a wider range of benefits, and in some cases may well offer coverage for a shower chair.

To get coverage for a shower chair for use in the home, your doctor, who must be a Medicare-enrolled physician, has to prescribe a shower chair for you.

Your doctor is going to have to show how it is “medically necessary” – and that it is going to help you with your care of a diagnosed medical condition.

To find out more about the diagnosis, the documents, the guidelines, and letter of medical necessity for a shower chair, you can read my article “Does Medicare Cover Shower Chairs”.

Does Medicare cover walk-in showers ?

Typically, Medicare Part B will not cover bathroom safety equipment, or modifications as I noted earlier, and unfortunately walk in showers fall into this area, unless it can be proven to be “medically necessary”.

Walk-in showers are considered to be comfort items and “not primarily medical in nature”.

But as I have also noted if you can prove that if it is unconditionally “medically necessary”, with a prescription certifying this from a Medicare-enrolled doctor, a diagnosis with “proof of need” that supports this, lots of supporting evidence of why you can’t live without it, evidence of why this particular walk in shower will do what you need, and that it can be reasonably expected that the shower will either maintain or improve your condition, then Medicare may agree to help cover.

Medicare Advantage plans may cover bathroom items and home modifications since the fall enrollment of 2020, in the case of chronic conditions.

Will Medicare pay for bathroom modifications ?

Almost all home modifications will not be covered by Medicare Part B.

Medicare Part B typically only covers what it considers to be “medically necessary”, and unfortunately, any modifications are seen as not primarily medical in nature.

In the rare instances that Medicare will cover the cost of a bathroom modification, i.e. walk in bathtubs, your doctor will need to convince Medicare that it really is a “medical necessity”.

To do this, a medical diagnosis for proof of need is required, plus a prescription of “medical necessity” from and signed by a physician which demonstrates –

- why you cannot live without the modifications – the necessity

- what it is that is needed from the required equipment, or bathroom modification

Medicare Part B also requires that –

- it can be reasonably expected that the equipment, or modification will either maintain the patient’s condition, or

- give rise to an improvement in their condition

Just because has all the required documentation, diagnosis and prescriptions, it isn’t a guarantee that Medicare Part B will give any coverage.

And to top it all off, you will also have to pay up front hoping that Medicare will agree, and reimburse you to some extent afterwards.

If you don’t qualify through Medicare Part B for a bathroom modification, which is the most likely scenario, unfortunately, there are a number of other possibilities open to the elderly –

- HCBS programs and waivers

- 1915 waivers

- Assistive Technology programs for equipment

- State Financial Assistance Programs or Nursing Home Diversion Programs

- USDA Rural Development grants

- Veterans Direct HCBS

- Low Income Energy Assistance Program

- Weatherization Programs

- Nonprofit groups offering services and assistance

You can find out about all of these in my article on Medicare and bathroom modifications.

What if your item of bathroom safety equipment isn’t covered ?

If you only have Medicare Part B, and they won’t accept your device as “medically necessary” you will either have to pay for the items yourself, or improvise.

Rather than having me install grab bars, my mom prefers to use a walker to help her to get in and out of the shower, as it can be re-positioned in so many ways. She will also use it for other tasks when she needs to stand, if she’s going to be there a while.

I wouldn’t stand with a walker in the shower unless you have one which is waterproof, and specifically designed for the shower.

If your parent’s shower is large enough you may be able to put a 3 in 1 portable commode chair in it, which is just as easy to sit and wash on, as a shower chair – but again, only do this if your 3 in 1 commode is waterproof. Commode chairs are covered by Original Medicare Part B, so if you qualify for one, this may be an almost cost free solution to a shower chair.

You can buy shower commodes, which as the name suggests are commodes which can go in the shower.

If your shower is too small for your bedside commode, it is simple enough to give a sponge bath on the bedside commode in another room.

Certain bedside commodes – generally 3-in-1 commodes – can be placed over a toilet seat, once the potty part has been removed, thus acting as a raised toilet seat, and a very stable one at that.

I had bought a raised toilet seat for my Mom, but she found a portable 3-in-1 commode placed over the toilet to be much more secure and comfortable, and getting on and off using the arm rests proved much easier than a raised toilet seat.

Don’t despair if you can’t get what you want covered under Medicare Part B, there are other options which include funding for quite large equipment, such as walk in bathtubs and low threshold, or roll-in showers, from some different sources for which your loved one’s may qualify.

There are also sources of financial assistance and funding grants if you need to re-model your bathroom for health reasons !

Before I get to those, I am just going to outline the Medicare process, and what you can get.

If you wish to jump ahead to the different sources of coverage and funding, click here.

or if you want to make bathing easier for your parent, and you are learning how to help them wash, you may be interested in this article here.

What equipment does Medicare pay for ?

Medicare covers certain Durable Medical Equipment for use in the home when it considers it to be “medically necessary”.

Medicare will not cover equipment, for use in the home, which it considers to be a comfort item, or an item which is “not primarily medical in nature”. Equipment such as grab bars, shower chairs and raised toilet seats fall into this category.

Medical supplies, which are disposable, are also not covered by Medicare Part B for use in the home. This would be items such as gloves, fabric dressings and gauze.

There are two exceptions for disposable medical supplies –

- if a beneficiary is receiving the Home Health benefit, some supplies are included

- if a disposable medical supply is used in conjunction with an item of durable medical equipment which is being covered at the time by Medicare

What is Durable Medical Equipment ?

Durable medical equipment is medical equipment for use in the home which is able to withstand repeated use over a sustained period of time.

Medicare has guidelines which outline what medical conditions and situations justify the coverage of each different piece of durable medical equipment, i.e. when it is “medically necessary”.

In their literature Medicare gives examples of Durable Medical Equipment as walkers, commode chairs, hospital beds and wheelchairs.

Medicare considers durable medical equipment must be –

- Durable (it has to be capable of withstanding repeated use over a sustained period of time)

- It has to be employed for a medical reason, as not just for comfort

- Not usually useful to someone who isn’t sick or injured

- It must be used in your home

- It should have an expected lifetime of at least 3 years

If the equipment you wish to have doesn’t meet these criteria, you probably won’t be able to get it covered by Medicare.

Medicare-approved Durable Medical Equipment supplier near me ?

To find a local Medicare DME supplier, use this link at Medicare.gov

List of Durable Medical Equipment typically covered by Medicare

Air-Fluidized Bed

Alternating Pressure Pads and Mattresses

Audible/visible Signal Pacemaker Monitor

Pressure reducing beds, mattresses, and mattress overlays used to prevent bed sores

Bead Bed

Bed Side Rails

Bed Trapeze – covered if your loved one is confined to their bed and needs one to change position

Blood sugar monitors

Blood sugar (glucose) test strips

Canes (however, white canes for the blind aren’t covered)

Commode chairs

Continuous passive motion (CPM) machines

Continuous Positive Pressure Airway Devices, Accessories and Therapy

Crutches

Cushion Lift Power Seat

Defibrillators

Diabetic Strips

Digital Electronic Pacemaker

Electric Hospital beds

Gel Flotation Pads and Mattresses

Glucose Control Solutions

Heat Lamps

Hospital beds

Hydraulic Lift

Infusion pumps and supplies (when necessary to administer certain drugs)

IPPB Machines

Iron Lung

Lymphedema Pumps

Manual wheelchairs and power mobility devices (power wheelchairs or scooters needed for use inside the home)

Mattress

Medical Oxygen

Mobile Geriatric Chair

Motorized Wheelchairs

Muscle Stimulators

Nebulizers and some nebulizer medications (if reasonable and necessary)

Oxygen equipment and accessories

Patient lifts (a medical device used to lift you from a bed or wheelchair)

Oxygen Tents

Patient Lifts

Percussors

Postural Drainage Boards

Quad-Canes

Respirators

Rolling Chairs

Safety Roller

Seat Lift

Self-Contained Pacemaker Monitor

Sleep apnea and Continuous Positive Airway Pressure (CPAP) devices and accessories

Sitz Bath

Steam Packs

Suction pumps

Traction equipment

Ultraviolet Cabinet

Urinals (autoclavable hospital type)

Vaporizers

Ventilators

Walkers

Whirlpool Bath Equipment – if your loved one is home bound and the pool is medically needed. If your loved one isn’t home bound, Medicare will cover the cost of treatments in a hospital.

Does Medicare Advantage cover bathroom safety equipment ?

Medicare Advantage Plans or, Medicare Part C, are run by private companies who have been contracted to provide, at a minimum, the same services as Original Medicare, and which, to make them more competitive have been allowed to offer extra benefits

For those Medicare Advantage Plans, there have been more new benefits allowed for those policies, as of the end of 2020.

In 2019, the Centers for Medicare & Medicaid released their plans to increase the competitiveness and coverage of Medicare Advantage and Medicare Part D plans.

Beginning in 2019, Medicare Advantage plans can now offer supplemental benefits that are not covered under Medicare Parts A or B, if they diagnose, compensate for physical impairments, diminish the impact of injuries or health conditions, and/or reduce avoidable emergency room utilization.

Source: “CMS finalizes Medicare Advantage and Part D payment and policy updates to maximize competition and coverage” April 1, 2019. You can read this on the CMS.gov website here.

Some Medicare Advantage plans now offer new benefits for bathroom safety equipment, and or modification.

You will have to shop around and see which plans offer these in your area, and also whether or not, the price is right for you.

How do you get your Medicare covered DME ?

For your purchase of a DME to qualify for Medicare coverage, you will need –

- to be enrolled in Medicare Part B

- a prescription signed by your Medicare-enrolled doctor which states the item is “medical necessity”

- to acquire the DME’s through a Medicare-approved supplier

If you are claiming DME for use at “home”, a hospital or nursing home cannot qualify as your “home” for medicare Part B, however they will be covered under Medicare Part A.

Long-term care facilities, such as assisted living, can qualify as a “home” for Medicare part B

What do you do now you have the signed prescription ?

If Medicare accepts to cover your DME purchase, you will need to pay your annual deductible (if it hasn’t already been met) and a co-payment of 20% of the Medicare-approved price of the purchase. Medicare will then cover the payment of the remaining 80% of the Medicare-approved price.

In the case of cheaper items, Medicare will usually purchase the items, but in cases such as hospital beds, it is more likely that they will rent a hospital bed on a monthly basis.

If the item is rented by Medicare from a Medicare-approved supplier who accepts assignment, you will have to pay a monthly co-payment of 20% of the Medicare-approved rental price, and Medicare will pay 80%.

What to avoid so that you pay the least amount with Medicare ?

For you to pay the lowest amount possible, you must be sure that you use a Medicare-enrolled “participating” supplier who accepts “assignment”. This ensures that you are only going to pay your Medicare co-pay of 20% of the Medicare-approved price, plus, if you haven’t already met it, your annual Medicare Part B deductible.

So why is that ? –

Medicare enrolled suppliers fall into two groups –

- Medicare Suppliers

- Medicare “Participating” Suppliers

Medicare “Participating” Suppliers have agreed to what is known as “assignment” – this obliges them to only charge the Medicare-approved price.

So, when you purchase your durable medical equipment from a Medicare Participating Supplier, you will not be paying any more than the 20% co-payment of the Medicare-approved price for the equipment, plus, if you have not yet met it, your annual deductible.

What happens if the supplier is not a Participating Supplier ?

A supplier who is Medicare enrolled, but not a “Participating” Supplier, has agreed to take payment from Medicare, but isn’t obliged to accept “assignment”.

The supplier is then free to add up to 15% to the price of the item, which on higher priced items can make the price considerably higher than the Medicare-approved price, and you are the one who pays the excess amount.

Medicare will pay the supplier 80% of the Medicare-approved price, and you have to pay the supplier the difference between the Medicare-approved price and the supplier’s price + the 20% co-pay of the Medicare-approved price + their annual deductible if you haven’t yet met it.

What if you are receiving treatment in a skilled nursing facility ?

If you are being cared for in a Skilled Nursing Facility or hospital, any necessary DME is covered by Medicare Part A (Hospital Insurance). The facility will take care of any equipment needed for up to 100 days.

Free Medicare advice

SHIP – State Health Insurance Assistance Programs – offers free advice on Medicare if you feel you need to talk to someone.

I have a short article explaining how to find your local SHIP, which you can read here – “Free Help Understanding Medicare And Medicaid ? Here’s Where You Get It”

List of Durable Medical Equipment covered by Medicaid ?

There is no definitive list of Durable Medical Equipment covered by Medicaid.

Medicaid is administered on both a federal and a state level, so there is not one set of rules and equipment covered

There are literally hundreds of different Medicaid and state programs and waivers across the US, all with different rules for eligibility, and different interpretations of what qualifies as Durable Medical Equipment.

In general, for Medicaid, Durable Medical Equipment must, firstly, be –

- medically necessary, as determined by a medical physician

- meet the definition of “Durable Medical Equipment”, which is basically the same as that of Medicare

Durable Medical Equipment is defined as –

- the equipment must be able to withstand repeated use over a sustained period of time

- the equipment must be used for a medical purpose only

- the equipment is for use in the home, first and foremost

- the equipment is not useful to a person who is not ill or injured

Depending on the different programs and waivers, what is covered as DME will vary.

Let’s now look at the different types of program supplying Medicaid.

Does Medicaid cover bathroom equipment ?

Yes, Medicaid will cover different bathroom equipment, and often the range of equipment is greater than that offered by Medicare. In addition, Medicaid frequently pays the whole amount, leaving you with no deductible or co-pay to make.

Medicaid in skilled nursing facilities and hospitals

In hospitals and skilled nursing facilities, the job of ordering the equipment needed for your loved ones will be handled by the facility. The facility is responsible for meeting a person’s DME needs, for up to 100 days.

Medicaid and state programs care for in the home

Medicaid programs which are for outside skilled nursing facilities are called “Home and Community Based Services”, “Waivers” or “1915 Waivers”.

You can get a very in depth explanation of HCBS programs and waivers at the following link to medicaid.gov –

https://www.medicaid.gov/medicaid/hcbs/authorities/index.html

These programs and waivers for services in the home, like Medicare, will also pay for “home medical equipment”, and unlike Medicare, often cover 100% of the cost.

The term “home” for HCBS programs and waivers purposes means that a recipient must be in –

- their own home

- their family home

- a group home

- an assisted living facility

- a custodial care facility

The HCBS programs have been developed to help individuals to live in their own homes, and to provide the care services and equipment needed so that they may be able to maintain their independence there.

If your parent requires certain safety equipment to live safely, and they qualify for the program, or waiver, they will usually get that equipment.

There are many state waivers which will allow for home modifications, including bathroom modifications, to adapt the home to the beneficiary’s needs.

The HCBS and Waiver programs do vary from state to state, but most allow for a good range of DME’s, and are often broader in their range than Medicare.

Consumer Direction/ Self Direction

Some waivers allow for a system called “Consumer Direction” or “Self Direction”.

The origin of the system was in “consumer-directed personal care services” run by certain states in the 1990s which, over time, and with the Affordable Care Act, have developed into what is now called Self Direction by Medicaid.

The beneficiary is given a budget, which they may spend to cover their requirements, under the guidance of a financial planner. The allotted budget can be used to buy products, including durable medical equipment. If a walk in bathtub, grab bar, bath lift, or shower chair is considered a medical necessity and is within the allotted budget, they may well be able to have one.

You can find out more about this and the different waivers here at Medicare.gov

Money follows the person

The program Money follows the person was designed specifically to help people to leave nursing facilities, and to return them to their homes, or assisted living facilities.

Durable medical equipment which is required for the persons to return to their homes is bought by the program, so if the beneficiary is deemed by the program to have a walk in tub, grab bars, or a bath lift they will most likely get them, as without this equipment they would not be safe if returned home.

How to find the HCBS programs, waivers and 1915 waivers in your state

I have an article with all the HCBS Waivers, 1915 Waivers, HCBS Programs and the Money Follows The Person Programs for seniors which are available in each state listed by state, and with links to the different program websites. In addition to that, I have included lists of all the PACE programs – Program of All-inclusive Care for the Elderly offered by each state (not all states have a PACE Program) –“Medicaid Home and Community Based Services Waivers and Programs For Seniors Listed By State”.

How to go about purchasing items in these Medicaid and state funded programs ?

Step 1

– get the doctor, or therapist, to provide a medical justification letter, stating that the equipment desired is medically necessary.

Step 2

– contact a DME supplier, who is Medicaid approved, and give them the medical justification letter from the doctor, or therapist.

Step 3

– the supplier should fill out a Prior Approval Application.

Step 4

– the document goes to the Medicaid state office where the purchase is either approved, or denied.

Step 5

– if the purchase is unsuccessful, you will be notified as to the reasons why, and how to appeal the decision.

Step 6

– if the purchase is approved, you will receive the item.

If your income is a bit too high to qualify for Medicaid

Spend Down Programs

Spend Down programs are to help a program participant’s to get Medicaid coverage through a system of income, or income + asset level reduction – certain deductions for different specific expenses are allowed.

There are two types of Spend Down –

- Income Spend Down

- Asset Spend Down

I’ve written a short post about how it works, which you can find here – What is Spend Down ?

To find your State Medicaid State Agency

If the documents are too technical, I wouldn’t waste your time trying to work your way through them, I would contact your state Medicaid Agency, and you can do that here.

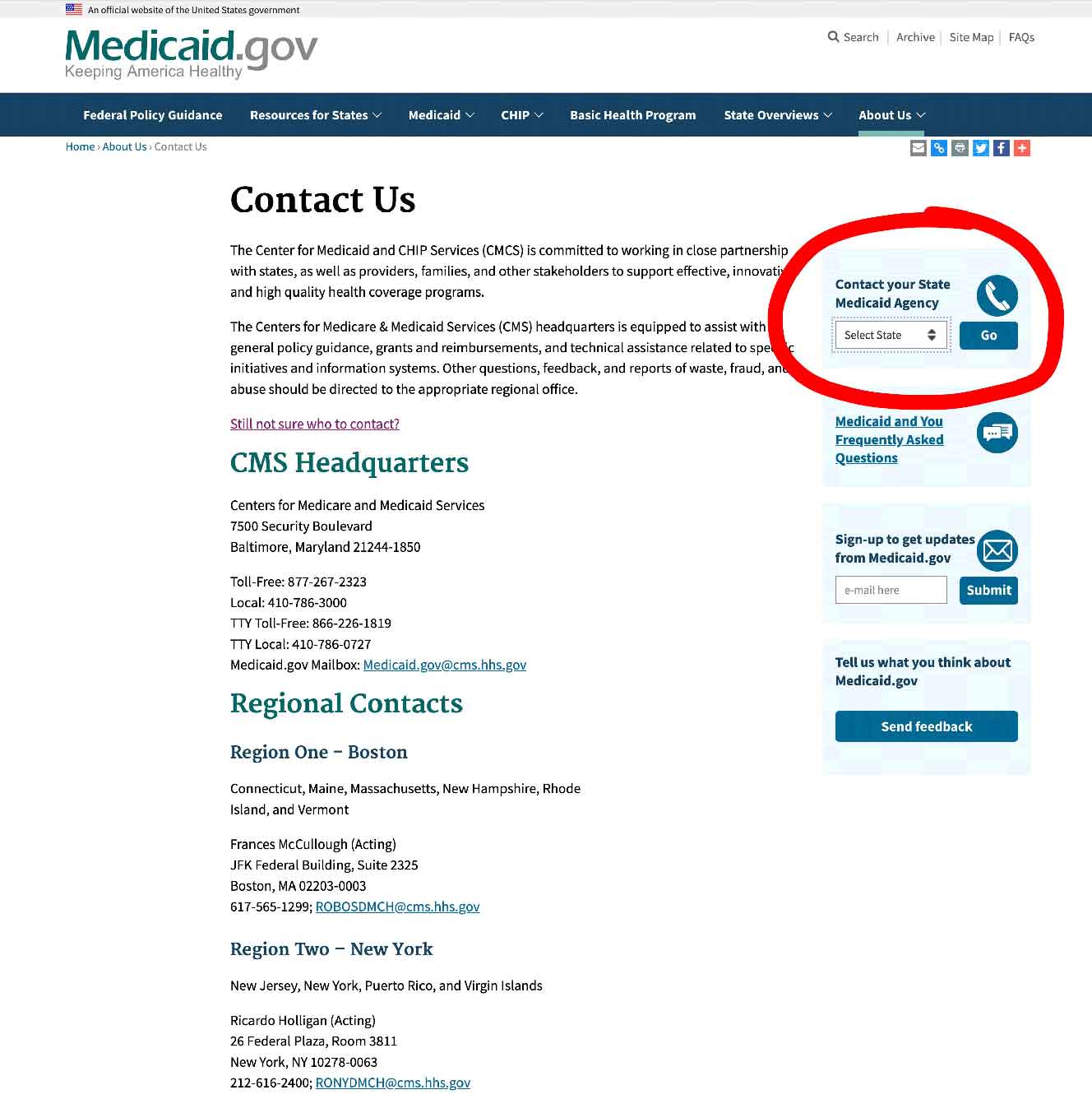

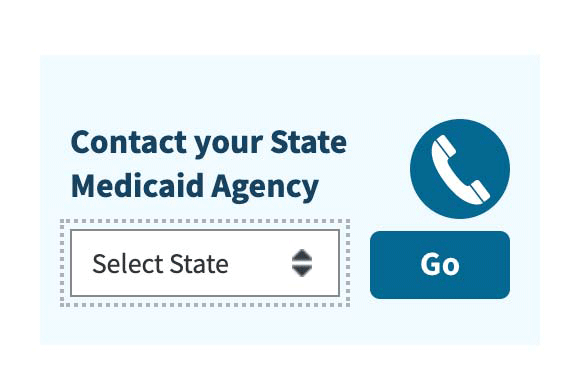

Step 1 – Once you have clicked the link to Medicaid.gov, just look over to the right on the website page, and you will see the section I have outlined in the image below.

If the documents are too technical, I wouldn’t waste your time trying to work your way through them, I would contact your state Medicaid Agency, and you can do that here.

Step 2 – select your state and click on the button they have marked “GO” – it will take you to your State medicaid Agency, and you will be able to get all the contact info and make calls 0r do emails to get all the help you need.

How to get bathroom equipment and DME covered as a Veteran

The Department of Veterans’ Affairs has a range of grants, programs and forms of financial assistance and pensions which will help to cover the cost of DME for veterans.

You can find out about your local VA Medical Centers and different clinics and offices in each state here.

Below are just some different forms of assistance available if you are a veteran –

- Grants for remodeling their homes to adapt them due to disabilities inflicted during military service

- Veterans Direct HCBS on which the beneficiary has control over the way the budget is spent, and what it is spent on

- Veterans’ Pensions – some specific pensions will allow for the purchase of equipment that veterans need for their homes

All the above will pay for bathroom safety equipment and even bathroom remodeling.

Other funding sources for the elderly

Here are a couple of other sources of funding available to the elderly for making changes to the bathroom or buying safety equipment. These sources do not limit the funding to just the bathroom, though.

State Financial Assistance Programs

These are non-Medicaid programs, which exist to lower the number of elderly persons entering Medicaid run nursing homes.

The programs run on a state-by-state basis and are designed to help the elderly to remain living in their homes – not all states have them.

The programs will pay for home modifications and also purchase necessary equipment, which includes bathroom safety equipment and walk in tubs and showers.

Eligibility for the programs differs with each one, but generally they are for the elderly and the disabled.

USDA Rural Development Section 504 Home Repair program

It is possible for the elderly, to get a grant for bathroom remodeling and safety equipment if they live in a rural area.

This program gives loans to low-income homeowners to “repair, improve or modernize their homes or grants to elderly very-low-income homeowners to remove health and safety hazards.” – source USDA.GOV

The maximum grant is $7500.00, which is also the lifetime limit for grants.

To be eligible for the grant, you must –

- be the homeowner

- be 62 yrs and over

- have a family income of less than 50% of the local average income

- be unable to repay a home repair loan.

Applications are accepted at any time at local Rural Development offices here.

Protection and Advocacy Programs

These are legal services providing assistance to the elderly who are disputing denied claims.

Free bathroom safety equipment

There are quite a number of ways for the elderly to get free durable medical equipment, and with a little searching it is possible to find items.

Do be aware though that if you use some of the online services available, most of these are not going to guarantee the quality of the equipment, unless they say that they have refurbished it, and that it is safe.

Typically, there will be a disclaimer accepting no responsibility for any accidents which may arise from the use of the free item.

Here’s a list of the places that you can find free durable medical equipment –

- State Assistive Technology Programs

- Community Medical Equipment Loan Closets

- Craigslist – online listing near you

- UsedHME.com – Used Home medical equipment

- Freecycle.org

- Nextdoor.com – an online listing of free items in your neighborhood

- Facebook Groups and Facebook Marketplace listings of items in your area which are offered for free

Free bathroom safety equipment on Assistive Technology Programs

A national grant is given to all states to be used in “Assistive Technology Programs”. The “programs” are meant to increase access to assistive devices in the home for those who need them.

The elderly are one of the primary groups who are meant to benefit from these projects.

The terms “Assistive Technology” and “DME” are pretty much interchangeable, and it covers all manner of equipment which can help in the home, so bathroom safety equipment is part of this.

Elderly adults are often able to obtain free, or very cheap Durable Medical Equipment and Assistive Technology Devices from their state AT Programs.

State AT programs tend, in general, to work with nonprofit organizations and charities, to provide new, and refurbished equipment to those in need.

So and take a look at your state Assistive Technology Program

Finding your state AT Program

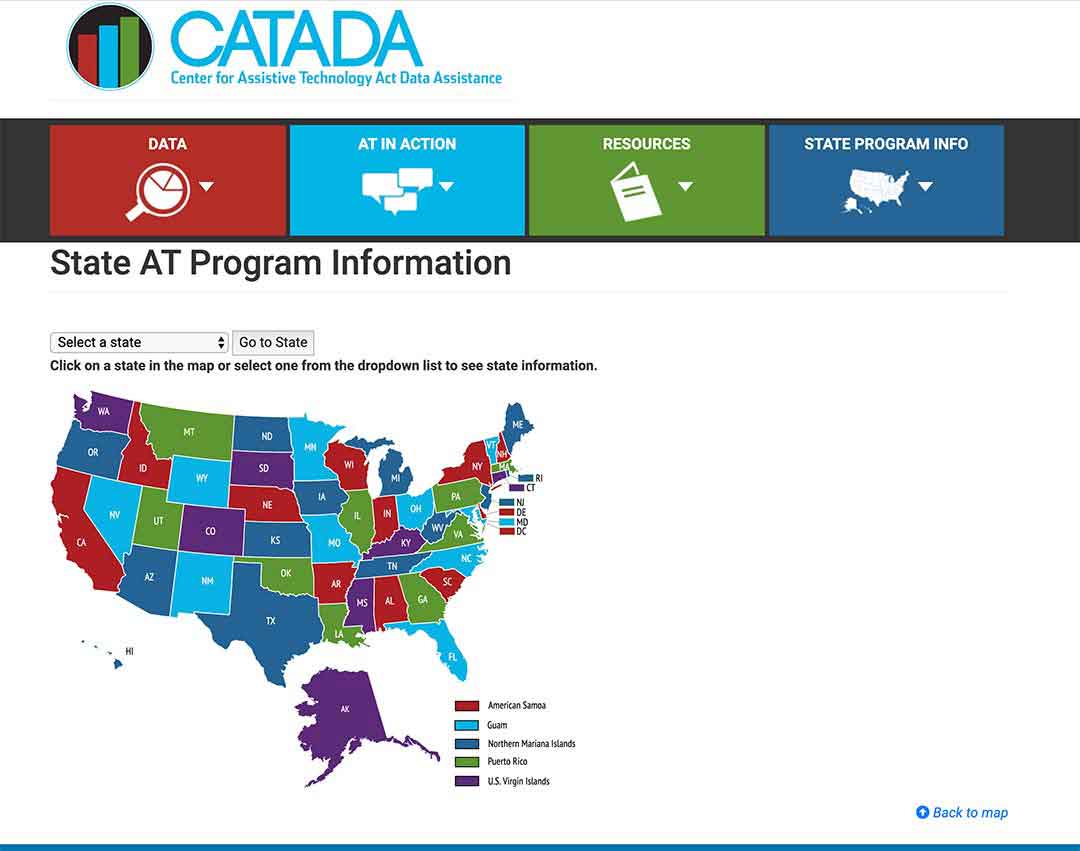

To find out what projects your state runs, click here.

Step 1/

Select your state from the map or from the drop-down menu.

Then click on “Go to state”

– I chose Florida for this example

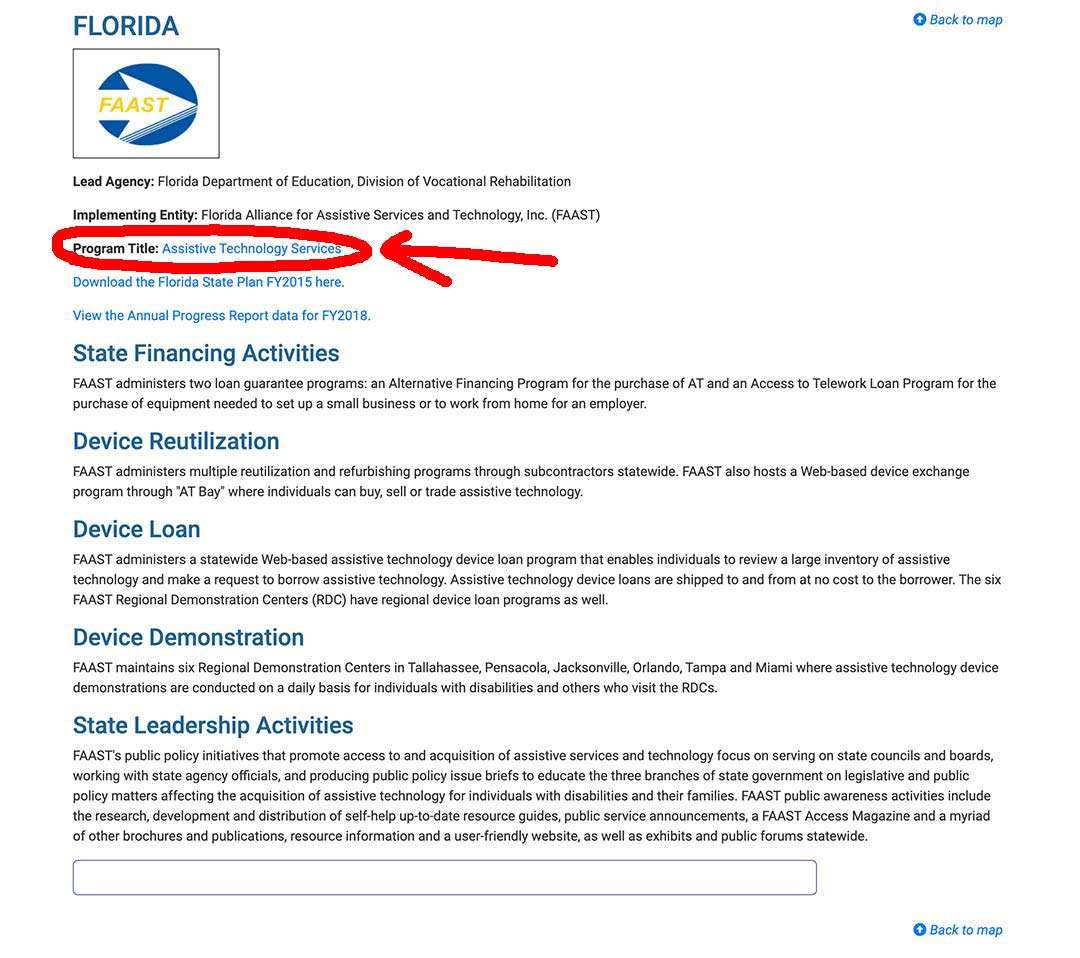

Step 2/

Look “Program Title” and click on it – In this example I outlined it in red.

Step 3/

This takes you to your state AT Program website where you can sign up, or use their contact info to get in touch and find out what they offer to help the elderly.

Free bathroom equipment from Medical Equipment Loan Closets

Many towns and cities have medical equipment loan closets run by community volunteers, where seniors can borrow, and even be given DME for free.

The equipment available depends on the group of course, but you can find anything from hospital beds to walkers, and usually all for free.

Free bathroom equipment on Craigslist

You can use the online classified listing website Craigslist to find durable medical equipment that private individuals are offering for free.

What is helpful about this listing is the ease with which you can do a local search. You can restrict it to your town, or even to a neighborhood in a larger city.

There is a section in the sales listing, which is “free stuff”, and you just select that and look through it.

Free bathroom equipment on UsedHME.com

This is a website which is specifically for those who wish to sell, buy or donate used home medical equipment.

You can just go on the site, set up how far you are willing to travel from your home, and then search for free equipment within that area.

Once you have found an item, you will be able to get the contact details of the person offering the equipment, and organize with them how you will pick it up.

Free bathroom equipment from Freecycle.org

This is an organization of groups of people all over the world who offer used items for free.

You can search for groups in your area on their website, and then look through what is available.

If you see things which interest you, you ask to join the relevant group, and then contact the person offering the item you are interested in.

Everything is free.

Free bathroom equipment from Nextdoor.com

This is a site of neighborhood groups where you can buy, sell, donate and get items for free.

You can join your neighborhood and search for items of durable medical equipment which are being given away.

Free bathroom equipment on Facebook Selling Groups and Marketplace

Facebook has a lot of what are called “selling groups” where people buy and sell products. You can often find items which are being offered for free – I actually saw a hospital bed being offered for free last year on one group.

You are able to join groups if you have a Facebook account.

You then select the distance from your home within which you want to search. Facebook will then give you a list of the groups, and you can join the ones you want to.

You will then see postings of all the items in the groups, and which are offered for free.

You can also join Facebook Marketplace, which is separate from groups and is a platform where people on Facebook can buy and sell items, but also donate and get for free.

You just need to browse Marketplace to see what there is.

Marketplace is often not available when you first join Facebook, and you may have to wait a few months for it to appear in your Facebook dashboard, but the selling groups are available to join straight away.

Where to ask about free bathroom equipment in your neighborhood

You could try some of the following locations in your neighborhood –

- Your local Area Agency on Aging

- Lions Clubs

- Rotary Clubs

- Local church communities

Area Agencies on Aging

Area Agencies on Aging are nonprofit agencies appointed by the state to provide services to help adults over the age of 60, their families and their caregivers to find the information, assistance and services that they need in the community – the ultimate goal is to help the elderly to maintain their independence and to remain living in their own homes.

Your local Area Agency on Aging is an excellent place to start asking questions on who may know where to find free medical equipment, where there may be loan closets for DME, or if you want, cheap thrift stores selling gently used equipment.

The National Association of Area Agencies on Aging has a locator tool to help you find an agency near you, which can be found here.

Lions Clubs

The Lions run some community loan closets for home medical equipment for seniors.

You can find a club near you, and ask if they have, or know of, any loan closets in your area.

I have written an illustrated guide showing how to very quickly find a Lions Club near you, and you can find that here.

Rotary Clubs

Just like the Lions organization, Rotary Clubs do a huge amount of charity work, and run many programs through the organization’s clubs.

Si if you are having trouble finding loan closets in your area, it may be a good idea to locate a club near you and ask if they know of clubs, or other organizations, in your area that have free medical equipment loan closets.

You can use their club locator tool to find a club near you.

I have written another illustrated guide on locating a Rotary Club near you, that you can read here – it’s a very quick and easy read.

Nonprofits offering services

There are nonprofit organizations which offer their services, help, and time, on home modifications for the elderly, and disabled, adults in need.

One such organization which is working across the US is Rebuilding Together.

You can find out if there is an affiliate group in your area, by using their locator tool here on their website.

You can also contact your local Area Agency on Aging to find out what other nonprofits organizations are offering their services near you.

Summary

Original Medicare Part B doesn’t cover much bathroom safety equipment for use in the home, but there are possibilities of getting the equipment through other Veterans, Medicaid and state run programs, and independent state programs and grants, at a time when administrations are doing as much as they can to help the elderly to age in their own homes.

I’m Gareth, the author and owner of Looking After Mom and Dad.com

I have been a caregiver for over 10 yrs and share all my tips here.